Kwarteng says highest price of revenue tax being abolished, and primary price being reduce to 19% from subsequent April

Kwarteng concludes with two bulletins about revenue tax.

He says the highest price of revenue tax – the 45% price for earnings over £150,000 – is being abolished altogether.

He says Labour by no means had a forty five% price of revenue tax when it was in energy.

And he says the federal government will reduce revenue tax by 1p within the pound from April subsequent 12 months. That’s one 12 months sooner than deliberate, and it’ll take the speed right down to 19%, he says.

Because of this we could have some of the aggressive and progressive revenue tax programs on the planet.

That’s it. He has completed the speech.

Key occasions

Filters BETA

Union leaders condemn plan to put new restrictions on strike motion

And union leaders have additionally criticised the proposals to put new restrictions on strike motion.

In his speech Kwasi Kwarteng mentioned:

At such a essential time for our financial system, it’s merely unacceptable that strike motion is disrupting so many lives.

Different European nations have minimal service ranges to cease militant commerce unions closing down transport networks throughout strikes.

So we’ll do the identical.

And we’ll go additional.

We’ll legislate to require unions to place pay affords to a member vote, to make sure strikes can solely be referred to as as soon as negotiations have genuinely damaged down.

In response Mick Lynch, normal secretary of the Rail, Maritime and Transport (RMT) union, mentioned:

We have already got essentially the most extreme anti-democratic commerce union legal guidelines in western Europe and this newest risk will rightly enrage our members.

The federal government needs to be working in direction of a negotiated settlement within the nationwide rail dispute, not looking for to make it even tougher to take efficient strike motion.

RMT and different unions is not going to sit idly by or meekly settle for any additional obstacles on their members exercising the fundamental human proper to withdraw their labour.

And Manuel Cortes, normal secretary of the TSSA, mentioned:

Unions are democratic organisations and industrial motion solely happens as a final resort and after a postal poll of members which additionally contains having to fulfill undemocratic thresholds.

Frankly, having to poll our members on pay affords earlier than they’ll take industrial motion is not going to make a blind little bit of distinction.

If the supply is garbage, it would nonetheless be garbage whether or not our elected office reps have consulted our members on it or a poll has taken place.

This new Tory proposal will serve solely to elongate disputes and generate better anger amongst union members. It’ll do exactly nothing to encourage employers to come back to the negotiating desk with lifelike affords.

Union leaders have condemned the mini-budget as “a price range for the wealthy”.

The Unite normal secretary, Sharon Graham, mentioned it was a price range for the wealthy, massive enterprise and the Metropolis.

This mini-budget is unashamedly a price range for the wealthy, massive enterprise and the Metropolis – highest earners’ tax slashed, company tax slashed, funding bankers’ bonuses let rip. #MiniBudget 1/3

— Sharon Graham (@UniteSharon) September 23, 2022

Billionaires and metropolis bankers will as soon as once more be contemplating which tax haven they are going to stash their cash in, while thousands and thousands of unusual households proceed to wrestle to make ends meet. #MiniBudget 2/3

— Sharon Graham (@UniteSharon) September 23, 2022

If there are billions of kilos out there to spend then one of the best ways to assist the financial system could be to present public sector staff a pay rise. #MiniBudget 3/3

— Sharon Graham (@UniteSharon) September 23, 2022

The Unison normal secretary, Christina McAnea, mentioned it was “an all-out offensive to make the wealthiest even richer”. She added:

In the course of an enormous cost-of-living disaster, this isn’t the time for financial experiments which can be doomed to fail.

There are plenty of important jobs that want filling. The easiest way to cope with 300,000 vacancies throughout well being and care is to present workers a wage rise that tops inflation.

Threats to unions are assaults on staff merely attempting to win higher pay. Selecting to facet with metropolis bankers over struggling households queueing at meals banks gained’t go down effectively with all these feeling deep despair.

Decision Basis additionally cautions that the massive improve in borrowing to fund the mini-budget can even imply increased rates of interest, leaving the longer run degree of GDP largely unaffected.

The extent of development, or depth of any recession, within the years forward shall be pushed much more by the trail of power costs than the extent of taxation – with nations choosing each increased (Germany) and decrease (US) tax ranges outgrowing the UK financial system over the previous 15 years.

5 – Warning wanted on development: Whereas power assist will enhance GDP this winter, the borrowing required can even imply increased rates of interest. Progress within the years forward is prone to be pushed much more by the trail of power costs than the tax cuts introduced in the present day. pic.twitter.com/AGXWgQSfxG

— Decision Basis (@resfoundation) September 23, 2022

Decision: UK to borrow additional £411bn over subsequent 5 years

Graeme Wearden

Kwasi Kwarteng’s tax cuts – the most important in 50 years – will assist to drive up borrowing by £411bn over the subsequent 5 years, the Decision Basis have calculated.

Decision’s early evaluation of the mini-budget has discovered that it’s going to enhance development within the short-term but additionally result in increased rates of interest.

Decision has additionally labored out that nearly half of the non-public tax cuts confirmed in the present day will go to richest 5% of the inhabitants, who shall be £8,560 higher off.

Somebody on an revenue of £1 million will obtain a tax reduce price £55,220 subsequent 12 months, the thinktank has labored out.

In distinction, simply 12 per cent of the positive aspects will go to the poorest half of households, who shall be £230 higher off on common subsequent 12 months.

4 – Nearly two-thirds (65%) of the positive aspects from private tax cuts introduced will go to the richest fifth of households: Nearly half (45%) will go to the richest 5% alone, whereas simply 12% of the positive aspects will go to the poorest half of households. pic.twitter.com/QxsWFEgLba

— Decision Basis (@resfoundation) September 23, 2022

Decision has calculated that the deterioration of the financial outlook since March, and extra packages of power assist, are estimated to have elevated borrowing by £265bn over the subsequent 5 years.

Tax cuts of £146bn elevate that to £411bn over the subsequent 5 years.

Decision explains that this can break the UK’s fiscal guidelines:

Whereas additional borrowing is biggest this 12 months (£130 billion) given the dimensions of power invoice assist, the permanence of the tax cuts combines with increased rates of interest and weaker development to imply that the £30 billion of headroom the earlier Chancellor maintained in opposition to his fiscal rule of getting debt falling as a share of GDP has been blown by twice over by 2026-27.

1 – £45 billion of tax cuts have been introduced in the present day – going far past election guarantees to cancel company tax will increase and reverse this 12 months’s Nationwide Insurance coverage rise. These are the biggest tax cuts to be introduced in a single fiscal occasion for the reason that Nineteen Seventies. pic.twitter.com/AFELfcsp1c

— Decision Basis (@resfoundation) September 23, 2022

2 – A report improve in borrowing: The choice to mix the largely unavoidable increased deficit attributable to rising power costs/rates of interest with everlasting tax cuts will drive up borrowing by £411 billion in coming years. No Chancellor has elevated borrowing by a lot. pic.twitter.com/5H4wMcwDHz

— Decision Basis (@resfoundation) September 23, 2022

Torsten Bell, Chief Government on the Decision Basis, mentioned:

“This will likely not have been a Price range, however the Chancellor has actually blown the price range with the most important package deal of tax cuts introduced for the reason that ill-fated Barber Price range of 1972. His choice to mix the largely unavoidable increased deficit attributable to rising power costs and rates of interest with everlasting tax cuts will drive up borrowing by over £400 billion within the coming years. No Chancellor has ever chosen to completely improve borrowing by a lot.

“With out vital cuts to public spending, debt shall be heading in the right direction to rise in each 12 months. This isn’t what sustainable public funds seem like. Each scrap of Treasury orthodoxy has been torn up.

“Whereas the Vitality Value Assure will do a superb job of softening the residing requirements squeeze this winter for wealthy and poor households alike, in the present day’s tax cuts will do little to spice up the incomes of these on low and center incomes. Somebody on an revenue of £1 million will obtain a tax reduce price £55,220 subsequent 12 months.

“This borrowing surge will imply increased GDP this winter, however it would additionally imply increased rates of interest because the Financial institution of England goals to suck out the enhance to demand the Chancellor has offered. Even those that imagine decrease taxes will make a significant distinction to development needs to be cautious about placing all their eggs in that basket. In spite of everything, the tax take will stay at ranges not sustained for the reason that Forties – even on these plans.”

These are from the Inexperienced celebration MP Caroline Lucas.

In order that’s it. Who’re the winners from this price range? Bankers, metropolis fatcats, fossil gasoline giants, the extraordinarily rich. Who’re the losers? Everybody else. And never one phrase about local weather & nature safety, on which all wealth finally relies upon #Bankersbudget

— Caroline Lucas (@CarolineLucas) September 23, 2022

That was vile from @KwasiKwarteng who truly simply mentioned “for too lengthy on this nation we have indulged in a combat over redistribution”

Indulged?

Coping with inequality is by some means over-generous? Does he suppose folks select to be poor & face drawback? Disgusting#MiniBudget— Caroline Lucas (@CarolineLucas) September 23, 2022

This price range might have delivered a retrofit revolution to create 140,000 jobs, slash power payments, reduce emissions & profit the financial system by £7 billion a 12 months. As a substitute we get dogma & deregulation – an environment-wreckers constitution to profit fossil gasoline giants & the super-wealthy pic.twitter.com/CGeVxuWtBt

— Caroline Lucas (@CarolineLucas) September 23, 2022

That is from Ashwin Kumar, a modelling knowledgeable and professor of social coverage at Manchester Metropolitan College.

Jason Rodrigues

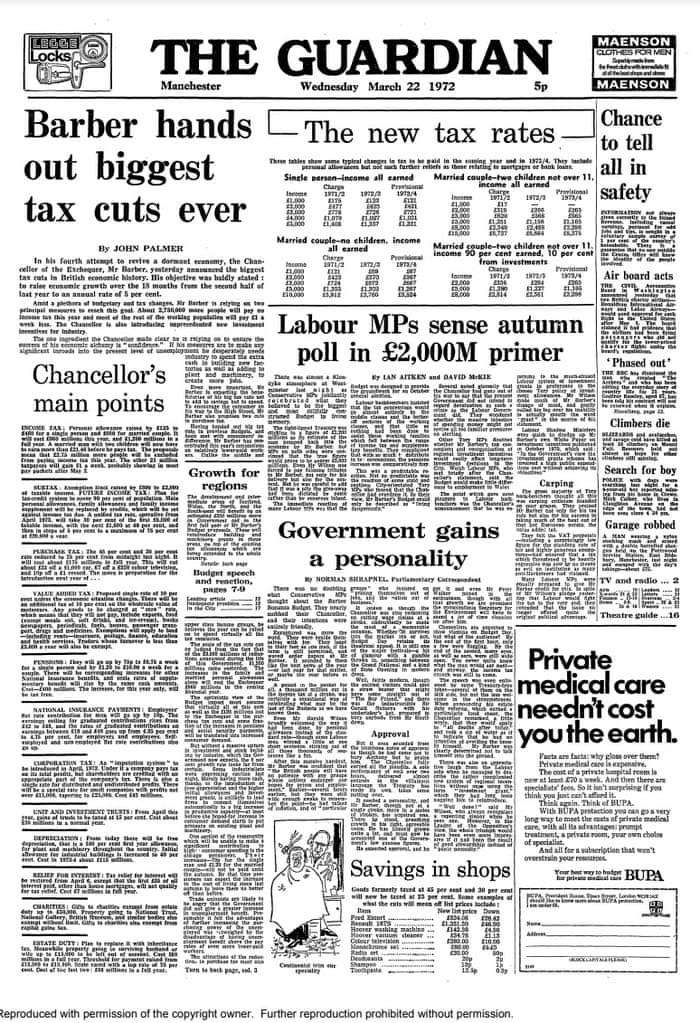

Kwasi Kwarteng’s mini-budget has been in comparison with the budget presented by Anthony Barber, Tory chancellor in 1972.The ensuing ‘Barber growth’, then bust, was deemed reckless. Gripped by sluggish development and low funding, the UK determined to resolve its issues by embarking on a “sprint for development” – spending massive and chopping taxes. Barber set development targets of 10% for the next two years and shaved £1 billion off revenue tax. His price range did develop the financial system however inflation surged. This was worsened by the hike in oil costs following the 1973 Yom Kippur Warfare. Inside 18 months Barber did a U-turn, bringing in a deflationary price range, and Edward Heath’s authorities was compelled into introducing an incomes coverage (wages freeze).

That is how the Guardian reported it on the time.

Round 660,000 prime earners will achieve £10,000 on common from abolition of highest price of revenue tax, Treasury admits

Rowena Mason

The Treasury acknowledged after the price range that round 660,000 of the best earners taking house greater than £150,000 a 12 months will profit from the scrapping of the 45p price, getting again on common £10,000 a 12 months. The general prices of the measures are forecast to be round £2bn.

The Treasury was requested why it couldn’t produce Workplace for Price range Duty forecasts, and claimed it might not be capable to publish full forecasts in time. It admitted there have been no forecasts for a way a lot the expansion plan would enhance development, or when Kwarteng hoped to succeed in the two.5% goal. He’s reviewing his fiscal guidelines, however these is not going to be set out at this stage. They continued to insist it was not a price range, so subsequently was not accompanied by the standard distributional impression exhibiting how the measures will have an effect on each wealthy and poor.

A Treasury spokesperson mentioned he “disagreed” that it was a price range for the wealthy or that it was “trickledown economics” however the intention was that “rising the financial system advantages everybody”.

Conservative backbenchers gave an especially muted response to Kwarteng, unusually refraining from cheering or banging their seats behind the chancellor. A number of Tory MPs informed the Guardian they have been nervous concerning the political implications of giving tax cuts to the wealthy, whereas offering little assist for a lot of the inhabitants with thecost of residing past the 1p reduce in revenue tax.

In distinction, Labour MPs have been each outraged by the measures and buoyed by the concept voters would reject the Tories, with one shadow cupboard minister saying they thought it might “go down like a bucket of sick” within the Crimson Wall.

The selloff within the pound is gathering tempo – sterling is down two cents in opposition to the US greenback.

At simply $1.105, sterling is getting worryingly near the $1.10 degree.

The pound has additionally shed a eurocent in opposition to the euro to €1.132 – this sterling stoop isn’t simply concerning the robust greenback.

Neil Wilson of Markets.com says there’s a “fireplace sale of UK belongings” that’s “completely horrible to observe”, as UK authorities bonds costs tumble too.

The response within the bond market to the misnamed mini-Price range (it was something however mini!) is putting with yields surging after the chancellor unveiled sweeping tax cuts that abandon any semblance of fiscal self-discipline.

It means extra borrowing and extra borrowing prices. This isn’t the response any chancellor desires from a price range however what else might he anticipate?

The UK’s FTSE 100 index of blue-chip shares can also be underneath actual strain, down over 2%.

It has simply fallen by 7,000 factors for the primary time since June, with European inventory markets additionally being hit by fears of a looming recession.

Our Enterprise liveblog has extra particulars:

Campaigners condemn mini-budget as ‘hammer blow’ to the poor

Campaigners and charities have described the mini-budget measures as a ‘hammer blow’ to the poor.

Becca Lyon, head of kid poverty at Save the Kids, mentioned:

The prime minister mentioned she would ship on the cost-of-living disaster. As a substitute, the UK authorities has delivered tax cuts to assist the richest and a hammer-blow to low-income households.

The chancellor has prioritised bankers’ bonuses over serving to weak youngsters by the cost-of-living disaster, whose hard-working dad and mom face unimaginable decisions.

At the moment’s bulletins overwhelmingly profit the nation’s wealthiest households, in the meantime nearly 4 million youngsters danger going chilly and hungry this winter.

Alison Garnham, chief govt on the Youngster Poverty Motion Group, mentioned:

At the moment was a significant alternative to supply reassurance and assist to those that want it essentially the most – however as a substitute the Authorities dangers a collision with actuality, and the 4 million children at present residing in poverty within the UK shall be compelled to pay the worth.

Imran Hussain, director of coverage and campaigner at Motion for Kids, mentioned:

If the brand new chancellor has cash to spend on tax cuts for individuals who are comparatively higher off, then he has the cash to spend throwing a lifeline to low-income households who’re desperately battling the cost-of-living disaster. Many now face a bleak Christmas.

While the power worth assure will assist offset the close to apocalyptic rises that had been predicted, it doesn’t deal with the mounting pressures households face with meals, gasoline, housing and different prices that proceed to climb.

And Mark Russell, chief govt on the Kids’s Society, mentioned:

Modifications to the tax system proper now are barking up the flawed tree … We have to see much more direct assist for households bearing the brunt of the cost-of-living disaster.

Within the Commons MPs, significantly Tory MPs, generally reply ecsastically once they hear a chancellor from their celebration ship a price range that they suppose shall be in style. What was notable about in the present day was that Conservative backbenchers didn’t reply like that. A few of them did reply very enthusiastically (“How refreshing to listen to some Conservative insurance policies finally,” mentioned Richard Drax), however a lot of them, with out being overtly essential, did sign reservations. Aubrey Allegretti wrote up some examples at 10.45am. Listed here are some extra.

Kevin Hollinrake mentioned that alhtough development and chopping taxes have been Conservative rules, “balancing the books” was a Tory precept too. He requested Kwasi Kwarteng:

Can he verify as he seeks to steadiness the books sooner or later, due to course there shall be the next deficit both means on this announcement, he is not going to achieve this by chopping infrastructure funding within the north?

Sir Bob Neill mentioned the Conservatives ought to stand for sound cash. He mentioned:

I additionally welcome the modifications to stamp responsibility, however will [Kwarteng] keep in mind, as I’m positive he does as a Conservative, that we additionally imagine in sound cash and that we should control inflation? As a result of we are not looking for the good thing about the stamp responsibility reduce to be eroded for a lot of householders by the elevated mortgage prices.

And Sir Jeremy Wright warned concerning the danger of upper rates of interest. He mentioned:

Would [Kwarteng] additionally agree that confidence will evaporate if folks’s prices on their mortgages improve additional than the advantages that they achieve from tax reductions, and can he do all he can to make it possible for doesn’t occur?

Enterprise organisations broadly welcome mini-budget

Enterprise organisations have warmly welcomed the mini-budget.

That is from Tony Danker, the director normal of the CBI.

Like Covid, the power disaster has meant Authorities has needed to spend massively to guard folks and companies. Which means we’ve no alternative however to go for development to afford it.

At the moment is day certainly one of a brand new UK development strategy. We should now use this chance to make it rely and convey development to each nook of the UK.

Fifteen years of anaemic development can’t be repeated.

Taking motion to get Britain’s financial system shifting once more by starting development on transport and inexperienced infrastructure initiatives exhibits rapid supply. Planning reform is lengthy overdue.

That is from Shevaun Havilland, the director normal of the British Chambers of Commerce.

Companies throughout the UK will enthusiastically welcome the chancellor’s pledge to give attention to financial development and velocity up new infrastructure growth.

Kitty Usher, the chief economist on the Institute of Administrators, additionally welcomed the plans.

It is a excellent news day for British enterprise. In a time of low confidence and financial uncertainty, the brand new chancellor’s emphasis on going for development shall be very welcome to corporations of all sizes throughout the UK. Taken along with the power payments reduction scheme, the package deal as complete will make it simpler for companies navigating a difficult financial atmosphere within the coming months.

However she mentioned there have been considerations about whether or not the measures have been inexpensive.

Nonetheless, we’re involved that the chancellor had not requested the OBR to undertake its normal impartial evaluation of the impression of its proposals on authorities debt and the broader macroeconomy. With out this, neither companies nor parliament have the reassurance that the dimensions of this intervention is inexpensive and so doesn’t jeopardise total financial stability.

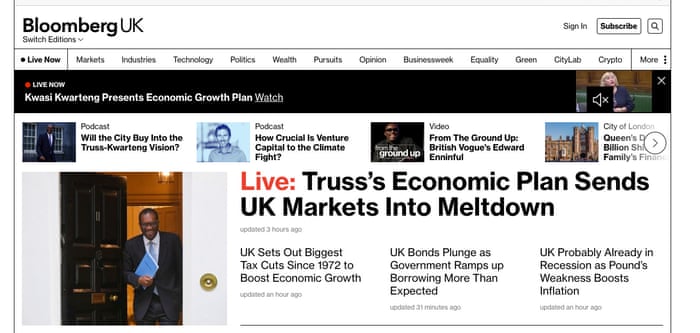

Right here is the headline on the Bloomberg UK homepage. Bloomberg is a information service primarily for the Metropolis, which is often reasonably cautious in its coverge.

UPDATE: Bloomberg has tweeted this.

From Mark Drakeford, the Welsh first minister

This #MiniBudget embeds unfairness throughout the UK.

The UK Authorities needs to be providing significant assist to those that want it essentially the most. As a substitute, they’re giving tax cuts to the wealthy, bonuses to bankers and defending the eye-watering earnings of power corporations.

— Mark Drakeford (@PrifWeinidog) September 23, 2022

Within the Commons Andrew Mitchell, the Conservative former worldwide growth secretary, requested Kwasi Kwarteng if he might verify that the UK was heading in the right direction to return help spending to 0.7% of nationwide wealth in 2024. Kwarteng refused to present that dedication. He replied:

We’re all the time taking a look at our manifesto commitments and given our management on this I hope we will come to the 0.7% as is practicable and the general public funds enable.

Graeme Wearden

The UK’s Debt Administration Workplace has confirmed that Britain’s borrowing wants will surge this 12 months, to pay for the tax cuts introduced in the present day.

The DMO, which is chargeable for managing the federal government’s debt and money wants, is elevating its debt issuance plans by £72.4bn, to £234.1bn.

These additional financing wants imply the DMO should situation an additional £62.4bn of gilts – taking the entire to be offered this 12 months to £193.9bn.

That is serving to to drive up the price of authorities borrowing so dramatically this morning –– as buyers will demand the next price of return for swallowing all this additional debt from the UK.

Bond yields (the speed of return for holding the debt) are actually on observe for his or her largest surge in a long time – with two-year gilts yields nonetheless the best since 2008.

From Nicola Sturgeon, Scotland’s first minister

The tremendous rich laughing all the best way to the precise financial institution (tho I think a lot of them can even be appalled by the ethical chapter of the Tories) whereas growing numbers of the remaining counting on meals banks – all because of the incompetence and recklessness of this failed UK gov

— Nicola Sturgeon (@NicolaSturgeon) September 23, 2022