Bloomberg (3 )

The embattled cryptocurrency sector as well as its affluent leaders encounter a minute of numeration after the collapse of crypto exchange FTX as well as bush fund Alameda Study

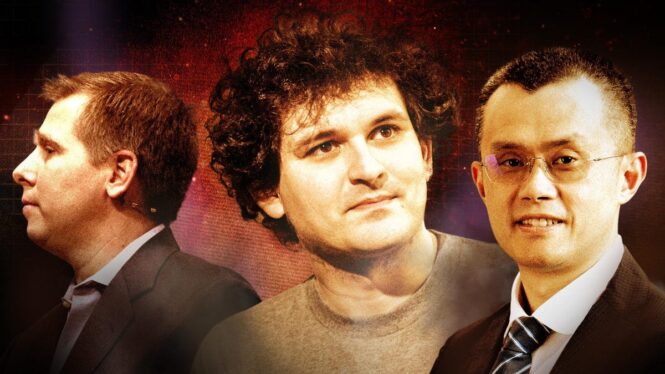

In January 2022, Sam Bankman-Fried was riding high. His Bahamas-based FTX had actually simply elevated $400 million from popular investor at a $32 billion assessment. A couple of weeks later on, when Forbes released its yearly Globe’s Billionaires checklist, SBF, as he’s understood, was crypto’s second-wealthiest individual, worth $24 billion.

Currently, Bankman-Fried is most likely damaged, as well as waiting for test. Prior to he was apprehended in the Bahamas, SBF informed a number of media electrical outlets his checking account was to $100,000, which he was “unsure” just how he’ll pay his legal representatives. Gary Wang, FTX’s various other cofounder as well as the firm’s previous principal innovation policeman– that got in an appeal manage the Stocks as well as Exchange Payment– has actually additionally seen his lot of money, as soon as approximated at $5.9 billion, cleaned.

FTX’s death was a suitable end to a year of wide range devastation in the cryptocurrency as well as blockchain field. The post-pandemic financial shock, which caused rising cost of living as well as increasing rate of interest, drawn resources out of the speculative crypto environment. Famous companies imploded, from the $40 billion collapse in Might of mathematical stablecoin TerraUSD, to the crypto bush fund 3 Arrowheads (which proclaimed for insolvency in July), to the insolvencies of interest-bearing loaning companies Voyager Digital, Celsius as well as BlockFi. Bitcoin, the biggest cryptocurrency as well as a market bellwether, is down 65% from its $69,000 top in November 2021. On the other hand some $2 trillion of market price has actually run away electronic possessions for more secure fields.

Because of this, 17 of crypto’s richest financiers as well as owners have actually jointly shed an approximated $116 billion in individual wide range given that March, according to Forbes’ quotes. Fifteen of them have actually shed majority their lot of money over the previous 9 months. 10 have actually shed their billionaire condition entirely.

” We’re currently at the snapping point in crypto where everybody will certainly need to take a time out as well as claim, ‘Okay, we have actually seen a lots of financial wide range ruined in the last number of months, we require to begin taking this seriously,'” claims Matt Cohen, owner of Surge Ventures, an equity capital company. “A great deal of blockchain modern technologies as well as crypto business developed remedies for issues that really did not require dealing with, as well as I assume we’re currently mosting likely to have a difficult reset.”

December total assets since 12/23/22

Forbes

The guy with one of the most to shed is Changpeng Zhao, Chief Executive Officer of Binance, crypto’s biggest exchange, an expansive worldwide network of dirty subsidiaries. CZ, as he’s understood, has actually an approximated 70% risk in Binance, which Forbes’ worths at $4.5 billion– below $65 billion in March.

CZ assisted establish FTX’s death moving on November 6 when he tweeted that Binance would certainly offer its continuing to be FTT, the indigenous cryptocurrency of FTX. That caused a work on FTX’s funds as consumers clambered to withdraw their cash, just to uncover it was gone. FTX proclaimed insolvency a couple of days later on. Zhao dominated his opponent, and now he has to emulate the effects. That can consist of the clawback in insolvency court of the more than $2.1 billion that Binance made from offering its risk in FTX back to Bankman-Fried in the summertime of 2021. (Zhao assisted seed FTX in 2019.)

CZ additionally encounters raised suspicion of central exchanges, especially Binance, as well as continuous examinations of him as well as his firm by authorities in Europe as well as the USA over accusations of assisting in cash laundering as well as various other economic criminal offenses. (Binance has actually rejected misbehavior.) In current weeks, CZ has actually looked for to reassure Binance customers that their crypto down payments are completely backed, appointing audit company Mazars to generate “evidence of gets” records. These declarations, which do not consist of obligations, were extensively slammed as inadequate for giving an insufficient photo of a firm’s economic wellness. Mazars has given that stopped its collaborate with crypto business, contributing to the unpredictability around Binance’s funds– as well as the exchange’s future.

” I do not think an organization can linger, running in this amorphous means, not regulated by any individual or anywhere, particularly when it’s run by a public person,” claims Lisa Ellis, an equity expert at MoffettNathanson, a department of SVB Stocks. Binance’s “dodgy operating version” would certainly be a “non-starter for lots of financiers, public or exclusive,” includes Ellis.

CZ specified in a webinar on December 23 that Binance has absolutely no obligations: “We are fairly an one-of-a-kind company, we do not have lendings from any type of various other companies,” he stated. “We will certainly show all the FUD [fear, uncertainty and doubt] is incorrect.” A representative for Binance stated that Forbes’ quote of CZ’s total assets “not an essential statistics for CZ. What’s more crucial is developing purposeful usage instances for crypto.”

Barry Silbert, head of crypto empire Digital Money Team, goes to the heart of crypto’s market transmission. Among DCG’s essential possessions, crypto loaning system Genesis Global Funding, owes financial institutions a minimum of $1.8 billion, according to a resource acquainted with the issue (and also as Reuters initially reported). In addition, DCG is encumbered financial obligation. It presumed a $1.1 billion obligation from Genesis, which originated from a negative finance Genesis had actually made to the now-bankrupt 3 Arrowheads hedge fund. Independently, DCG owes Genesis an additional $575 million, which schedules in Might. DCG additionally owes $350 million to investment company Elridge if Genesis goes under, the Financial Times reported.

To survive, Silbert will likely need to increase outdoors resources or dismantle his DCG crypto realm, that includes some 200 financial investments in crypto companies as well as symbols, consisting of crypto information website CoinDesk, bitcoin mining company Shop as well as Grayscale Investments, a possession administration company that provides shares in an openly traded Bitcoin count on. Forbes approximates the worth of DCG’s impressive obligations are above the reasonable market price of its possessions in the present market setting; DCG might additionally have a hard time to unload illiquid endeavor wagers. For these factors, Forbes approximates the present worth of Silbert’s 40% risk in DCG to be roughly $0. Silbert’s individual financial investments can not be figured out. A representative for DCG decreased to comment.

” They had a solvency concern at Genesis, which changed right into a liquidity concern. However those losses do not go away,” claims Ram Ahluwalia, chief executive officer of crypto-focused Lumida Riches Monitoring, that mentions that Genesis financial institutions will certainly have cases on DCG possessions also if Genesis proclaims insolvency. “If DCG does not increase fresh equity resources it will certainly be regarded as a zombie company.”

Cameron as well as Tyler Winklevoss, the bitcoin billionaires commemorated in The Social Media Network for their duty in Facebook’s beginning, are additionally captured in Silbert’s loaning internet. Gemini, the doubles’ independently held crypto exchange, provided their customers returns as high as 8% throughout the booming market via their Gemini Earn item, which contracted out the loanmaking to Genesis; currently Gemini consumers are owed some $900 million by Genesis, according to a resource acquainted with the issue. On November 16, Genesis put on hold withdrawals, leaving consumers annoyed. Gemini Buck, the exchange’s stablecoin as well as a vital element of Gemini Earn’s loaning program, has actually experienced huge discharges. The Winklevii have actually continued to be silent, besides sparsely worded Twitter updates regarding Gemini developing a financial institution board.

For Brian Armstrong, that is the chief executive officer of openly traded exchange Coinbase, FTX’s collapse offered a chance to strike. On November 8, in the disorderly hrs after Binance introduced its tentative requisition of FTX, Armstrong heralded his vision for crypto while dissing Binance’s Zhao. “Coinbase as well as Binance are adhering to various methods. We’re attempting to comply with a managed, relied on technique,” Armstrong stated on the Bankless podcast. “To take a look at it intellectually truthfully, we’re picking to comply with the policies. It’s a harder course as well as in some cases your hands are connected, yet I assume that’s the ideal long-lasting approach.” In a 13-tweet thread that exact same day, Armstrong repeated those motifs.

Capitalists do not appear to care. Coinbase’s supply is down 64% given that August as well as greater than 95% from its $100 billion IPO in April 2021, eliminating a lot of Armstrong’s lot of money.

On the other hand, Coinbase’s various other cofounder, Fred Ehrsam, obtained shed by Bankman-Fried. His crypto endeavor company Standard spent $278 million in FTX equity. Ehrsam has actually not provided any type of public declarations regarding the financial investment. Matt Huang, Ehrsam’s companion at Standard, said on Twitter: “We really feel deep remorse for having actually purchased an owner as well as firm that eventually did not straighten with crypto’s worths as well as that have actually done massive damages to the environment,” including that Standard’s equity financial investment in FTX “made up a little component of our complete possessions” which Standard had actually never ever delegated FTX to hold any one of its electronic property financial investments.

Exclusive crypto companies that elevated resources in 2021 or earlier this year at high evaluations are being traded at considerable markdowns on additional markets as well as in over the counter offers, claims Matt Cohen of Surge Ventures, that anticipates to see bigger markdowns for the 4th quarter as business prepare year-end capitalist records. “Q4 audit period is mosting likely to be the moment when the rubber fulfills the roadway on what funds are mosting likely to be discounted appropriately,” he claims.

For instance, shares of NFT exchange OpenSea are trading at a 75% price cut given that January, when OpenSea struck a $13.3 billion assessment, according to information from exclusive market exchanges ApeVue as well as CapLight. Day-to-day trading quantities on OpenSea’s NFT exchange have actually been under $10 million in the last month, contrasted to over $200 million back in January, according to crypto website DappRadar. OpenSea’s 30-something cofounders, Devin Finzer as well as Alex Atallahh, are no more billionaires.

Nikil Viswanathan as well as Joe Lau, the owners of Alchemy, a crypto software application company that powers various other Web3 endeavors, have actually additionally left the three-comma club, based upon approximated markdowns of their risks in Alchemy, which last elevated outdoors resources in February at a $10.2 billion assessment. According to Viswanathan, FTX’s collapse “injures the customer assumption of the [crypto] room. We have actually seen this play out in the Lehman Brothers as well as Bernie Madoff falls down in 2008– it takes some time to recuperate.” Alchemy, nevertheless, has actually proceeded expanding throughout the bearish market, claims Viswanathan. “The distinction remains in Web3 we have actually seen programmer task speed up throughout also one of the most turbulent times, which indicates an unbelievably solid, mission-driven area of contractors.”

Jed McCaleb, cofounder of crypto company Surge, is thought to be the only individual that made their lot of money in crypto to have actually preserved a lot of his lot of money via the decline. However that’s due to the fact that he offered out nearly completely prior to the collision. McCaleb unloaded some $2.5 billion well worth of XRP, Surge’s indigenous token, in between December 2020 as well as July 2022, meeting the splitting up arrangement he authorized with Surge’s various other owners back in 2013. Today, XRP professions around $0.40 per coin, down around 50% from previously this year, when McCaleb was unloading numerous bucks’ well worth of XRP symbols every week.

Chris Larsen, Surge’s various other owner as well as its chairman, has actually shed over $2 billion this year, because of XRP’s decreasing rate as well as Forbes’ approximated price cut on Surge’s equity assessment. Surge, which last elevated resources in 2019 at a $10 billion assessment, redeemed shares from a capitalist in 2015 at a filled with air $15 billion assessment afterwards capitalist had actually taken legal action against Surge about a Stocks as well as Exchange Payment claim submitted versus Surge in December 2020; that instance is still functioning its means via courts.

Tim Draper, an investor that holds around 30,000 bitcoins, went down from the billionaire rankings previously this year, when Bitcoin struck $33,000. As ever before however, Draper continues to be positive regarding bitcoin’s future, although his oft-repeated $250,000 rate target looks extra extravagant every day. “I believe that this is the start of completion of the central symbols,” Draper informs Forbes “If a token is systematized, you go to the grace of the individual that manages the money. Which was absolutely the instance with FTX.”