September 29, 2022

Click on for PDF

U.S. anti-corruption enforcement has continued apace via the primary eight months of 2022. Though some will level to declining numbers of Overseas Corrupt Practices Act (“FCPA”) enforcement actions in 2022 so far, notably towards firms, as in comparison with the heights of latest years, our view from the trenches is that enforcement is evolving, not fading. As evidenced by the bevvy of exercise catalogued within the pages that comply with, our expertise is prosecutors on the U.S. Division of Justice (“DOJ”) and enforcers on the U.S. Securities and Alternate Fee (“SEC”) stay acutely targeted on worldwide anti-corruption enforcement and that the compliance challenges confronted by international firms are as difficult at the moment as they’ve ever been. As well as, the expanded employment of cash laundering fees has broadened prosecutors’ attain.

This consumer replace gives an summary of the FCPA and different home and worldwide anti-corruption enforcement, litigation, and coverage developments from the primary eight months of 2022. In January 2023, we are going to publish our complete year-end replace on 2022 FCPA developments.

FCPA OVERVIEW

The FCPA’s anti-bribery provisions make it unlawful to corruptly provide or present cash or anything of worth to officers of overseas governments, overseas political events, or public worldwide organizations with the intent to acquire or retain enterprise. These provisions apply to “issuers,” “home issues,” and people performing on behalf of issuers and home issues, in addition to to “any individual” who acts whereas within the territory of america. The time period “issuer” covers any enterprise entity that’s registered underneath 15 U.S.C. § 78l or that’s required to file stories underneath 15 U.S.C. § 78o(d). On this context, overseas issuers whose American Depositary Receipts (“ADRs”) or American Depositary Shares (“ADSs”) are listed on a U.S. alternate are “issuers” for functions of the FCPA. The time period “home concern” is even broader and consists of any U.S. citizen, nationwide, or resident, in addition to any enterprise entity that’s organized underneath the legal guidelines of a U.S. state or that has its principal place of job in america.

Along with the anti-bribery provisions, the FCPA additionally has “accounting provisions” that apply to issuers and people performing on their behalf. First, there’s the books-and-records provision, which requires issuers to make and preserve correct books, information, and accounts that, in cheap element, precisely and pretty replicate the issuer’s transactions and disposition of property. Second, the FCPA’s inner accounting controls provision requires that issuers devise and keep cheap inner accounting controls geared toward stopping and detecting FCPA violations. Prosecutors and regulators often invoke these latter two sections once they can’t set up the weather for an anti-bribery prosecution or as a mechanism for compromise in settlement negotiations. As a result of there is no such thing as a requirement {that a} false report or poor management be linked to an improper fee, even a fee that doesn’t represent a violation of the anti-bribery provisions can result in prosecution underneath the accounting provisions if inaccurately recorded or attributable to an inner accounting controls deficiency.

Worldwide corruption additionally might implicate different U.S. legal legal guidelines. Incessantly, prosecutors from DOJ’s FCPA Unit cost non-FCPA crimes similar to cash laundering, mail and wire fraud, Journey Act violations, tax violations, and even false statements, along with or as a substitute of FCPA fees. With out query, probably the most prevalent amongst these “FCPA-related” fees is cash laundering—a generic time period used as shorthand for statutory provisions that usually criminalize conducting or trying to conduct a transaction involving proceeds of “specified illegal exercise” or transferring funds to or from america, in both case to advertise the carrying on of specified illegal exercise, to hide or disguise the character, location, supply, possession or management of the proceeds, or to keep away from a transaction reporting requirement. “Specified illegal exercise” consists of over 200 enumerated U.S. crimes and sure overseas crimes, together with the FCPA, fraud, and corruption offenses underneath the legal guidelines of overseas nations. Though this has not all the time been the case, in latest historical past, DOJ has often deployed the cash laundering statutes to cost “overseas officers” who will not be themselves topic to the FCPA. It’s not uncommon for DOJ to cost the alleged supplier of a corrupt fee underneath the FCPA and the alleged recipient with cash laundering violations.

FCPA AND FCPA-RELATED ENFORCEMENT STATISTICS

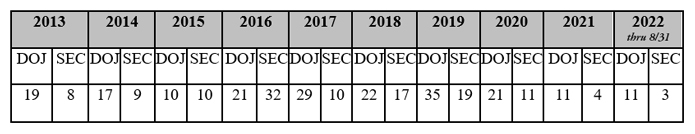

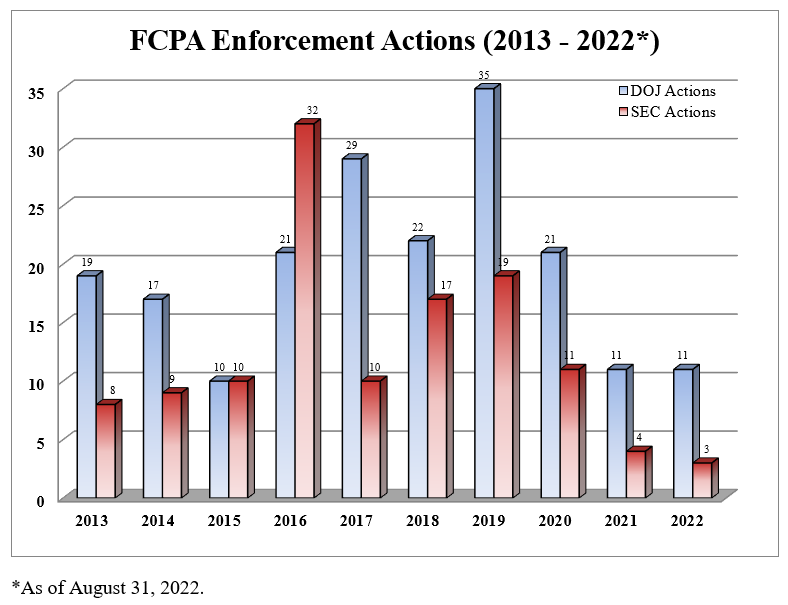

The under desk and graph element the variety of FCPA enforcement actions initiated by DOJ and the SEC, the statute’s twin enforcers, in the course of the previous 10 years.

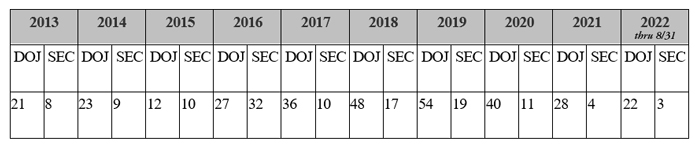

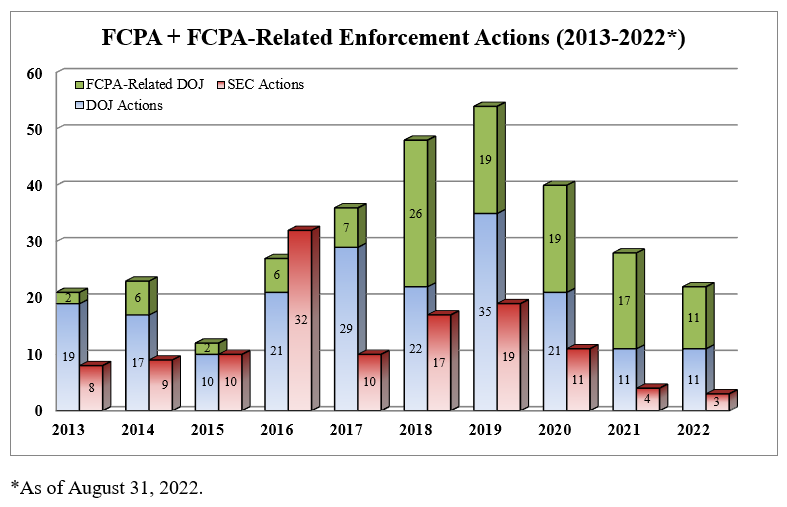

However as our readers know, the variety of FCPA enforcement actions represents solely a chunk of the strong pipeline of worldwide anti-corruption enforcement efforts by DOJ. Certainly, the rising proportion of “FCPA-related” fees within the total enforcement docket of FCPA prosecutors is a pattern we’ve got been remarking upon for years. In complete, DOJ introduced 11 such FCPA-related actions within the first eight months of 2022, bringing the general depend to 22 instances that DOJ’s FCPA unit filed, unsealed, or in any other case joined because the starting of the 12 months. The previous 10 years of FCPA plus FCPA-related enforcement exercise is illustrated within the following desk and graph.

2022 MID-YEAR FCPA + FCPA-RELATED ENFORCEMENT ACTIONS

CORPORATE ENFORCEMENT ACTIONS

By way of August, there have been three company FCPA enforcement actions from every of DOJ and the SEC in 2022, which is on par with the company enforcement exercise for all of 2021 however nonetheless down from latest historic developments. There have been extra resolutions in September not coated herein, and we are going to proceed monitoring the tempo of company FCPA enforcement in our forthcoming year-end replace and past to see if it is a momentary lull or a longer-term pattern. Within the meantime, the 5 firms topic to FCPA enforcement within the 12 months so far comply with.

Tenaris S.A.

Most lately, on June 2, 2022, Luxemburg-based international metal pipe provider Tenaris, an ADR-issuer, consented to the entry of an administrative cease-and-desist order by the SEC to resolve FCPA bribery, books and information, and inner controls fees. In line with the SEC’s Order, between 2008 and 2013, brokers and staff of Tenaris’s Brazilian subsidiary paid roughly $10.4 million in bribes to a high-ranking procurement supervisor at Brazil’s state-owned oil and fuel firm Petróleo Brasileiro S.A. (“Petrobras”) to influence the procurement supervisor to not open up the subsidiary’s ongoing pipe provide mission to competitors, finally resulting in the award of over $1 billion in contracts. To resolve the fees, Tenaris agreed to pay greater than $78 million, consisting of roughly $42.84 million in disgorgement, $10.26 million in prejudgment curiosity, and a $25 million civil cash penalty. Tenaris additionally agreed to self-report to the SEC for 2 years on the standing of its remediation and implementation of compliance measures associated to its compliance program and accounting controls. As we’ve got mentioned in earlier updates, Gibson Dunn represented Petrobras and efficiently negotiated a non-prosecution settlement with DOJ and an SEC decision and navigated seamlessly a three-year self-monitorship.

In line with a press release launched by Tenaris, DOJ closed its investigation into this matter with out taking motion. Notably, that is Tenaris’s second brush with the FCPA, having resolved twin FCPA enforcement actions with DOJ and the SEC in 2011 arising out of alleged corruption in Uzbekistan.

Glencore Worldwide A.G.

Undoubtedly the bombshell FCPA enforcement matter of 2022-to-date got here on Might 24, when Swiss multinational commodity buying and selling and mining firm Glencore resolved legal FCPA bribery fees in seven African and Latin American nations. Concurrently, Glencore entered right into a parallel legal and civil market manipulation decision with a unique unit of DOJ’s Fraud Part and the U.S. Commodity Futures Buying and selling Fee (“CFTC”) based, partially, on the identical conduct, along with separate anti-corruption resolutions with Brazilian and UK authorities. In line with the corruption-related allegations, from 2007 to 2018, Glencore offered greater than $100 million in funds and different gadgets of worth to intermediaries for the aim of bribing overseas officers in Brazil, Cameroon, the Democratic Republic of the Congo, Equatorial Guinea, Ivory Coast, Nigeria, and Venezuela to acquire contracts and different advantages.

The evaluation of legal and civil penalties towards Glencore for the online of associated resolutions entails a posh set of credit and offsets, however in complete Glencore is predicted to pay roughly $1.5 billion to resolve the entire issues. The whole fee to U.S. enforcement businesses is predicted to be $1.02 billion, of which roughly $700.7 million is allocable to the FCPA case comprised of a legal nice of $428.521 million and legal forfeiture of $272.186 million. On prime of that, Glencore agreed to pay $39.6 million to the Brazilian Federal Prosecutor’s Workplace, and as mentioned under in our UK Enforcement Replace, a subsidiary pleaded responsible to UK Bribery Act fees and is scheduled to be sentenced in November 2022. Glencore has said that the decision within the UK, and different pending proceedings within the Netherlands and its dwelling nation of Switzerland, are collectively anticipated to extend the general decision to $1.5 billion. Moreover, Glencore agreed to a three-year compliance monitor in reference to the FCPA decision and a separate three-year compliance monitor in reference to the market manipulation decision, the scope of that are nonetheless being negotiated.

Past the sheer measurement of the matter, there are quite a few notable features to the Glencore decision:

- First, Glencore is neither a U.S. firm nor issuer (therefore, no SEC decision), and DOJ’s FCPA jurisdiction seems to be premised loosely on the approval of sure funds by staff (together with former West African oil dealer Anthony Stimler, who pleaded responsible to FCPA fees as coated in our 2021 12 months-Finish FCPA Replace) whereas in america, the transmittal of at the very least one electronic mail from america by Stimler, and using U.S. correspondent banking accounts for at the very least among the alleged bribe funds. The main points of DOJ’s allegations and jurisdictional theories will not be absolutely fleshed out within the company charging paperwork, however DOJ’s strategy appears to be {that a} multi-country corruption conspiracy going down largely outdoors of america could also be introduced inside U.S. jurisdiction in its entirety attributable to correspondent banking transactions or via a single act taken by one co-conspirator whereas in america, probably even a low-level dealer concerned in a single spoke of the alleged conspiracy.

- Second, though there’s precedent in company FCPA enforcement actions for comparatively modest legal forfeiture actions to accompany legal fines, usually offset within the legal nice calculation, Glencore is the primary of which we’re conscious by which the quantity of achieve was utilized by DOJ each as the first enter for the Tips nice and, on prime of that, disgorged by DOJ via parallel forfeiture. On this method, DOJ not solely utilized a legal penalty, which is customary, but it surely additionally disgorged all allegedly tainted earnings, which isn’t customary in a non-issuer case (i.e. the place the SEC shouldn’t be concerned). Whereas DOJ has utilized forfeiture in a restricted method in some FCPA instances, this seems to be the primary time it has required an organization to disgorge all ill-gotten achieve within the absence of a parallel SEC motion. This observe has precedent in different kinds of white collar company instances, notably by prosecutors within the Southern District of New York, however to not our information within the FCPA instances.

- Third, as famous above, part of the CFTC’s fees had been based on the identical alleged corruption conduct coated within the DOJ FCPA decision, making this the second time that the CFTC has charged corruption as “manipulative and misleading conduct” underneath the Commodity Alternate Act. The primary occasion was the case towards Vitol, Inc., coated in our 2020 12 months-Finish FCPA Replace, which arose out of the identical reality sample.

Stericycle, Inc.

The one twin FCPA enforcement motion so far in 2022 got here on April 20, when Illinois-based waste administration firm Stericycle resolved FCPA bribery and accounting fees with DOJ and the SEC arising from allegations of corruption in Argentina, Brazil, and Mexico. The charging paperwork collectively allege that, between 2011 and 2016, Stericycle representatives paid roughly $10.5 million in bribes to authorities officers to acquire contracts and different advantages that cumulatively netted the corporate roughly $21.5 million in earnings.

To resolve the legal fees, Stericycle entered right into a deferred prosecution settlement with a $52.5 million penalty and requiring the imposition of a compliance monitor for a two-year time period. The SEC decision requires the disgorgement of roughly $28 million in earnings and prejudgment curiosity, along with the imposition of the identical compliance monitor. As well as, Stericycle entered right into a parallel $9.3 million decision with Brazil’s Controladoria-Geral da União and the Advocacia-Geral de União, which after offsets within the DOJ / SEC resolutions will internet out to a complete decision of roughly $84 million. Parallel United States and Brazilian enforcement actions, similar to seen right here, have turn out to be commonplace.

Jardine Lloyd Thompson Group Holdings Ltd.

On March 18, 2022, DOJ introduced its first “declination with disgorgement” FCPA decision in practically two years, with UK insurance coverage firm JLT Group. DOJ’s declination letter asserted that it had discovered proof that JLT Group, via an worker and its brokers, paid roughly $3.15 million in alleged bribes to Ecuadorian officers between 2014 and 2016, via an middleman primarily based in Florida, with a purpose to acquire or retain insurance coverage contacts with Ecuadorian state-owned surety Seguros Sucre. The underlying conduct is similar coated in our 2020 Mid-12 months FCPA Replace the place we reported on the prosecution of 4 defendants—together with former JLT Group govt Felipe Moncaleano Botero—within the Southern District of Florida for cash laundering conspiracy.

DOJ declined to prosecute primarily based on JLT Group’s voluntary disclosure of the misconduct, full and proactive cooperation, immediate and complete remediation, and settlement to disgorge simply over $29 million in alleged improper good points. JLT Group associates additionally reached resolutions with Colombian and UK authorities, as coated under in our worldwide enforcement developments part. Gibson Dunn represented JLT Group in acquiring the DOJ declination, and within the worldwide resolutions.

KT Company

First in however final up, the preliminary FCPA company enforcement motion of 2022 got here on February 17, when Korea’s largest telecommunications operator and ADS issuer KT Company resolved FCPA books-and-records and inner controls fees with the SEC. In line with the executive stop and desist order, KT Company maintained a number of “slush funds” between 2009 and 2017, from which it made unlawful contributions to legislative officers in Korea who sat on committees with affect over the telecommunications trade and likewise to Vietnamese authorities officers to obtain contracts.

With out admitting or denying the allegations, KT Company agreed to settle with a $3.5 million civil penalty and the disgorgement of $2.8 million in earnings plus prejudgment curiosity. KT Company additionally will self-report on FCPA compliance remediation for a two-year time period. There isn’t a indication so far of a parallel DOJ enforcement motion.

INDIVIDUAL ENFORCEMENT ACTIONS

There have been FCPA and FCPA-related fees filed or unsealed, or by which DOJ FCPA prosecutors first entered an look, towards 19 particular person defendants in the course of the first eight months of 2022.

Extra PDVSA Expenses

In recent times, we’ve got coated quite a few corruption-related reality patterns arising out of worldwide enterprise dealings with Venezuela’s state-owned and state-controlled oil firm, Petróleos de Venezuela, S.A. (“PDVSA”). The primary eight months of 2022 was no exception to this longstanding pattern.

On March 8, 2022, a grand jury sitting within the Southern District of Florida indicted two former senior prosecutors from the anti-corruption division of the Venezuelan Lawyer Basic’s Workplace, Daniel D’Andrea Golindano and Luis Javier Sanchez Rangel, for allegedly laundering $1 million in bribes via a checking account in Florida. The indictment asserts that Rangel and Golindano accepted funds from a contractor that was itself underneath investigation by the Lawyer Basic’s Workplace for allegedly receiving over $150 million in contracts from PDVSA entities, in alternate for closing the investigation with out looking for legal fees towards the contractor. The defendants have but to make an look in court docket and have been transferred to fugitive standing.

In a separate alleged PDVSA-related scheme, on June 23, 2022, Jhonnathan Marin, former Mayor of Guanta, Venezuela, pleaded responsible to a single depend of cash laundering conspiracy. In line with the legal info, between 2015 and 2017, Marin accepted $3.8 million in bribes from an unnamed PDVSA contractor to affect a number of PDVSA joint ventures operated within the port city space to award tens of tens of millions of {dollars}’ value of enterprise to the contractor. Marin at present awaits a September 2022 sentencing date earlier than the Honorable Robert N. Scola, Jr. of the U.S. District Courtroom for the Southern District of Florida.

In a 3rd case involving PDVSA, on July 12, 2022 a grand jury sitting within the Southern District of Florida returned an indictment charging monetary asset managers—Ralph Steinmann and Luis Fernando Vuteff—with taking part within the $1.2 billion “Operation Cash Flight” PDVSA foreign money conversion / embezzlement scheme that we first coated in our 2018 12 months-Finish FCPA Replace. The genesis of the scheme arises from the substantial distinction between the official and unofficial charges at which Venezuelan bolivars might be exchanged for U.S. {dollars}, with members of the scheme inflicting PDVSA to enter into contracts to transform bolivars on the “unofficial charge” of 60:1, then again into {dollars} on the official charge of 6:1, thereby immediately rising the skin funding tenfold on the expense of PDVSA and with the help of corrupt funds. For his or her half, Steinmann and Vuteff are every charged with one depend of cash laundering, with the indictment alleging that between 2014 and 2018 they laundered greater than $200 million in proceeds from the scheme, together with by opening financial institution accounts on behalf of Venezuelan authorities officers to obtain the alleged bribe funds. Vuteff has reportedly been arrested and is pending extradition from Switzerland. Steinmann shouldn’t be earlier than the court docket and DOJ has asserted that he’s a fugitive.

Lastly, in yet one more case involving a nonetheless totally different PDVSA corruption reality sample, on August 24, 2022, a grand jury sitting within the Southern District of Florida returned an indictment charging Venezuelan businessman Rixon Rafael Moreno Oropeza with cash laundering offenses in reference to an alleged bribery scheme involving Petropiar, a three way partnership between PDVSA and a U.S. oil firm. Moreno is alleged to have paid tens of millions in bribes from financial institution accounts in Florida to a senior Venezuelan authorities official and senior Petropiar staff to acquire as a lot as $30 million in contracts from Petropiar at costs that had been inflated as a lot as 100-times market worth. Based mostly on public information, it doesn’t seem that Moreno is but in U.S. custody.

Extra Vitol & Sargeant Marine Defendants

We have now been masking ongoing, and at instances overlapping, investigations in Latin America involving vitality buying and selling agency Vitol Inc. and asphalt firm Sargeant Marine, Inc., in addition to quite a few particular person defendants, since our 2020 12 months-Finish Replace. In March 2022, there have been a number of extra developments, together with new fees and new FCPA Unit connections to present fees.

On March 16, 2022, DOJ charged Dutch citizen and former Vitol dealer Lionel Hanst with a single depend of conspiracy to commit cash laundering alleging that, from November 2014 to September 2020, Hanst laundered bribes from and on behalf of Vitol for the good thing about officers at Ecuadorian, Mexican, and Venezuelan state oil firms Empresa Publica de Hidrocarburos del Ecuador (“PetroEcuador”), Petróleos Mexicanos (“PEMEX”), and PDVSA. Hanst pleaded responsible and is awaiting sentencing earlier than the Honorable Eric N. Vitaliano of the U.S. District Courtroom for the Japanese District of New York.

Proper across the similar time, from March via Might 2022, DOJ FCPA Unit prosecutors concerned within the Hanst case entered appearances in a number of ongoing instances. Though these instances had been filed in earlier years, there have been no press releases nor entries of look by FCPA Unit members to determine them as FCPA-related enforcement actions—till this 12 months.

In Might 2021, Japanese District of New York prosecutors charged Gonzalo Guzman Manzanilla and Carlos Espinosa Barba, former staff of PEMEX’s procurement subsidiary, with conspiracy to commit cash laundering in reference to the Vitol bribery scheme. The allegations are that, between 2017 and 2020, Guzman and Espinosa agreed to offer a Vitol dealer with confidential, inside info on PEMEX-related bids in exchanges for bribes. Each have pleaded responsible to single counts of conspiracy to commit cash laundering and likewise await sentencing earlier than Decide Vitaliano.

The identical DOJ FCPA Unit prosecutors entered their appearances in March 2022 in 2020 instances towards brothers Antonio and Enrique Ycaza, who’ve every been charged with conspiracy to violate the FCPA and cash laundering statutes in reference to alleged bribery that straddles the Sargeant Marine and Vitol investigations. The allegations are that, between 2011 and 2019, the brothers operated purported consulting firms that had been used to funnel roughly $22 million in bribes to PetroEcuador officers on behalf of Sargeant Marine and Vitol. Just like the others, the Ycaza brothers have pleaded responsible and await sentencing earlier than Decide Vitaliano.

Lastly, in Might 2022, FCPA Unit prosecutors entered their appearances in extra 2020 instances towards a unique set of brothers, Bruno and Jorge Luz. The Luz brothers have every pleaded responsible to a single depend of conspiracy to violate the FCPA’s anti-bribery provisions, related to a scheme to create shell firms that had been allegedly used to launder greater than $5 million in bribes to Petrobras officers on behalf of Sargeant Marine. Just like the others, the Luz brothers await sentencing earlier than Decide Vitaliano.

Extra Odebrecht-Associated Expenses

We have now been masking an ongoing stream of corruption fees arising from the 2016 blockbuster FCPA decision with Brazilian building conglomerate Odebrecht S.A. since our 2016 12 months-Finish FCPA Replace, together with most lately in our 2021 12 months-Finish FCPA Replace. On March 24, 2022, one other case was added to the pile with the indictment of former Comptroller Basic of Ecuador Carlos Ramon Polit Faggioni on six counts of cash laundering. In line with the indictment, between 2010 and 2016, Polit solicited and obtained over $10 million in bribes from Odebrecht in alternate for utilizing his political place to learn Odebrecht’s enterprise in Ecuador. Though the bribery scheme came about considerably outdoors of america, the U.S. nexus is that Polit allegedly directed a member of the conspiracy to launder sure of the funds via Florida-based firms for use to buy and renovate properties in Florida.

Polit has pleaded not responsible and at present awaits a Might 2023 trial date within the U.S. District Courtroom for the Southern District of Florida.

Extra Corsa Coal Defendant

We coated in our 2021 12 months-Finish FCPA Replace the FCPA responsible plea of Frederick Cushmore, Jr., former Head of Worldwide Gross sales for an unnamed Pennsylvania-based coal firm. That coal firm has since recognized itself as Corsa Coal, and on March 31, 2022 additional fees had been introduced. On that date, a grand jury sitting within the U.S. District Courtroom for the Western District of Pennsylvania indicted former Vice President Charles Hunter Hobson on seven counts of FCPA bribery, cash laundering, and wire fraud conspiracy. The indictment alleges that Hobson participated in a scheme to pay $4.8 million to an agent with the intention {that a} portion can be used to pay bribes to officers of state-owned Egyptian firm Al Nasr Firm for Coke and Chemical substances to acquire $143 million in coal supply contracts, and likewise sought to acquire a share of the illicit funds as kickbacks for his personal profit. The indictment additional alleges that Hobson and his co-conspirators communicated through encrypted messaging companies, similar to WhatsApp, and private electronic mail addresses in an effort to hide the scheme.

Hobson has pleaded not responsible and no trial date has but been set. Corsa Coal has reported that it’s cooperating with DOJ and likewise the Royal Canadian Mounted Police, however no public fees have but been filed towards the entity as of the date of publication.

Extra Seguros Sucre Defendants

We coated above DOJ’s ongoing investigation of suspected corruption involving Seguros Sucre, Ecuador’s state-owned insurance coverage firm, with the company JLT Group declination with disgorgement. Seemingly impartial of that matter, at the very least partially, we noticed developments in two different Seguros Sucre-related corruption instances in the course of the first eight months of 2022.

First, on March 24, 2022, monetary advisor Fernando Martinez Gomez pleaded responsible to 1 depend of cash laundering related to alleged corrupt funds to officers of Seguros Sucre and Seguros Rocafuerte, one other Ecuadorian state-owned insurer, in addition to a separate wire fraud scheme involving the misuse of consumer property held by Martinez’s employer, Biscayne Capital, in a pyramid scheme that finally led to the liquidation of Biscayne. The FCPA-related cash laundering cost arises out of the identical scheme resulting in the fees towards 4 people—together with Chairman of Seguros Sucre and Rocafuerte Juan Ribas Domenech—coated in our 2020 Mid-12 months FCPA Replace. Martinez awaits sentencing earlier than the Honorable Carol Bagley Amon of the U.S. District Courtroom for the Japanese District of New York.

On July 14, 2022, in one other seemingly separate Seguros Sucre investigation, a grand jury sitting within the Southern District of Florida returned an indictment towards three insurance coverage brokers—Luis Lenin Maldonado Matute, Esteban Eduardo Merlo Hidalgo, and Christian Patricio Pintado Garcia—charging them every with seven counts of FCPA and cash laundering violations related to alleged bribes paid to officers of Seguros Sucre and Seguros Rocafuerte. Merlo, a Florida resident, has been arrested and at present faces a September 2022 trial date. Maldonado and Pintado, each Ecuadorian residents residing in Costa Rica, have been transferred to fugitive standing, though Pintado has made an look via counsel.

2022 MID-YEAR CHECK-IN ON FCPA-RELATED ENFORCEMENT LITIGATION

As our readership is aware of, following the submitting of FCPA or FCPA-related fees, legal and civil enforcement proceedings can take years to wind their method via the courts. The substantial variety of enforcement instances from prior years, particularly involving contested legal indictments of particular person defendants, has led to an lively first eight months of enforcement litigation in 2022. A choice of prior-year issues that noticed materials enforcement litigation developments follows.

Second Circuit Affirms Dismissal of Hoskins FCPA Expenses

For years, we’ve got been following the case of Lawrence Hoskins, the UK citizen working for a UK subsidiary of French multinational Alstom S.A. on a mission in Indonesia with out ever setting foot in america and who but in some way ended up in U.S. court docket answering FCPA and cash laundering fees. Most lately, in our 2020 Mid-12 months FCPA Replace, we coated the grant of Hoskins’s Rule 29 Movement for a Judgment of Acquittal on the FCPA fees, however denial as to the cash laundering fees, by the Honorable Janet Bond Arterton of the U.S. District Courtroom for the District of Connecticut, following the jury trial conviction on all of these counts in November 2019. Cross-appeals adopted and the case wound its method again to the U.S. Courtroom of Appeals for the Second Circuit for a second time.

On August 12, 2022, in an opinion authored by the Honorable Rosemary S. Pooler, a break up panel of the Second Circuit affirmed the district court docket’s ruling rejecting the jury’s FCPA convictions however affirming the jury’s cash laundering convictions. To know this opinion, nevertheless, one should return to the primary time Hoskins’s case was earlier than the Second Circuit. As coated in our 2018 12 months-Finish FCPA Replace, the Second Circuit largely affirmed the decrease court docket’s pretrial ruling that DOJ couldn’t cost a defendant underneath the FCPA primarily based on conspiracy or aiding-and-abetting theories if that defendant doesn’t himself fall inside one of many “three clear classes of individuals who’re coated by [the FCPA’s anti-bribery] provisions,” which Hoskins as a overseas nationwide performing outdoors of america didn’t himself fall into. The Second Circuit did, nevertheless, maintain that the federal government ought to be permitted to make a displaying that Hoskins acted as an agent of a home concern (specifically, Alstom’s U.S. subsidiary), which might carry him throughout the statute’s attain. That set the stage for the 2019 trial, the place DOJ persuaded the jury that Hoskins acted on behalf of Alstom Energy, Inc. (the U.S. entity), however couldn’t then recover from the hurdle of Decide Arterton’s looking out exegesis of the FCPA on Rule 29. This was the choice now up for evaluation by the Second Circuit.

Basically, the Second Circuit majority agreed with Decide Arterton that there was no company relationship as between Hoskins and the U.S. Alstom entity. There was no actual query after the trial as as to whether corrupt funds had been made to Indonesian authorities officers to help Alstom acquire a significant energy plant contract, or whether or not Hoskins participated in procuring the brokers via which these funds had been made, understanding the aim of these funds. The query, moderately, was whether or not underneath widespread regulation ideas of company, the U.S. subsidiary and Hoskins established a fiduciary relationship whereby Hoskins would act as an agent on behalf of the U.S. entity because the principal. And the Second Circuit majority discovered that “[c]onspicuously lacking from the proof is something indicating that [Alstom Power] representatives truly managed Hoskins’s actions as Hoskins and his [] counterparts operated underneath separate, parallel employment buildings.” Though Hoskins obtained sure duties from Alstom Energy representatives, the Second Circuit discovered inadequate proof for the jury to seek out past an inexpensive doubt that Hoskins had authority to behave on behalf of the U.S. entity or that the U.S. entity was capable of rent, hearth, or in any other case management him. The one dissenting vote, from the Honorable Raymond J. Lohier, Jr., targeted principally on the deference accorded to jury verdicts coupled with a perception that there was ample (if not uncontroverted) proof of company on this case.

Though the case represents an vital affirmance of the boundaries of FCPA jurisdiction and company regulation, for Hoskins himself it should not be misplaced that the cash laundering counts had been affirmed by all three judges on the panel. The Second Circuit turned away his Speedy Trial Act and associated Sixth Modification claims, discovering that though greater than six years elapsed from indictment to trial, the overwhelming majority of that point was correctly excludable for Speedy Trial Act functions and inadequate prejudice was proven from the delay. And the Courtroom affirmed the jury directions on withdrawal from conspiracy and venue for the cash laundering counts. On that final level, as DOJ’s cash laundering urge for food grows it’s noteworthy that the Second Circuit held that for venue functions a multi-part wire switch (on this case from Alstom Energy in Connecticut to the agent in Maryland after which on to Indonesia) could also be prosecuted as a single, persevering with transaction in any of the U.S. districts via which the transaction traversed.

Roger Ng Trial Conviction

On April 8, 2022, following a virtually two-month trial and three days of deliberation, a federal jury in Brooklyn returned a responsible verdict on all three counts towards former Goldman Sachs affiliate managing director Ng Chong Hwa (“Roger Ng”). The convictions of conspiracy to commit FCPA bribery, conspiracy to commit cash laundering, and understanding circumvention of the FCPA’s inner controls provision, arose from the large corruption scheme involving 1Malaysia Improvement Financial institution (“1MDB”) that we’ve got been following for years.

In line with the Authorities’s trial proof, between 2009 and 2014, Ng participated in a scheme to launder billions of {dollars} from the Malaysian state-controlled financial improvement fund, together with by deceptive his agency into backing three bond transactions that had been, partially, procured via the fee of greater than $1 billion in bribes to authorities officers in Malaysia and the United Arab Emirates. The fund proceeds had been allegedly laundered via the U.S. banking system, together with famously for backing Hollywood blockbuster “The Wolf of Wall Road,” and different high-profile investments. Ng himself reportedly obtained $35 million for his function within the scheme.

As mentioned in our 2021 12 months-Finish FCPA Replace, the Courtroom beforehand denied Ng’s pretrial movement to dismiss the inner controls depend, which argued that Ng couldn’t have circumvented issuer Goldman Sachs’s inner accounting controls as a result of the alleged bribes used 1MDB (and never financial institution) funds. The Honorable Margo Okay. Brodie of the U.S. District Courtroom for the Japanese District of New York affirmed that ruling in denying Ng’s Rule 29 movement for a judgment of acquittal from the bench on the shut of DOJ’s case, and defined her reasoning in a written post-trial opinion issued on April 8, the day of the jury’s verdict. Decide Brodie defined that the trial proof was ample to indicate past an inexpensive doubt that Ng and cooperating co-defendant Timothy Leissner, who testified towards Ng, purposefully hid from varied approval committees throughout the financial institution the involvement of well-known politically uncovered individual Low Taek Jho (“Jho Low”) within the 1MDB funding, in addition to that the approval of varied authorities officers within the funding was procured via bribery. Whereas acknowledging that the time period “inner accounting controls” might be learn actually to use solely to safeguards regarding an issuer’s personal accounting entries, the Courtroom held that such a slim studying would frustrate the general intent of the statute and browse out the express requirement within the statute that issuers set up controls to authorize particular transactions.

Ng is at present scheduled to be sentenced in November 2022.

Baptiste and Boncy FCPA Expenses Dismissed on the Eve of Retrial

We coated in our 2021 12 months-Finish FCPA Replace the reversal of FCPA jury trial convictions of retired U.S. Military colonel Joseph Baptiste and businessperson Roger Richard Boncy, premised on an FBI sting simulating a bribery scheme involving Haitian port mission investments, primarily based on the ineffective help of Baptiste’s counsel infecting the basic equity of the joint trial. The retrial was set to start in July, however on June 27, 2022 DOJ moved to dismiss all fees with prejudice, and DOJ’s movement was granted by the Honorable Allison D. Burroughs of the U.S. District Courtroom for the District of Massachusetts the next day.

The trigger for the collapse of the prosecution stems from a December 2015 telephone name with Boncy that an undercover FBI agent recorded in the course of the investigation. The FBI inadvertently didn’t protect the recording, which grew to become a flashpoint in the course of the preliminary trial as Boncy insisted that he made exculpatory statements throughout that dialog that might present he didn’t consider the funding in query was corrupt. That declare discovered late vindication when, main as much as the second trial, the FBI found textual content messages on an FBI server that contemporaneously described the contents of the December 2015 telephone name, together with a press release by Boncy that the cash at problem wouldn’t be used to pay bribes. Aggressive discovery requests had been the important thing driver to realize this dismissal.

Baptiste and Boncy are actually discharged and free from fees.

Eleventh Circuit Remands Case to Tackle Overseas Diplomat Immunity Protection

In our 2021 12 months-Finish FCPA Replace we coated the denial of movement to make a particular look and problem the cash laundering indictment dealing with Alex Nain Saab Moran, a joint Colombian and Venezuelan nationwide charged with cash laundering offenses in reference to a $350 million construction-related bribery scheme in Venezuela. The Honorable Robert N. Scola, Jr. of the U.S. District Courtroom for the Southern District of Florida rejected the movement on the premise of the fugitive disentitlement doctrine, provided that Saab was not current in america himself.

On June 2, 2022, the U.S. Courtroom of Appeals for the Eleventh Circuit in a per curiam order declined to handle the deserves of Saab’s attraction. With respect to the request to make a particular look to problem the indictment, the problem had been mooted by Saab’s interceding extradition from Cabo Verde. However with respect to Saab’s declare that he was a overseas diplomat immune from prosecution, the Eleventh Circuit remanded the case for the district court docket to handle that problem within the first occasion. Saab’s renewed movement to dismiss is now set for a week-long evidentiary listening to again earlier than Decide Scola, starting in October 2022.

District Courtroom Finds Broad Privilege Waiver From Cooperation with DOJ

In our 2019 12 months-Finish and 2020 Mid-12 months FCPA updates, we coated the FCPA fees towards and intensive post-indictment litigation involving the previous Cognizant Expertise Options President and Chief Authorized Officer. The case is at present set for trial within the U.S. District Courtroom for the District of New Jersey in October 2022, however the pretrial disputes proceed apace. The person defendants have moved to compel discovery on various points, which the Honorable Kevin McNulty addressed in 5 separate memorandum opinions dated January 24 (two), March 23, April 27, and July 19, 2022.

Chief among the many points in dispute issues the recurring dilemma of how firms are to navigate cooperation with authorities investigations with out waiving the attorney-client privilege. Right here, as a part of its substantial cooperation efforts that finally led to a legal declination, Cognizant offered DOJ with “detailed accounts” of quite a few firm worker witness interviews carried out by outdoors counsel. The person defendants sought entry to all supplies related to these interviews, which Decide McNulty largely granted. The Courtroom held that by disclosing privileged info to DOJ, Cognizant waived attorney-client privilege and work product safety “as to all memoranda, notes, summaries, or different information of the interviews themselves,” no matter whether or not the interview summaries had been conveyed orally or in writing. Additional, “to the extent the summaries instantly conveyed the contents of paperwork or communications, these underlying paperwork or communications themselves are throughout the scope of the waiver.” Lastly, Decide McNulty held that “the waiver extends to paperwork and communications that had been reviewed and shaped any a part of the premise of any presentation, oral or written, to the DOJ in reference to this investigation.”

As famous above, the previous executives are at present scheduled to go to trial in October 2022. However this date could also be imperiled by defendants’ latest movement to conduct quite a few Rule 15 depositions in India, together with via the compulsion of letters rogatory. We’ll undoubtedly return to this matter in future FCPA updates.

SEC Obtains Default Judgment in 2019 Case

In one other improvement this 12 months in a case initiated in 2019, on June 27, 2022 the Honorable J. Paul Oetken of the U.S. District Courtroom for the Southern District of New York issued a default judgment towards Yanliang “Jerry” Li. As mentioned in our 2019 12 months-Finish FCPA Replace, Li, the previous China Managing Director of a “multi-level advertising and marketing firm,” later recognized as Herbalife Vitamin Ltd., was indicted by DOJ and charged by the SEC for FCPA bribery and accounting violations arising from an alleged scheme to bribe Chinese language authorities officers to acquire direct gross sales licenses and stifle adverse media protection in regards to the firm. Li has but to make an look in U.S. court docket, regardless that he was served with the SEC’s criticism in China, and Decide Oetken assessed an Alternate Act Tier II penalty (starting from $80,000 to $97,523) for every of 5 violations—(1) falsifying an expense report; (2) falsifying a SOX sub-certification; (3) endorsing a false audit report; (4) submitting a second false SOX certification; and (5) giving false testimony to the SEC—for a complete of $550,092 in penalties.

PDVSA-related Defendants Transfer to Dismiss Indictments on Jurisdictional Grounds

We coated in our 2021 12 months-Finish FCPA Replace the seismic grant of Daisy Teresa Rafoi Bleuler’s movement to dismiss the FCPA and cash laundering fees towards her within the U.S. District Courtroom for the Southern District of Texas by the Honorable Kenneth M. Hoyt. Decide Hoyt discovered that, as a matter of regulation, the indictment was poor in alleging the actions overseas by Swiss citizen Rafoi, who didn’t set foot within the territory of america in the course of the alleged PDVSA-related corruption scheme (and was difficult her indictment from overseas), had been inadequate to carry her throughout the scope of U.S. jurisdiction. DOJ has appealed this dismissal, arguing that “a overseas nationwide who actively participated in a US-linked scheme to pay bribes, may be accountable for FCPA conspiracy even when she shouldn’t be an enumerated FCPA actor who’s liable as a principal,” and additional that whether or not Rafoi certified as an agent was a query of reality for a jury to resolve.

On the heels of Decide Hoyt’s choice within the Rafoi case, co-defendant Paulo Jorge Da Costa Casqueiro Murta filed a movement to dismiss his personal fees, elevating most of the similar jurisdictional arguments. On July 11, 2022, Decide Hoyt granted the movement for a lot the identical reasoning as within the Rafoi case, however moreover on statute-of-limitations grounds and likewise granting a movement to suppress statements made by Casqueiro throughout a custodial interview in Spain. With respect to the statute-of-limitations matter, the Courtroom waded via the complexities of a number of 28 U.S.C. § 3292 tolling orders and located that the return of an indictment towards a co-defendant in 2017 ended the tolling interval as to the subsequently indicted Casqueiro regardless that a later tolling order was issued and additional Mutual Authorized Help Treaty responses had been filed by Swiss authorities. With respect to the suppression of statements, Decide Hoyt discovered that the circumstances of Casqueiro’s interview had been impermissibly coercive the place the defendant was summoned to the interview in Portugal by an area prosecutor, didn’t really feel like he was permitted to go away the interview underneath Portuguese regulation, and was not suggested of his protections underneath the U.S. structure by the U.S. Division of Homeland Safety brokers who carried out the interview.

DOJ instantly filed a movement to remain the Casqueiro dismissal pending attraction, arguing that the defendant had been extradited to america to face these fees and would possible go away america if he was not maintained on pretrial launch pending attraction. Decide Hoyt denied the keep request on the district court docket stage, however on August 3, 2022 the U.S. Courtroom of Appeals issued a keep pending decision of the deserves attraction, coupled with an order to expedite that attraction. On DOJ’s request, the Casqueiro and Rafoi appeals had been then consolidated for argument, which is at present scheduled for October 2022. We anticipate these appeals will result in an extra vital appellate ruling on the breadth of FCPA and cash laundering statutes’ jurisdiction over overseas nationals, supplementing the Second Circuit’s choice in Hoskins mentioned above.

Lastly, a 3rd co-defendant in the identical sprawling case—Nervis Gerardo Villalobos Cárdenasg—filed his personal movement to dismiss the indictment in February 2022, like Rafoi doing so from overseas. For causes which will solely be defined in a collection of sealed orders, the Villalobos movement has proceeded on a slower observe than the Casqueiro movement. DOJ makes most of the similar arguments opposing dismissal as within the different instances, together with renewing the identical “fugitive disentitlement” problem to the propriety of a court docket addressing a movement to dismiss filed by a so-called fugitive not earlier than the court docket because it made (and was rejected) in Rafoi’s case. The movement to dismiss stays pending as of the date of publication.

Former Venezuelan Nationwide Treasurer Extradited; Movement to Dismiss Denied

On Might 24, 2022, former Venezuelan Nationwide Treasurer Claudia Patricia Díaz Guillén made her preliminary look within the U.S. District Courtroom for the Southern District of Florida and entered a not responsible plea to the cash laundering fees towards her. As described in our 2020 12 months-Finish FCPA Replace, Díaz is alleged to have accepted bribes to facilitate extra favorable charges for overseas alternate transactions. Promptly following her extradition, Díaz moved to dismiss the fees on jurisdictional grounds much like these raised by the PDVSA defendants in Houston described above. However the Honorable William P. Dimitrouleas, unpersuaded by Decide Hoyt’s rulings in Rafoi and Casqueiro, made quick work of the movement by disposing of the matter as a difficulty for the jury in a two-page opinion dated July 12, 2022. Díaz at present faces an October 2022 trial date.

Fourth Circuit Affirms Lambert FCPA Trial Conviction

In our 2019 12 months-Finish FCPA Replace we coated the trial conviction of former Transport Logistics Worldwide, Inc. President Mark T. Lambert. On July 21, 2022, the U.S. Courtroom of Appeals for the Fourth Circuit, in a per curiam opinion, affirmed the FCPA bribery and wire fraud convictions. The court docket discovered no error by the trial court docket in ruling on varied evidentiary exclusions, nor in issuing an Allen cost when the jury initially couldn’t agree on a verdict. On the substance of the fees, the Fourth Circuit discovered ample proof to help the wire fraud convictions primarily based on DOJ’s proof that Lambert actively hid materials information from the sufferer buyer by advantage of quoting inflated prices that secretly included the prices of bribing one of many buyer’s representatives, Vadim Mikerin, who additionally was prosecuted by DOJ.

Fifth Circuit Declares SEC Observe of Imposing Civil Financial Penalties in Administrative Proceedings Unconstitutional

Those that have adopted our consumer updates through the years might recall that most of the SEC’s settled FCPA enforcement actions for the primary three many years of the statute had been filed as civil complaints in federal district court docket. That each one modified with the Dodd-Frank Wall Road Reform Act of 2010 (“Dodd-Frank”), which amongst many different vital reforms granted the SEC authority to impose civil financial penalties in administrative proceedings by which the SEC seeks a cease-and-desist order. Quickly thereafter, the overwhelming majority of settled enforcement actions (in FCPA and different instances) started being filed as administrative cease-and-desist proceedings.

Probably imperiling that observe, on Might 18, 2022 a three-judge panel from the U.S. Courtroom of Appeals for the Fifth Circuit held in Jarkesy v. SEC that the SEC imposing civil financial penalties in administrative proceedings is unconstitutional as a result of Congress delegated its legislative energy to the SEC with out offering an intelligible precept by which the SEC might train that energy. The Honorable Jennifer Walker Elrod, writing for the Courtroom, acknowledged that Congress had authority to assign disputes to company adjudication in “particular circumstances,” however right here discovered that Congress had given the SEC “unique authority and absolute discretion to resolve whether or not to carry securities fraud enforcement actions throughout the company as a substitute of in an Article III court docket” whereas saying “nothing in any respect indicating how the SEC ought to make that decision.” The Fifth Circuit additional concluded that the SEC’s in-house adjudication violated the Petitioners’ Seventh Modification proper to a jury trial.

This choice doesn’t contain FCPA enforcement instantly, however its reverberations will definitely be felt in FCPA in addition to different SEC enforcement areas till the regulation settles. For extra on the Jarkesy choice, please see our separate article, “Jarkesy Wins Reduction from ALJ Management After Years of Combating for his Proper to a Jury Trial.”

Continued Deferred Prosecution Settlement Scrutiny

We coated in our 2021 12 months-Finish FCPA Replace Deputy Lawyer Basic Lisa O. Monaco’s October 2021 announcement that DOJ was modifying sure of its company legal enforcement insurance policies, and concurrently highlighting rising scrutiny that DOJ was giving to firms’ compliance with pretrial diversion (deferred and non-prosecution) agreements. The thrust of Monaco’s statements within the latter class was to precise a priority that some firms continued to violate the regulation or in any other case did not stay as much as their obligations in the course of the interval of their deferred and non-prosecution agreements. As we famous in our final replace, shut in time to this speech various firms introduced that DOJ was conducting so-called “breach investigations,” together with within the FCPA context similar to the next instance (amongst others):

- On March 3, 2022, Cellular TeleSystems Public Joint Inventory Firm (“MTS”) introduced a one-year extension of its 2019 FCPA deferred prosecution settlement (additionally coated in our 2019 12 months-Finish FCPA Replace), along with the monitorship that accompanied it. MTS reported that there had been no dedication that it had breached the phrases of its settlement, however that the extension was attributable to a wide range of elements, together with the COVID-19 pandemic and to permit ample time for MTS to implement enhancements to its anti-corruption compliance program and have these enhancements reviewed by the monitor.

There isn’t a query that DOJ and the SEC are making use of elevated scrutiny to firms underneath the supervision (lively as in a monitorship, or passive as in self-reporting) that comes with deferred and non-prosecution agreements. We anticipate extra developments on this space within the months and years to come back.

CEO and CCO Certifications of Compliance Packages

When the Might 2022 Glencore FCPA decision described above required the corporate’s Chief Govt Officer and Chief Compliance Officer every to certify on the conclusion of the three-year time period of the monitorship that the corporate’s compliance program within reason designed and carried out to fulfill the necessities of the plea settlement the compliance trade sat up and took discover. Compliance-focused advocacy organizations have argued that imposing this requirement on CCOs places them in an untenable place, and, in impact, places a goal on their again for any imperfections within the company compliance program they oversee.

DOJ officers have gone on the talking circuit in protection of this new coverage. On Might 26, 2022, Deputy Lawyer Basic Monaco asserted at a SIFMA occasion that this was in actual fact DOJ’s “effort to empower the gatekeepers” and be certain that CCOs are saved within the loop on compliance issues. Echoing this sentiment, DOJ FCPA Unit Chief David Final mentioned at a June 14, 2022 Worldwide Bar Affiliation occasion that this certification “shouldn’t be meant to be a gotcha sport,” however moderately designed to “incentivize” CEOs and CCOs to “be sure that they’re checking that [their] compliance program is as much as snuff.” And DOJ Fraud Part Assistant Chief Lauren Kootman mentioned at a Girls’s White Collar Protection Affiliation occasion on June 22, 2022 that “[t]he intention is to not put a goal on the again of a chief compliance officer,” however moderately to make sure that firms appropriately useful resource their compliance departments. These assurances have offered chilly consolation to many within the compliance trade, and sure this can be a seamless supply of dialogue because the coverage is carried out extra broadly. On that notice, Kootman has confirmed that this requirement “most probably” can be integrated into all company FCPA resolutions going ahead.

2022 MID-YEAR FCPA-RELATED LEGISLATIVE AND POLICY DEVELOPMENTS

Along with the enforcement developments coated above, the primary eight months of 2022 noticed quite a few vital developments in FCPA-related legislative and coverage areas.

DOJ Points More and more Uncommon FCPA Opinion Process Launch (22-01)

By statute, DOJ should present a written opinion on the request of an issuer or home concern stating whether or not DOJ would prosecute the requestor underneath the anti-bribery provisions for potential (not hypothetical) conduct it’s contemplating. As soon as a standard staple of FCPA observe, this process has seen seldom use in recent times. Certainly, DOJ’s final opinion process launch (coated in our 2020 12 months-Finish FCPA Replace) was issued in August 2020, and was itself then the primary since 2014. On January 21, 2022, DOJ issued a brand new opinion process launch (its 63rd total) deciphering how the FCPA applies to funds made underneath bodily duress in response to extortionate calls for by overseas officers.

Requestor is a U.S. home concern that owns and operates maritime vessels. Whereas awaiting entry to the port of Nation B, one among Requestor’s vessels inadvertently anchored within the territorial waters of Nation A, the place it was intercepted by that nation’s navy. The vessel’s captain was detained in an area jail with out entry to care wanted to handle his “severe medical circumstances,” at which level a 3rd celebration who claimed to be performing on behalf of Nation A’s navy contacted Requestor and demanded $175,000 in money in alternate for the captain’s launch and permission to go away Nation A’s territorial waters. After unsuccessfully attempting to acquire formal documentation explaining the authorized foundation for the fee, and failed makes an attempt at acquiring intervention by different businesses of the U.S. authorities, Requestor sought DOJ’s opinion that it will not be prosecuted for making the fee to acquire the discharge of its vessel’s captain and crew.

In gentle of the exigent, life-threatening circumstances, DOJ acted swiftly and issued an preliminary response inside two days of the October 2021 request, following up with the total opinion in January 2022 upon the submission of extra info. DOJ concluded that it will not pursue an enforcement motion on these information as a result of “Requestor wouldn’t be making the fee ‘corruptly’ or to ‘acquire or retain enterprise.’” With respect to the “corrupt intent” aspect of the FCPA, DOJ concluded it will not be met right here as a result of Requestor’s main motivation in making this fee was to “keep away from imminent and probably severe hurt to the captain and the crew.” Notably, DOJ distinguished this circumstance of bodily duress from the extra generally skilled circumstance of financial duress—the place firms are “shaken down” for corrupt funds on the threat of unjust monetary penalties—observing that funds made in response to financially coercive calls for could be unlawful underneath the FCPA. With respect to the “acquire or retain enterprise” aspect of the FCPA, DOJ concluded that it will not be met right here as a result of Requestor had no ongoing or anticipated enterprise in Nation A. DOJ additional famous Requestor’s clear efforts to handle this case in response to the fee demand, which didn’t evince a corrupt intent.

Whereas FCPA Opinion Process Launch 2022-01 doesn’t break any genuinely new floor and, like different opinion releases, is expressly restricted to the precise information at hand, it does nonetheless provide helpful steerage to firms and practitioners alike relating to DOJ’s interpretation of those two vital components of the FCPA. Specifically, the flexibility to make even a big money fee underneath questionable circumstances to protect the bodily security and wellbeing of staff is genuinely useful. Nonetheless, we should warning our readers to train warning in increasing the logic of this opinion into the realm of financial coercion, which DOJ does deal with in another way as expressed in its opinion.

FinCEN Advisory Concerning Kleptocracy and Overseas Public Corruption

On April 14, 2022, the Division of Treasury’s Monetary Crimes Enforcement Community (“FinCEN”) launched its “Advisory on Kleptocracy and Overseas Public Corruption,” which was developed to offer steerage to monetary establishments in figuring out and disclosing transactions involving the proceeds of overseas public corruption. As detailed in our 2021 12 months-Finish FCPA Replace and standalone consumer alert, “U.S. Technique on Countering Corruption Alerts Give attention to Enforcement,” in December 2021, the Biden Administration—which beforehand recognized the combat towards corruption as a “core nationwide safety curiosity of america”—launched a United States Technique on Countering Corruption, articulating an formidable, whole-of-government strategy to combating corruption and its downstream societal results. FinCEN describes this newest Advisory as a part of the Biden Administration’s broader anti-corruption efforts.

Unsurprisingly, the Advisory describes Russia as a jurisdiction of “specific concern” on this space given “the nexus between corruption, cash laundering, malign affect and armed interventions overseas, and sanctions evasion,” which is per america’ broader efforts to fight and disrupt Russia-related monetary exercise following its invasion of Ukraine, together with asset freezes and seizures carried out via Process Pressure KleptoCapture, mentioned additional in our separate consumer alert “United States Responds to the Disaster in Ukraine with Extra Sanctions and Export Controls.” The Advisory describes two typologies and patterns of exercise related to kleptocracy and overseas public corruption. First, “wealth extraction,” or the “siphoning off” of nationwide sources by oligarchs and elites, is characterised as being carried out via bribery and extortion schemes involving overseas public officers or the misappropriation of embezzlement of public property for personal enrichment, which might generally be achieved via public procurement within the protection and well being sectors or via bribes and kickbacks paid within the context of huge infrastructure or improvement tasks. Second, the Advisory notes that kleptocrats and different corrupt public officers will interact in comparable exercise to drug traffickers or different legal actors to launder the proceeds of corruption, similar to via using advanced networks of shell firms or offshore accounts or the conversion of ill-gotten good points into the acquisition of high-value property similar to luxurious actual property, personal jets and yachts, artwork and antiquities, or resorts.

The Advisory concludes with a set of 10 widespread “pink flag” indicators that monetary establishments ought to look out for in an effort to determine, forestall, and report probably suspicious transactions involving the proceeds of kleptocracy or overseas public corruption. These embody transactions involving a number of authorities contracts being awarded to the identical entity or entities with widespread possession, transactions by which authorities enterprise is being carried out via private accounts, transactions involving overseas public officers and the acquisition of high-value or luxurious property and/or jurisdictions with which the officers do not need identified ties, using third events or shell firms to obscure the involvement of overseas public officers, transactions involving extreme fees or inconsistent or incomplete documentation, and transactions involving entities beneficially owned by people linked to identified kleptocrats or their relations.

2022 MID-YEAR CHECK-IN ON THE FCPA SPEAKER’S CORNER

U.S. authorities anti-corruption enforcement personnel had been lively on the talking circuit within the first eight months of 2022, providing a glimpse into DOJ and SEC priorities and expectations for the businesses that seem earlier than them. In lots of situations, these statements are extra broadly targeted on white collar crime basically, however the classes could also be utilized within the FCPA context. We’ll cowl the September 15, 2022 speech by U.S. Deputy Lawyer Basic Lisa Monaco in a separate, forthcoming consumer alert.

Lawyer Basic Merrick Garland

Talking to the ABA Institute on White Collar Crime in Washington D.C. on March 3, 2022, Lawyer Basic Merrick Garland made clear that DOJ’s first precedence in company legal instances is the prosecution of people who “commit and revenue from company malfeasance.” Garland said that DOJ’s give attention to particular person accountability is one of the simplest ways to discourage company crimes within the first place as a result of firms are solely capable of act via people. As well as, Garland argued that the prosecution of people is important as a result of it bolsters People’ belief within the rule of regulation. Towards the tip of his remarks, Garland famous that over the lengthy course of his profession he has seen DOJ’s curiosity in prosecuting company crime “wax and wane,” and concluded that “at the moment, it’s waxing once more.”

Assistant Lawyer Basic Kenneth Well mannered

In a March 25, 2022 speech earlier than NYU Regulation’s Program on Company Compliance and Enforcement, Assistant Lawyer Basic for the Felony Division Kenneth Well mannered offered particulars on how DOJ evaluates company compliance applications. He said that DOJ’s aim with such evaluations is to make sure that “firms are designing and implementing efficient compliance methods and controls, making a tradition of compliance, and selling moral values.” First, in accordance with Well mannered, an organization’s compliance program should be well-suited to the corporate’s particular threat profile. Second, a compliance program should display an organization’s dedication to compliance in any respect ranges of the corporate. Third, DOJ needs to see proof that the company compliance program truly works in observe. Lastly, Well mannered emphasised that firms ought to be capable of display an “moral tradition” that permeates all areas of the company construction.

Principal Deputy Assistant Lawyer Basic Nicholas McQuaid

In a speech delivered at a discussion board hosted by the American Convention Institute on January 27, 2022, Felony Division Principal Deputy Assistant Lawyer Basic Nicholas McQuaid admonished attendees to not give attention to the variety of prosecutions of FCPA violations within the final 12 months. Though as famous in our 2021 12 months-Finish FCPA Replace, FCPA resolutions in 2021 fell to their lowest stage since 2015, McQuaid said that DOJ entered 2022 with a “strong pipeline” of instances and that he expects there to be “vital resolutions” over the subsequent 12 months.

2022 MID-YEAR CHECK-IN ON FCPA-RELATED PRIVATE CIVIL LITIGATION

Though the FCPA doesn’t present for a personal proper of motion, our readership is aware of properly that civil litigants have pursued a wide range of causes of motion in reference to FCPA-related conduct, with various levels of success. A choice of issues with materials developments within the first eight months of 2022 follows.

Choose Shareholder Lawsuits / Class Actions

- Cellular TeleSystems PJSC – As coated in our 2021 12 months-Finish FCPA Replace, shortly following MTS’s 2019 joint FCPA decision with DOJ and the SEC for alleged corruption in Uzbekistan, the corporate discovered itself a defendant in a category motion swimsuit filed within the U.S. District Courtroom for the Japanese District of New York, alleging that the corporate issued false and deceptive statements in regards to the its lack of ability to foretell the end result of the U.S. authorities’s investigations, the effectiveness of its inner controls and compliance methods, and its cooperation with U.S. regulatory businesses. In March 2021, the Honorable Ann M. Donnelly dismissed the lawsuit, discovering that the plaintiffs didn’t display that the challenged claims had been false or deceptive, that MTS might have predicted the end result of the investigation, or that its disclosures in regards to the existence of the investigation had been inadequate. Simply over a 12 months later, on March 31, 2022, the U.S. Courtroom of Appeals for the Second Circuit issued a abstract order affirming Decide Donnelly’s dismissal. The Second Circuit held that the criticism was “devoid of any factual allegations that with particularity set up that MTS executives knew that they may fairly estimate their potential legal responsibility arising from the federal government investigations however opted not to take action.”

Choose Civil Fraud / RICO Actions

- Stryker / Zimmer Biomet – In March 2022, Mexican authorities healthcare company Instituto Mexican del Seguro Social (“IMSS”) misplaced two appeals of lawsuits involving alleged bribery of overseas officers. In each fits, one within the Sixth Circuit (Stryker) and the opposite within the Seventh Circuit (Zimmer Biomet), the Circuit Courtroom affirmed the respective district court docket’s choice to grant a movement to dismiss on discussion board non conveniens grounds in instances the place the related brokers, proof, and harm had been all discovered to be primarily based in Mexico and there was no displaying that the Mexican court docket system was an insufficient discussion board.

- Olympus Latin America – IMSS suffered one other litigation defeat, this time for various causes and within the U.S. District Courtroom for the Southern District of Florida, when on August 31, 2022 the Honorable Kathleen M. Williams dismissed with prejudice the Mexican state company’s fraud declare towards Olympus arising from a portion of the information that led to Olympus’s 2016 FCPA decision described in our 2016 12 months-Finish FCPA Replace. Decide Williams decided that IMSS’s 2021 criticism was premature as a result of it was filed greater than 4 years after Olympus’s 2016 deferred prosecution settlement. The Courtroom rejected IMSS’s arguments that it didn’t know that its contracts with Olympus had been coated within the FCPA decision as a result of they weren’t named particularly, holding that there was an obligation to train diligence upon the general public launch of the deferred prosecution settlement.

- Odebrecht S.A. – We final caught up on the bevvy of civil litigation filed towards Brazilian building conglomerate Odebrecht within the wake of its 2016 anti-corruption settlements with U.S., Brazilian, and Swiss authorities in our 2018 12 months-Finish FCPA Replace. On July 19, 2022, in a civil fraud case introduced by bond purchasers that was allowed to proceed to discovery, U.S. Justice of the Peace Decide Barbara Moses of the U.S. District Courtroom for the Southern District of New York imposed extreme sanctions on Odebrecht for discovery violations. The Courtroom had beforehand ordered Odebrecht to offer discovery to the bondholders regarding supplies beforehand offered to U.S. and Brazilian authorities however, with out looking for a protecting order or in any other case objecting, Odebrecht merely failed for greater than a 12 months to show over the paperwork on the grounds that they had been prohibited from doing so underneath Brazilian regulation. As a consequence, Decide Moses imposed Rule 37 sanctions establishing as a reality within the matter that the Odebrecht defendants made materials misrepresentations to plaintiff bondholders with scienter. One week later the events requested a settlement convention with Decide Moses.

Choose Anti-Terrorism Act Fits

- Sure Pharmaceutical and Medical Machine Corporations – We reported in our 2020 12 months-Finish FCPA Replace on a choice by the Honorable Richard J. Leon of the U.S. District Courtroom for the District of Columbia dismissing a lawsuit introduced by U.S. service members and their households alleging that sure pharmaceutical and medical gadget firms violated the Anti-Terrorism Act (“ATA”) by paying bribes to officers on the Iraqi Ministry of Well being, which was managed by the terrorist group Jaysh al-Mahdi (“JAM”), which JAM then used to fund assaults towards the plaintiffs. Decide Leon dominated that the Courtroom lacked private jurisdiction over the overseas defendants, and the plaintiffs had did not adequately plead a violation underneath the ATA as to the remaining. On January 4, 2022, the U.S. Courtroom of Appeals for the District of Columbia, in an opinion by Honorable Cornelia T.L. Pillard, reversed the dismissal and revived the case, discovering that causation was adequately alleged and the district court docket’s jurisdictional evaluation was “unduly restrictive.” Defendants have petitioned for a rehearing en banc, which stays pending as of the date of publication.

Different Civil Lawsuits

- Cicel (Beijing) Science & Tech. Co. – We final coated the breach-of-contract lawsuit introduced by Cicel towards Misonix, Inc. in our 2017 12 months-Finish FCPA Replace. Cicel claimed wrongful termination of a distribution contract with Misonix, which then defended by arguing that it terminated solely after discovering probably corrupt conduct and disclosing it to DOJ and the SEC. On October 7, 2017, the Honorable Arthur D. Spatt of the S. District Courtroom for the Japanese District of New York denied Misonix’s movement to dismiss, permitting the case to proceed to discovery. However earlier this 12 months, on January 20, 2022, the Honorable Gary R. Brown granted Misonix’s movement for abstract judgment, discovering that undisputed information conclusively proved Cicel’s involvement in unlawful conduct, which Misonix moved swiftly to remediate upon discovery by conducting an inner investigation, terminating the connection, and disclosing the matter to DOJ and the SEC. No prosecution was introduced towards Misonix, as each DOJ and the SEC closed their investigations in 2019.

2022 MID-YEAR INTERNATIONAL ANTI-CORRUPTION DEVELOPMENTS

World Financial institution

The World Financial institution has been fairly lively in the course of the first eight months of 2022 in debarring firms and people for corrupt practices:

- On January 4, 2022, the World Financial institution introduced a 12-month debarment adopted by a 12-month conditional non-debarment of ADP Worldwide S.A., a French-based airport developer, operator, and supervisor, for allegedly attending improper conferences with authorities officers in the course of the tender for a contract and failing to reveal that charges paid to a retained agent had been partially transferred to a non-contracted guide. Colas Madagascar S.A. was additionally debarred for 2 years for arranging the improper conferences with authorities officers, and Bouygues Bâtiment Int’l was sanctioned with conditional non-debarment for 12 months for attending the conferences.

- On February 23, 2022, the World Financial institution introduced a 34-month debarment adopted by an 18-month conditional non-debarment of AIM Consultants Restricted, a consultancy firm primarily based in Nigeria, and its managing director, Amin Moussali. In line with the World Financial institution, AIM via Moussali paid roughly $45,500 in kickbacks to varied mission officers after receiving fee for a service contract in reference to a $908 million World Financial institution-funded mission designed to cut back soil vulnerability and erosion in sure sub-watersheds in Nigeria. As a part of a settlement settlement, Moussali agreed to finish company ethics coaching, and AIM agreed to implement an integrity compliance program in accordance with the ideas set out within the World Financial institution Group’s Integrity Compliance Tips.

- On March 30, 2022, the World Financial institution debarred a Nigerian know-how consulting firm and its managing director for 50 months and 5 years, respectively, for performing as a guide and making “appreciation” funds to mission officers. In line with the World Financial institution, SofTech IT Options and Companies Ltd., underneath the route of its managing director Isah Salihu Kantigi, served as a conduit via which he and different consultants made unlawful funds to mission officers in reference to a $1.8 billion mission funded by the World Financial institution, which was designed to offer focused money transfers to poor and weak households underneath an expanded nationwide social security internet. As a part of a settlement, Kantigi dedicated to taking company ethics coaching that demonstrates a dedication to private integrity and enterprise ethics, and SoftTech dedicated to implementing a company ethics coaching program.

- On April 14, 2022, the World Financial institution sanctioned Germany-based Voith Hydro Holding GmbH & Co. KG and two subsidiaries for his or her alleged corrupt practices in energy tasks within the Democratic Republic of The Congo and Pakistan. In line with the World Financial institution, between 2012 and 2016, Voith Hydro took actions to realize unfair tender benefits, together with making improper funds to a business agent to realize favorable choices in contract executions and failing to reveal these funds. The Voith Hydro entities face a spread of 15-34 months of debarment, adopted by conditional non-debarment phrases.

Inter-American Improvement Financial institution

On March 18, 2022, The Inter-American Improvement Financial institution (“IDB”), which gives financing in Latin America, introduced a three-year debarment of Brazilian building firm Construtora COESA and 26 subsidiaries for simulating competitors for a contract, failing to behave upon information of corruption, and making illicit funds totaling $1.7 million to public officers concerned in supervising and managing the contracts. In 2019, an affiliated entity settled with Brazilian authorities in relation to those and different issues for $460 million. The IDB credited the prior nice and Construtora COESA’s cooperation for a decreased sanction.

Europe

United Kingdom

JLT Specialty Restricted

On June 22, 2022, the UK Monetary Conduct Authority (“FCA”) introduced a decision with JLT Specialty, a UK subsidiary of JLT Group which, as famous above, reached a declination with disgorgement decision with the U.S. DOJ and, as coated under, additionally reached a decision with Colombian authorities. JLT Specialty agreed to pay the FCA £7.8 million for alleged failings in regards to the threat administration methods that it had in place between 2013 and 2017 that had been answerable for countering the dangers of bribery and corruption, which nice was decreased primarily based on the help the corporate offered all through the investigation, as properly its self-report to related authorities and remediation. The FCA additionally commented that this was its second anti-corruption enforcement motion towards JLT Specialty, with the primary occurring in 2013 as coated in our 2013 12 months-Finish FCPA Replace. Gibson Dunn represented JLT Group in reference to the FCA and U.S. investigations.

Glencore Vitality (UK) Restricted