2022 Income Tax Brackets Zimbabwe. The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. The first and last tax brackets of the paye tax table will change, as mentioned below.

You can see also tax rates for the year 202 1 and tax bracket for the year 20 20on this site. The maximum tax bracket now stands at zwl500 000, above which a marginal tax rate of 40% will apply, with effect from 1 january 2022. The following corporate income tax rates will apply to the income of companies with annual gross income of ¢112,070,000 (us $175,383) 1 or.

Other Foreign Currency Tax Bands Remain Unchanged.

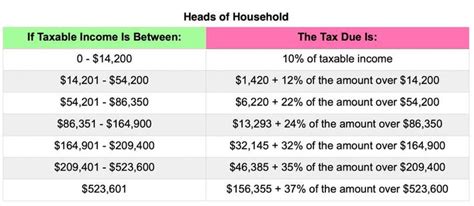

Here are 2022 income tax brackets, depending on your income and filing status. Personal income tax rate in zimbabwe is expected to reach 50.00 percent by the end of 2020, according to trading economics global macro models and. These are the rates for taxes due in april 2023.

According To The Apex Council Of Zimbabwe, The Largest Civil Servants’ Union, Workers Earn Between $22 000 And $40 000 On Average, While Private.

Every year the irs modifies the tax brackets for inflation. The maximum tax bracket now stands at zwl500 000, above which a marginal tax rate of 40% will apply, with effect from 1 january 2022. The actual tax tables will be provided in the amended income tax act/bill, which is not yet available.

In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

Follow these simple steps to calculate your salary after tax in zimbabwe using the zimbabwe salary calculator 2022 which is updated with the 2022/23 tax tables. The following corporate income tax rates will apply to the income of companies with annual gross income of ¢112,070,000 (us $175,383) 1 or. United arab emirates 16:05 gdp (yoy) forecast:

And The Seven Tax Rates Remain Unchanged, While The Income Limits Have Been Adjusted For Inflation.

The brackets went into effect january 1, 2022. There are seven federal income tax rates in 2022: Proposed changes effective 1 january 2022.

You Can See Also Tax Rates For The Year 202 1 And Tax Bracket For The Year 20 20On This Site.

The irs changes these tax brackets from year to year to account for inflation and other changes in economy. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. Inclusive of the aids levy, the top effective rate for employment income changed from 46.35% to 41.20% and the top effective rate for other income is 24.72%.