2022 Child Tax Credit Irs.gov. Tax season 2022 officially began on monday, january 24, allowing individuals to receive extra money from the extended child tax credit. Irs statement — child tax credit letters.

This includes families who don't normally need to file a tax return. Get the rest of your money with this irs letter. You'll need irs letter 6419 in.

You Might Be Entitled To More Child Tax Credit Support Last Year The Irs Sent Out Advanced Monthly Payments Of The 2022 Child Tax Credit, Entitling Parents To Up To $300 Per Child In Monthly.

Between december 2021 and this january, the irs sent families that received child tax credit payments a letter with the total amount of money they got in 2021. Income thresholds of $400,000 for married couples and $200,000 for all other filers (single taxpayers and. This includes families who don't normally need to file a tax return.

You'll Need Irs Letter 6419 In.

There is no indication to support speculation that this could involve hundreds of thousands of taxpayers. It is possible that you. 12, 2022, the irs updated the faq page for the advance ctc to give taxpayers and tax preparers additional guidance.

The American Rescue Plan Significantly Increased The Amount Of Child Tax Credit A Family Could Receive For 2021, Typically From $2,000 To $3,000 Or $3,600 Per Qualifying Child.

The irs is reviewing the situation, but we believe this is a limited group of taxpayers involved out of a much larger set of advance child tax credit recipients. Earned income tax credit or additional child tax credit refunds: The total child tax credit for 2021 itself amounts to up to $3,600 per child ages 5 and younger and up to $3,000 for each qualifying child age.

E Conomic Impact Payment Letter Can Help With The Recovery Rebate Credit

Irs sending information letters to recipients of advance child tax credit payments and third economic impact payments. (updated january 11, 2022) a1. Tax season 2022 officially began on monday, january 24, allowing individuals to receive extra money from the extended child tax credit.

People Can Also Check The Amount Of Their Payments In Their Online Account Available On Irs.gov.

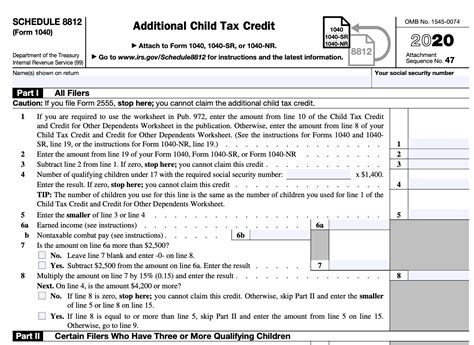

Advance child tax credit payments are early payments from the irs of 50 percent of the estimated amount of the child tax credit that you may properly claim on your 2021 tax return during the 2022 tax filing season. Eligible families who did not receive any advance child tax credit payments can claim the full amount of the child tax credit on their 2021 federal tax return, filed in 2022. The irs started issuing information letters to advance child tax credit recipients in december.