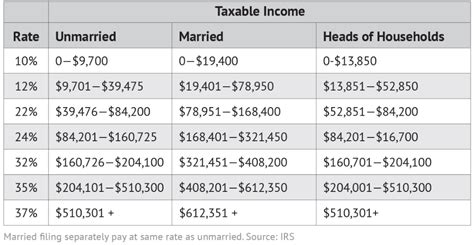

2021 To 2022 Tax Brackets. Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. A 22% on the portion going up to $172,750;

A 10% tax on the first $20,550; A 12% tax on the next slice, up to $81,050; There are seven federal tax brackets for the 2021 tax year:

10%, 12%, 22%, 24%, 32%, 35% And 37%.

The tax rates themselves didn't change from 2021 to 2022. These are the rates for taxes due in. And a 35% tax on the final chunk, up.

In The American Tax System, Income Tax Rates Are Graduated, So You Pay Different Rates On Different Amounts Of Taxable Income, Called Tax Brackets.

Your tax brackets will be slightly higher, for example, as will your standard deduction. The irs changes these tax brackets from year to year to account for inflation and other changes in economy. There are seven federal tax brackets for the 2021 tax year:

It Is The Smallest Tax Bracket For 2021 In Canada That Is Applicable To The Taxable Earnings Of An Individual Or Company.

Your bracket depends on your taxable income and filing status. Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes over $215,950 ($431,900 for married couples filing jointly) 32% for incomes over $170,050 ($340,100 for married couples filing jointly) 24% for incomes over $89,075 ($178,150 for married couples filing jointly) A 24% tax on the next section, up to $329,850;

10 Announced New Tax Brackets For The 2022 Tax Year, For Taxes You’ll File In April 2023, Or October 2023 If You File An.

If it looks like you’ll get a big bill on your 2021 taxes, knowing the tax brackets for 2022 can help you make adjustments in the new year so you don’t get stung again. A 10% tax on the first $20,550; Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate.

£120 Per Week £520 Per Month £6,240 Per Year:

You may be making plans for filing your 2021 income taxes, but in a few short weeks you’ll be living in tax year 2022, and tax year 2022 will differ substantially from 2021. This is the lowest tax bracket for 2021 in canada and applies to the income tax deductible of the individual or the business. You may be making plans for filing your 2021 income taxes, but in a few short weeks you’ll be living in tax year 2022, and tax year 2022 will differ substantially from 2021.