September 20, 2022

Click on for PDF

The variety of securities lawsuits filed since January has remained regular in comparison with the primary half of 2021. Now we have already seen many notable developments in securities regulation this yr. This mid-year replace offers an outline of the key developments in federal and state securities litigation within the first half of 2022:

- We discover what to look at for within the Supreme Court docket, together with the upcoming determination in SEC v. Cochran, which addresses an necessary jurisdictional query; the choice in West Virginia v. Environmental Safety Company, which may influence the SEC’s proposed local weather disclosure rule; and the way forward for gag guidelines.

- We study quite a lot of developments within the Delaware Court docket of Chancery, together with the applicability of Blasius and Schnell when board motion implicates the stockholder franchise; a novel, however “doubtless uncommon,” declare {that a} board’s wrongful refusal of a stockholder demand constituted a breach of fiduciary obligation; and when an activist-appointed director is perhaps conflicted by an expectation of future directorships.

- The Second Circuit in SEC v. Rio Tinto held that as a way to allege a declare of scheme legal responsibility, plaintiffs should present one thing extra than simply the misstatements or omissions themselves, reminiscent of dissemination. Though it’s too early to see the appliance of Rio Tinto on the district court docket degree, decrease courts had beforehand continued to grapple with the scope of Lorenzo.

- We once more survey securities-related litigation arising out of the coronavirus pandemic, together with securities class actions alleging that defendants made false claims in regards to the efficacy of their COVID-19 vaccines, remedies, and exams. Notably, because the starting of the yr, the SEC has filed a number of lawsuits associated to the pandemic.

- We discover the decrease courts’ utility of the Supreme Court docket’s determination in Omnicare, Inc. v. Laborers District Council Building Trade Pension Fund, which involved legal responsibility primarily based on a false opinion, typically to guage the sufficiency of pleadings in response to defendants’ motions to dismiss. Current selections emphasize that the context surrounding the opinion is a key consideration for figuring out whether or not that opinion is actionable. As such, different statements made contemporaneously to an opinion, the rationale why an opinion is being supplied, and the information degree of the speaker could be simply as necessary because the syntax and that means of the opinion itself.

- We study numerous developments in federal securities litigation involving particular function acquisition corporations (“SPACs”), together with a surge in Part 10(b) claims towards corporations reporting under-promised monetary outcomes after being acquired by SPACs. We additionally preview how the SEC’s newly proposed SPAC guidelines and amendments could doubtlessly influence this litigation.

- Lastly, we tackle a number of different notable developments within the federal courts, together with:

- the Second Circuit’s holding that an organization had an obligation to reveal a governmental investigation for functions of a declare beneath Part 10(b) of the Trade Act of 1934;

- the Ninth Circuit’s additional steering as to when a common company assertion by an organization is nonactionable;

- the Second Circuit’s affirming the dismissal of a securities class motion after reaffirming the PSLRA’s necessities for pleading falsity with ample particularity;

- the Ninth Circuit’s clarification and tightening of its loss causation commonplace; and

- the Eleventh Circuit’s holding that casual mass on-line communication, reminiscent of YouTube movies, can depend as “soliciting” the acquisition of an unregistered safety, affecting the sale of recent cryptocurrencies reliant on such strategies for traction.

I. Submitting And Settlement Traits

In response to Cornerstone Analysis, though new filings stay in step with the primary half of 2021, the variety of authorised settlements is up over 30% from the identical time final yr, and the median settlement quantity has rebounded from the low that we reported in our 2021 Mid-12 months Securities Litigation Replace. SPAC and crypto-related filings proceed to be a spotlight of plaintiffs’ attorneys, whilst the character of those fits continues to evolve.

A. Submitting Traits

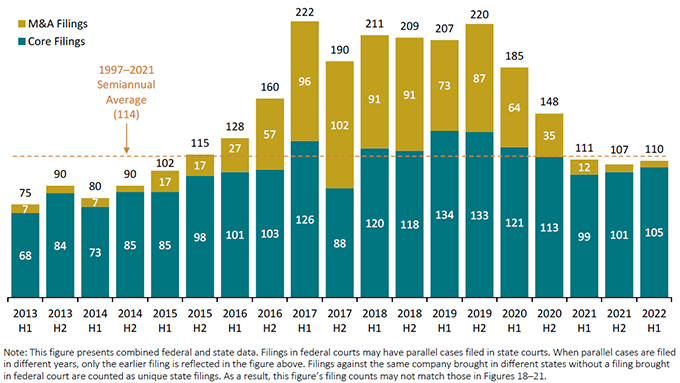

Determine 1 under displays the semi-annual submitting charges courting again to 2013 (all charts courtesy of Cornerstone Analysis). For the third six-month interval in a row, new filings remained under the historic semi-annual common. Notably, at 110, filings within the first half of 2022 barely high 50% of the typical semi-annual submitting charges seen between 2017 and 2019, although this deficit is basically pushed by a considerable lower in M&A filings. The 105 complete new “core” instances—i.e., securities instances with out M&A allegations—filed within the first half of 2022 characterize a modest improve from each the primary and second half of 2021 and are nearer to, although nonetheless under, different current intervals.

Determine 1:

Semiannual Variety of Class Motion Filings (CAF Index®)

January 2013 – June 2022

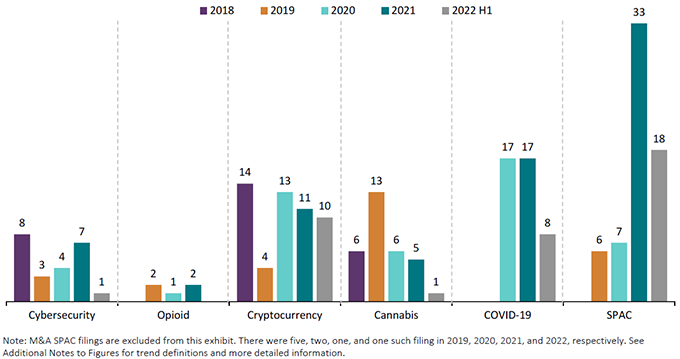

As illustrated in Determine 2 under, SPAC-related filings are on observe to fulfill or exceed final yr’s chart-topping efficiency and already exceed the entire SPAC-related filings in all of 2019 and 2020 mixed. This improve is pushed primarily by SPAC-related actions within the expertise and industrial sectors which have offset a possible decline in actions within the shopper area. Cryptocurrency-related actions are additionally on tempo to extend in 2022, pushed partially by the continued improve in actions towards crypto exchanges and allegations associated to securitization within the first half of the yr. Then again, cybersecurity filings, together with opioid and hashish instances, are on tempo to lower considerably.

Determine 2:

Abstract of Pattern Instances—Core Federal Filings

2018 – June 2022

B. Settlement Traits

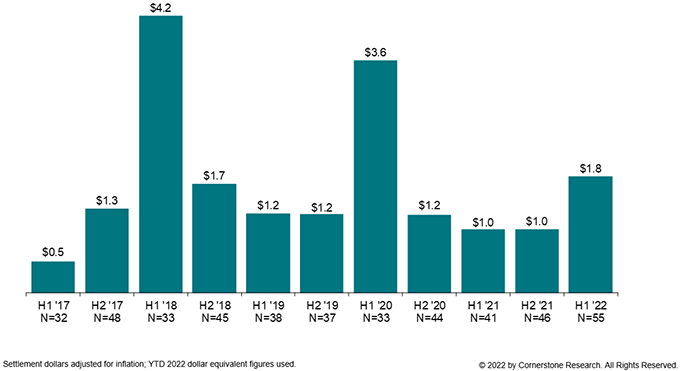

Extra settlements had been authorised within the first half of 2022 than have been in any half-year within the final 5 years. Moreover, as mirrored in Determine 3, the entire settlement worth within the first half of 2022 is sort of twice that of this time final yr, nearly assembly the entire worth of 2021. Of the 55 authorised settlements, 4 topped $100 million, relative to solely two this time final yr. And the median worth of settlements authorised is up 56% from the primary half of 2021 to $12.5 million.

Determine 3:

Complete Settlement {Dollars}

January 2017 – June 2022

({Dollars} in Billions)

II. What To Watch For In The Supreme Court docket

Though it has been a comparatively quiet first half of 2022 for securities litigators within the Supreme Court docket, one determination has a possible influence on rulemaking and a number of other different selections could possibly be on the horizon.

A. Cochran To Handle Jurisdictional Questions Of Administrative Regulation Judges

On November 7, 2022, the Supreme Court docket will hear argument in SEC v. Cochran, No. 21-1239 (fifth Cir., 20 F.4th 194; cert. granted, Might 16, 2022). The query introduced is procedural—whether or not a federal district court docket has jurisdiction to listen to a go well with through which the respondent in an ongoing SEC administrative continuing seeks to enjoin that continuing, primarily based on an alleged constitutional defect within the provisions of the Trade Act that govern the removing of the executive regulation decide who will conduct the continuing.

Following an enforcement motion towards Respondent that alleged she didn’t adjust to federal auditing requirements, the ALJ decided Respondent had, certainly, violated the Trade Act. Then, nevertheless, the Supreme Court docket’s determination in Lucia v. SEC, 138 S. Ct. 2044 (2018), held that the SEC’s ALJs are officers of america and that their appointments should adjust to the Structure’s Appointments Clause. Id. at 2049. Thus, in Cochran, the SEC remanded all pending administrative actions for brand spanking new proceedings earlier than constitutionally appointed ALJs. Cochran v. U.S. Sec. & Exch. Comm’n, 20 F.4th 194, 198 (fifth Cir. 2021), cert. granted sub nom. Sec. & Exch. Comm’n v. Cochran, 142 S. Ct. 2707 (2022). Respondent introduced go well with within the federal district court docket, searching for (1) a declaration that the SEC’s ALJs are unconstitutionally insulated from the president’s removing energy and (2) an injunction barring the SEC from persevering with the executive proceedings towards her. Id. at 213. The district court docket dismissed the motion for lack of subject-matter jurisdiction, holding that the Trade Act implicitly strips district courts of jurisdiction to listen to challenges—together with structural constitutional claims just like the Respondent’s—to ongoing SEC enforcement proceedings. Id. at 198. The Fifth Circuit panel affirmed. Id.

The Fifth Circuit, en banc, reversed, holding that Respondent may convey her removing declare in federal court docket with out ready for a last willpower by the SEC. Cochran, 20 F.4th at 212. The Fifth Circuit’s en banc determination created a break up from the Second, Fourth, Eleventh, and D.C. Circuits, which held that the Trade Act implicitly divests federal courts from jurisdiction to listen to constitutional challenges to ongoing SEC administrative proceedings.

Two days after the Supreme Court docket granted certiorari in Cochran, the Fifth Circuit issued a 2-1 determination in Jarkesy v. Sec. & Exch. Comm’n, 34 F.4th 446 (fifth Cir. 2022), which additionally mentioned a problem to the constitutionality of SEC proceedings earlier than an ALJ in comparable circumstances. In its determination, the Fifth Circuit issued three findings: (1) the SEC, by way of its determination to proceed earlier than an ALJ, disadvantaged Petitioner of his constitutional proper to a jury trial for a securities fraud motion searching for civil penalties, (2) Congress impermissibly granted legislative authority to the SEC by empowering it to resolve whether or not to convey an enforcement motion earlier than a federal court docket or an ALJ and, due to this fact, which defendants ought to obtain sure authorized processes assured in an Article III continuing, and (3) due to the insulation offered by the removing restrictions for the SEC’s ALJs, the President can’t take care that the legal guidelines are faithfully executed in violation of Article II of the Structure. Id. at 465. On July 1, 2022, the SEC petitioned the Fifth Circuit for rehearing en banc. A petition for certiorari could comply with.

The Supreme Court docket’s determination in Cochran is unlikely to handle the Seventh Modification and non-delegation questions mentioned in Jarkesy. Nonetheless, each Cochran and Jarkesy will doubtlessly have important implications for defendants in different enforcement proceedings, for different federal companies that make the most of in-house courts, and for events searching for to problem ALJ authority. Because the SEC continues to face constitutional challenges towards its proceedings earlier than ALJs, defendants confronting enforcement actions ought to anticipate to see the SEC opting to proceed in federal court docket when potential.

In Cochran, attorneys from Gibson Dunn submitted amicus briefs supporting Cochran within the Supreme Court docket on behalf of Raymond J. Lucia, Sr., George R. Jarkesy, Jr., and Christopher M. Gibson, and within the Fifth Circuit on behalf of the Texas Public Coverage Basis. In Lucia, attorneys from Gibson Dunn represented petitioners Lucia and Raymond J. Lucia Corporations, Inc.

B. EPA Resolution May Influence SEC’s Proposed Local weather Disclosure Rule

On June 30, 2022, in a 6-3 break up determination, the Supreme Court docket held that the Environmental Safety Company (“EPA”) lacks the authority to alter the Clear Air Act’s definition of “greatest system of emission discount.” West Virginia v. Environmental Safety Company, 142 S. Ct. 2587, 2610 (2022). Counting on the Main Questions Doctrine, which requires “a transparent assertion [] essential for a court docket to conclude that Congress supposed to delegate [broad economic authority to an agency],” id. at 2594, the Court docket examined, amongst different issues, Congress’s repeat rejection of an identical scheme. Id. at 2610.

Whereas showing irrelevant to securities at first blush, the choice in West Virginia v. EPA has the potential to halt the SEC’s lately proposed local weather danger disclosure rule in its tracks. The SEC seeks to “require registrants to incorporate sure climate-related disclosures of their registration statements and periodic studies.” U.S. Securities and Trade Fee, SEC Proposes Guidelines to Improve and Standardize Local weather-Associated Disclosures for Buyers. Congress, nevertheless, has repeatedly didn’t authorize such laws up to now (e.g., Local weather Disclosure Act of 2021 [HR 2570], Local weather Disclosure Threat Act of 2019 [HR 3623], Local weather Disclosure Act of 2018 [S 3481]). It’s due to this fact potential that the SEC’s new proposed rule may run awry of the Supreme Court docket’s determination.

C. The Court docket As soon as Once more Requested To Think about Gag Rule In Novinger

On July 12, 2022, the Fifth Circuit issued an order in SEC v. Novinger, 40 F.4th 297 (2022). There, Novinger sought to strike a provision in his 2016 settlement settlement with the SEC, stopping him from saying something in public that may dispute any of the SEC’s allegations towards him. Id. at 300. Novinger argued that such a provision is an unconstitutional restriction of speech by the federal government, whereas the SEC argued that even when the gag rule violates Novinger’s constitutional rights, settlement agreements which embrace voluntary waivers of constitutional rights are usually not per se invalid, together with settlement agreements which waive a proper to a jury trial. Id. at 303.

With out dissent, the Fifth Circuit denied Novinger’s problem, teeing up a chance for the Supreme Court docket to contemplate the problem. Id. at 308. Lower than a month earlier than the Fifth Circuit dominated towards Novinger, the Supreme Court docket declined to listen to Romeril v. SEC, 15 F.4th 166 (2nd Cir. 2021), cert. denied, 142 S. Ct. 2836 (2022), which challenged the same gag rule, however from a a lot older settlement. Despite the fact that Novinger’s petition in all probability will endure the identical destiny as Romeril’s, it’s clear that challenges to those gag guidelines will proceed. In a concurrence to the Fifth Circuit’s opinion in Novinger, two of the three judges on the panel highlighted that the SEC “by no means responded” to “a petition to evaluate and revoke the SEC coverage [that] was filed practically 4 years in the past,” and predicted that “it won’t be lengthy earlier than the courts are known as on to completely take into account this coverage.” Novinger, 40 F.4th at 30.

Attorneys from Gibson Dunn wrote an amicus temporary on behalf of the CATO Institute in help of Romeril’s petition for certiorari.

III. Delaware Developments

A. Court docket Of Chancery Once more Upholds Board’s Rejection Of Non-Compliant Dissident Nomination Below Intermediate Customary Of Evaluate

In February, the Delaware Court docket of Chancery reiterated that “[f]undamental rules of Delaware regulation mandate that the court docket . . . conduct an equitable evaluate of [a] board’s rejection of [a director] nomination” discover pursuant to advance discover bylaws even when such rejection is “contractually correct.” Strategic Funding Alternatives LLC v. Lee Enterprises, Inc., 2022 WL 453607, at *1 (Del. Ch. Feb. 14, 2022). In Lee Enterprises, a useful proprietor of the corporate sought to appoint a number of administrators as a part of a takeover try, but it surely didn’t adjust to unambiguous advance discover bylaws requiring it to change into a report holder and submit the corporate’s nominee questionnaire kinds earlier than the nomination deadline. Id. Denying the useful proprietor’s request to allow its candidates to face for election, Vice Chancellor Lori W. Will held that the board’s rejection of the non-compliant nomination discover was contractually correct and equitable beneath the circumstances. Id.

Echoing the court docket’s current determination in Rosenbaum v. CytoDyn Inc., 2021 WL 4775140, at *1 (Del. Ch. Oct. 13, 2021), which we mentioned in our 2021 12 months-Finish Securities Litigation Replace, the court docket declined to use each the stringent evaluate of Blasius Industries, Inc. v. Atlas Corp., 564 A.2nd 651 (Del. Ch. 1988), and the deferential enterprise judgment rule. See Lee Enterprises, 2022 WL 453607, at *14–15. As a substitute, the court docket utilized enhanced scrutiny—Delaware’s intermediate commonplace of evaluate first set forth in Unocal Corp. v. Mesa Petroleum Co., 493 A.2nd 946 (Del. 1985)—which requires administrators to “establish the right company goals served by their actions” and “justify their actions as affordable in relation to these goals.” Lee Enterprises, 2022 WL 453607, at *16 (quoting Mercier v. Inter-Tel (Del.), Inc., 929 A.2nd 786, 810 (Del. Ch. 2007)). The court docket finally held for the defendants, discovering that the bylaws had been “validly enacted on a transparent day,” and the board “didn’t unfairly apply” them or make “compliance [with them] tough.” Id. at *18.

B. Court docket Of Chancery Presents Steerage On “Imprecise” Schnell Customary

In Coster v. UIP Corporations, Inc., 2022 WL 1299127 (Del. Ch. Might 2, 2022), the court docket upheld a board’s determination to dilute a stockholder’s 50% possession stake beneath the “compelling justification” commonplace of evaluate set forth in Blasius Industries, Inc. v. Atlas Corp., 564 A.2nd 651 (Del. Ch. 1988). Providing useful steering on how the Blasius commonplace interacts with precedents deciphering Schnell v. Chris-Craft Industries, Inc., 285 A.2nd 437 (Del. 1971), when a board’s disenfranchising actions are at situation, the court docket held that Blasius utilized—and Schnell didn’t—as a result of the board’s disenfranchising motion “didn’t completely lack religion foundation.” Coster, 2022 WL 1299127, at *10.

In Coster, upon the loss of life of plaintiff’s husband, plaintiff turned a 50% shareholder of UIP. Id. at *1. UIP’s two 50% stockholders deadlocked relating to the composition of UIP’s board. Id. To trigger UIP to purchase her stake for 30 instances UIP’s complete fairness worth, plaintiff filed a lawsuit asking the court docket to nominate a custodian with full management of the corporate. Id. at *3. For its half, the UIP board believed that the appointment of a custodian “rose to the extent of an existential disaster for UIP” as a result of it may “set off broad termination provisions in key contracts and threaten a considerable portion of UIP’s income.” Id. at *12. Thus, in response to the lawsuit, the board issued one-third of the entire excellent shares “to reward and retain a necessary worker” who had lengthy been promised them. Id. at *5. Coster then sued once more to invalidate the issuance as a per se breach of fiduciary obligation. Id. at *1.

After trial, the court docket entered judgment in favor of the director defendants, discovering their actions had been motivated a minimum of partially by good religion beneath your entire equity commonplace. Id. at *10. The Delaware Supreme Court docket reversed and remanded, nevertheless, holding the court docket of Chancery ought to have prolonged its inquiry to find out whether or not the board acted for inequitable causes, as specified by Schnell and Blasius. Id. at *1.

On remand, the court docket supplied new steering on Schnell, which holds that “inequitable motion doesn’t change into permissible just because it’s legally potential,” and embodies the Delaware doctrine that “director actions are ‘twice-tested,’ first for authorized authorization, and second for fairness.” Id. at *6. “Heeding the [Delaware Supreme Court’s prior] coverage willpower that Schnell must be deployed sparingly,” the court docket interpreted Schnell to use solely the place “administrators haven’t any good religion foundation for approving … disenfranchising motion.” Id. at *8. Crediting the UIP board’s good-faith perception that avoiding the appointment of a custodian and rewarding and retaining a necessary worker had been in UIP’s greatest pursuits, the court docket concluded that the board didn’t act “solely for an inequitable function,” and Schnell didn’t apply. Id. at *10.

Subsequent, the court docket thought-about Blasius. Assuming the UIP board acted “for the first function of impeding the train of stockholder voting energy,” the court docket centered on “whether or not the board establishe[d] a compelling justification for [its] motion[s]” and “[its] actions had been affordable in relation to [its] legit goal.” Id. at *11–12. The court docket answered the primary query within the affirmative: it agreed with the UIP board that the appointment of a custodian was “an existential disaster,” and stopping that disaster was a “compelling justification.” Id. at *12. It additionally discovered that diluting two deadlocked stockholders equally was “appropriately tailor-made” to attaining that aim. Id. at *13. As a result of it discovered that the UIP board had a compelling justification for diluting the plaintiff, the court docket entered judgment in favor of the defendants.

C. The Court docket Of Chancery Acknowledges A “Novel” Wrongful Demand Refusal Declare

In Might, the Delaware Court docket of Chancery in Garfield v. Allen, C.A. No. 2021-0420-JTL, 277 A.3d 296 (Del. Ch. Might 24, 2022), declined to dismiss a declare for breach of fiduciary obligation arising from a board’s wrongful rejection of a stockholder demand letter. In Garfield, a stockholder of ODP Company despatched the corporate a letter demanding that efficiency share grants awarded to the corporate’s CEO be modified as they violated the fairness compensation plan’s (the “2019 Plan”) share limitation. Id. at 313–14. After the corporate refused to behave on the demand, the stockholder filed claims towards the corporate’s administrators and its CEO alleging that their actions breached the 2019 Plan and their fiduciary duties. Id. at 314.

The entire plaintiff’s claims survived the defendants’ movement to dismiss. Though most had been ruled by settled regulation, one concept the plaintiff superior was novel: the entire administrators “breached their fiduciary duties by not fixing the apparent violation after the plaintiff despatched a requirement letter calling the problem to their consideration.” Id. at 305; see additionally id. at 340. “The making of demand has not traditionally given rise to a brand new reason behind motion,” Vice Chancellor J. Travis Laster defined, as a result of “a stockholder who makes demand tacitly concedes that the board was disinterested and unbiased for functions of responding to the demand.” Id. at 339. In Garfield, nevertheless, the court docket discovered that the plaintiff overcame the tacit-concession doctrine as a result of he adequately pleaded details demonstrating that the board refused the demand in dangerous religion. Id. at 338–40 (citing Metropolis of Tamarac Firefighters’ Pension Tr. Fund v. Corvi, 2019 WL 549938 (Del. Ch. Feb. 12, 2019)). Observing that “[t]he aware failure to take motion to handle hurt to the company animates a kind of Caremark declare,” id. at 336–37, the court docket discovered that the “aware determination to go away a violative award in place help[ed] the same inference that the decision-maker[s] acted disloyally and in dangerous religion.” Id. at 337–38. It due to this fact held that this was one of many “doubtless uncommon” situations through which plaintiff’s claims that every one administrators acted in dangerous religion in rejecting the demand—and thus breached their fiduciary duties—had been viable. Id. at 340.

Lastly, Vice Chancellor Laster was cautious to notice the harmful implications of this “novel” concept, which, amongst different issues, embrace increasing alternatives for plaintiffs to create new claims with demand letters. Id. at 338–39. The court docket defined that the details at situation had been distinctive, nevertheless, as a result of the issue recognized by the demand was “apparent,” and established precedent supported an inference that the administrators acted in dangerous religion. Id. at 306, 340.

D. Court docket Considers Whether or not Activist-Appointed Outdoors Administrators Lack Independence From Activist

The Court docket of Chancery lately held that an activist’s observe of rewarding administrators with repeat appointments could be ample to name a director’s independence into query. In Goldstein v. Denner, 2022 WL 1671006, at *2 (Del. Ch. Might 26, 2022), a stockholder plaintiff adequately pleaded that sure members of Bioverativ’s board breached their fiduciary duties throughout a course of to promote the corporate to Sanofi. Initially, the activist was approached by Sanofi with an preliminary supply to purchase Bioverativ, however somewhat than alerting the board, the activist engaged in conduct violating Bioverativ’s insider buying and selling coverage. Id. at *1. Months later and after a number of presents that weren’t disclosed to the board, Sanofi submitted one other supply to your entire board, and, finally, the merger was effected at a value under Bioverativ’s standalone valuation beneath its long-range plan. Id. at *1, *13–*14.

Reviewing the independence of two activist-appointed exterior administrators, the court docket credited allegations that the activist had a observe of rewarding supportive administrators with extra profitable directorships and that every director hoped to domesticate such a repeat-player relationship with the activist. Id. at *2. One of many activist-appointed exterior administrators had knowledgeable relationship with the activist and, shortly earlier than becoming a member of the corporate’s board, allegedly obtained a profitable payout for serving to the activist full the sale of one other firm. Id. at *2, *49. Likewise, one other activist-appointed director, who allegedly was unemployed and trying to restart his profession on the time the activist appointed him, was rapidly appointed to the board of a second firm that the activist hoped to place in play. Id. at *2, *50. The court docket concluded that these allegations had been sufficient to make it moderately conceivable that the 2 administrators supported a sale of the corporate primarily based on an expectation of future rewards, somewhat than as a result of the transaction was in one of the best pursuits of the corporate. Id. at *2–3, *46, *50.

Facets of the choice in Goldstein counsel it is a subject that the court docket could also be focused on exploring extra sooner or later. Id. at *2, *47. First, the court docket relied predominantly on scholarship, and never case regulation, to help its holding that an activist’s observe of rewarding administrators with repeat appointments could be ample to name a director’s independence into query. Id. at *47–48. Second, the court docket itself thought its findings relating to the independence of the 2 activist-appointed administrators mentioned above had been a “shut name.” Id. at *46, *50.

IV. Lorenzo Disseminator Legal responsibility

As initially mentioned in our 2019 Mid-12 months Securities Litigation Replace, the Supreme Court docket held in Lorenzo v. SEC, 139 S. Ct. 1094 (2019), that those that disseminate false or deceptive data to the investing public with the intent to defraud could be liable beneath Part 17(a)(1) of the Securities Act and Trade Act Guidelines 10b-5(a) and 10b-5(c), even when the disseminator didn’t “make” the assertion throughout the that means of Rule 10b-5(b). On account of Lorenzo, secondary actors—reminiscent of monetary advisors and attorneys—may face “scheme legal responsibility” beneath Guidelines 10b-5(a) and 10b-5(c) merely for disseminating the alleged misstatement of one other as long as a plaintiff can present that the secondary actor knew the alleged misstatement contained false or deceptive data.

The largest growth on this area got here from the Second Circuit, which determined SEC v. Rio Tinto Plc., 41 F.4th 47 (2nd Cir. 2022). Gibson Dunn represents Rio Tinto on this and different litigation. A number of trial courts have additionally tried to grapple with the implications of Lorenzo.

In July 2022, as we reported in a Consumer Alert, the Second Circuit held in Rio Tinto that as a way to allege a declare of scheme legal responsibility, plaintiffs should present extra than simply the misstatements or omissions themselves. Id. at 48. The choice in Rio Tinto involved scheme legal responsibility claims made by the SEC towards mining firm Rio Tinto and its former CEO and CFO beneath Rule 10b-5(a) and (c) and Part 17(a)(1) and (3) of the Securities Act. Id. at 48. The SEC claimed that Rio Tinto’s monetary statements and accounting papers included representations a couple of newly acquired mining asset that defendants knew had been incorrect, that these papers misstated the mining asset’s valuation, and that the corporate ought to have taken an impairment on the mining asset at an earlier time. Id. at 50–51. Counting on Lentell v. Merrill Lynch & Co., 396 F.3d 161 (2nd Cir. 2005), the Southern District of New York dismissed the scheme legal responsibility claims on the idea that the SEC didn’t allege any fraudulent conduct past any misstatements or omissions. Rio Tinto, 41 F.4th at 48. The SEC filed an interlocutory enchantment, claiming that Lorenzo abrogated Lentell and its scheme claims primarily based solely on misstatements or omissions must be reinstated. Id. at 48–49.

The Second Circuit rejected the SEC’s expansive studying of Lorenzo, holding that “Lentell stays very important” and that even post-Lorenzo, “misstatements and omissions can type half of a scheme legal responsibility declare, however an actionable scheme legal responsibility declare additionally requires one thing past misstatements and omissions, reminiscent of dissemination.” Rio Tinto, 41 F.4th at 53, 49. (emphasis in authentic). To carry in any other case, the court docket reasoned, would impose major legal responsibility not solely upon the maker of an announcement, but additionally on those that participated within the making of the misstatements, and would undermine the precept that major legal responsibility beneath Rule 10b-5(b) is restricted to these actors with final management and authority over the false assertion. Id. at 54 (citing Janus Capital Group, Inc. v. First By-product Merchants, 564 U.S. 135 (2011)). Not like Lorenzo, the place the dissemination constituted conduct past any misstatement or omission, the SEC didn’t allege that the defendants did “one thing additional” that might be ample to search out scheme legal responsibility. Id.

A number of federal district courts additionally lately thought-about the scope of Lorenzo. In SEC v. Johnson, 2022 WL 423492, at *1–5 (C.D. Cal. Feb. 11, 2022), the SEC alleged that defendants—who created, managed, and managed two issuers—misled and deceived traders with regard to their compensation and misappropriated important investor funds. All however one defendant consented to judgment. Id. at *1. The district court docket relied totally on undisputed materials details as to negligence and scienter in denying abstract judgement on the SEC’s theories of scheme legal responsibility, partially, as a result of the SEC didn’t sufficiently temporary the problem and offered “little evaluation” as as to whether the alleged misstatements and omissions “additionally help scheme legal responsibility,” whereas noting the “appreciable overlap” among the many subsections of Guidelines 10(b) and 17(a). Id. at *7.

Then, in Strougo v. Tivity Well being, Inc., 2022 WL 2037966, at *10 (M.D. Tenn. June 7, 2022), the defendant was accused of a scheme involving the launching of a food plan programming firm and deceptive traders in regards to the firm’s efficiency. The district court docket in Tennessee rejected defendant’s argument that “scheme claims should be unbiased and distinct from misrepresentations claims.” Id. Fairly, the court docket held that scheme legal responsibility “could be primarily based upon misrepresentations or omissions and never simply misleading acts.” Id.

Though it’s too early to find out the influence of Rio Tinto, these selections preview how the scope of Lorenzo could develop in different circuits. We are going to proceed to watch this area.

V. Survey Of Coronavirus-Associated Securities Litigation

As we transfer by way of the third yr of the COVID-19 pandemic, courts proceed to work by way of the aftermath of the wave of coronavirus-related securities litigation that started in 2020. As we mentioned in our 2021 12 months-Finish Securities Litigation Replace, many instances stay centered on misstatements in regards to the efficacy of COVID-19 diagnostic exams, vaccinations, and coverings. As well as, there are a variety of instances involving false claims about pandemic and post-pandemic prospects, together with untimely claims that the pandemic could be “good for enterprise.” Many such instances are transferring into the movement to dismiss stage or have already got absolutely briefed motions to dismiss.

It is usually price noting that the SEC has been energetic because the starting of the yr, for instance, by submitting securities enforcement actions regarding a CEO’s alleged misstatements in regards to the buy of two million COVID-19 diagnostic exams, in addition to particular person defendants’ alleged determination to commerce on insider data suggesting {that a} cloud computing firm’s earnings had been unexpectedly—and artificially—inflated in mild of the pandemic.

Extra sources associated to the influence of COVID-19 could be discovered within the Gibson Dunn Coronavirus (COVID-19) Useful resource Heart.

A. Securities Class Actions

1. False Claims About Vaccinations, Remedies, And Testing for COVID-19

In re Chembio Diagnostics, Inc. Sec. Litig., No. 20-CV-2706, 2022 WL 541891 (E.D.N.Y. Feb. 23, 2022): Plaintiffs filed 4 lawsuits, which had been consolidated, towards defendant Chembio, an organization that developed an antibody take a look at in the course of the COVID-19 pandemic. 2022 WL 541891, at *1. Extra particularly, the plaintiffs sued the corporate’s executives and underwriters, claiming they overstated the efficacy of the antibody take a look at and its prospects. Id. at *2–5. In a February 2022 determination, the court docket discovered that the plaintiffs had not alleged scienter with ample specificity towards the company defendants. Id. at *8–11. The court docket let sure claims towards the underwriters proceed, nevertheless, discovering that the plaintiffs sufficiently pled that the underwriter defendants made a fabric misstatement by declaring within the Registration Assertion and Prospectus that the take a look at was “100% correct after eleven days whereas omitting to reveal the opposite information in Chembio’s possession that indicated a decrease accuracy.” Id. at *17. Accordingly, the court docket discovered, “the Registration Assertion didn’t disclose probably the most important dangers to Chembio’s enterprise: the potential lack of gross sales and advertising authorization in america for his or her flagship product.” Id. On March 9, the plaintiffs moved for reconsideration, and on July 21, 2022, the court docket denied the movement. See Dkt. No. 106. The court docket stayed all deadlines on this case on August 31, 2022, provided that the events have reached a settlement in precept. See Minute Order, No. 20-CV-2706 (E.D.N.Y. Aug. 31, 2022).

Sinnathurai v. Novavax, Inc. et al., No. 21-cv-02910 (D. Md. Apr. 25, 2022) (Dkt. No. 64): On this case, plaintiffs alleged that representatives of defendant Novavax made false and deceptive statements by overstating the regulatory and business prospects for its vaccine, together with by overstating its manufacturing capabilities and downplaying manufacturing points that might influence the corporate when its COVID vaccine obtained regulatory approval. On April 25, 2022, defendant Novavax moved to dismiss the criticism, arguing that the alleged misstatements constituted nonactionable puffery and mere statements of opinion. See Dkt. No. 64. Novavax additionally argued that the PSLRA’s protected harbor—which immunizes from legal responsibility statements relating to “the plans and goals of administration for future operations” or “the assumptions underlying or relating” to these plans and goals—insulates Novavax from legal responsibility relating to sure challenged statements in regards to the vaccine’s launch. Id. at 14. As well as, Novavax contended that the criticism doesn’t adequately plead that sure statements about scientific trials and manufacturing points had been false or deceptive. Id. at 17–23. In response, plaintiffs argued that the statements are actionable as a result of Novavax touted its enterprise (with statements reminiscent of “practically all main challenges” had been overcome, and “the entire severe hurdles” had been eradicated), however didn’t disclose identified details contradicting these representations. Dkt. No. 65 at 11. The plaintiffs additionally disputed that sure statements had been opinion, arguing that they’re “just about all flat assertions of proven fact that falsely assured traders that Novavax was able to file its [emergency use authorization] rapidly” and “had overcome the regulatory and manufacturing hurdles that had delayed that submitting.” Id. at 19–20. The movement to dismiss is absolutely briefed, however the court docket has but to situation a choice.

In re Sorrento Therapeutics, Inc. Sec. Litig., No. 20-cv-00966 (S.D. Cal. Apr. 11, 2022) (Dkt. No. 68): We started following this case in our 2020 Mid-12 months Securities Litigation Replace. Defendant Sorrento Therapeutics, Inc. is a biopharmaceutical firm that “purports to develop remedies for most cancers, ache, and COVID-19.” In the course of the class interval—Might 15, 2020 by way of Might 21, 2020—Sorrento was creating a monoclonal antibody remedy and made quite a lot of statements about its efficacy and promise. The plaintiffs argued that the defendants’ statements had been deceptive as a result of the remedy was nonetheless in preclinical testing phases. On April 11, 2022, the court docket dismissed the criticism in full (with depart to replead), discovering that it didn’t adequately allege that the defendants really lied to or misled traders in regards to the remedy’s preclinical testing standing. Dkt. No. 68 at 15. The court docket additionally discovered that the defendants’ statements that “there’s a treatment” and “[t]here’s a resolution that works one hundred pc” had been unactionable statements of company optimism. Id. at 11. Lastly, the court docket concluded that the criticism failed to ascertain a robust inference of scienter and that the plaintiffs didn’t make particular allegations exhibiting that the defendants had any intent to deceive traders or manipulate the preclinical trials. Id. at 13. The choice granting the movement to dismiss has been appealed to the Ninth Circuit.

Yannes v. SCWorx Corp., No. 20-cv-03349 (S.D.N.Y. June 29, 2022) (Dkt. No. 90): This case stems from allegations that defendant SCWorx, a hospital provide chain firm, artificially inflated its inventory value with a false declare in an April 13, 2020 press launch that SCWorx had a “dedicated buy order” to purchase two million COVID fast take a look at kits, after which the SCWorx inventory value elevated 434% from the prior buying and selling day. Dkt. No. 1 at 4–5. In June 2021, Choose Koeltl discovered that the criticism was adequately pleaded. Dkt. No. 52 at 1–3. After that call, the events reached a settlement. On June 29, 2022, Choose Koeltl granted last certification of the settlement class, consisting of all individuals or entities who acquired frequent inventory of SCWorx between April 13, 2020 and April 17, 2020. Dkt. No. 90 at 3. Public studies point out that beneath the settlement settlement, the insurers for SCWorx and its former CEO, Marc Schessel, will make a fee to the category plaintiffs and situation $600,000 price of frequent inventory to them. As described under, the SEC introduced in Might 2022 that it had filed a criticism towards SCWorx and Schessel and that the corporate agreed to a $125,000 civil penalty. Schessel can be dealing with felony fees.

In re Emergent Biosolutions Inc. Sec. Litig., No. 21-cv-00955 (D. Md. July 19, 2022) (Dkt. No. 77): This case entails allegations that sure high-level workers at Emergent, a biopharmaceutical firm that gives manufacturing companies for vaccines and antibody therapies, misled the general public in regards to the firm’s vaccine manufacturing enterprise. Dkt. No. 54 at 1–8. In June 2020, Emergent obtained funds from the federal authorities’s Operation Warp Pace program, which it used to order area for COVID vaccine manufacturing at Emergent’s Baltimore amenities. Dkt. No. 54 at 2. Emergent additionally entered into agreements with J&J and AstraZeneca to help the mass manufacturing of their vaccines. Id. The plaintiffs declare that, opposite to Emergent’s public proclamations of, inter alia, “manufacturing power” and “experience,” Emergent didn’t disclose myriad points on the amenities, together with that as much as 15 million doses of the J&J vaccine turned contaminated on the Baltimore amenities. Id. at 5–6, 74, 98. In response to studies that issues on the amenities weren’t remoted incidents, the federal government positioned J&J in command of the plant and prohibited it from producing the AstraZeneca vaccine. Id. at 6. Emergent’s inventory fell drastically consequently. Id. at 7. On Might 19, 2022, Emergent moved to dismiss the criticism for failure to state a declare. Dkt. No. 72. Lead plaintiffs sought judicial discover of a newly revealed Congressional report and associated supplies that the plaintiffs contend present that many extra doses of the vaccine had been destroyed as a consequence of Emergent’s high quality management failures and that Emergent hid proof of contamination in an try to evade oversight from authorities regulators. Dkt. No. 77. That movement, in addition to the movement to dismiss, stay pending.

Wandel v. Gao, No. 20-CV-03259, 2022 WL 768975 (S.D.N.Y. Mar. 14, 2022): This lawsuit was introduced by shareholders of Phoenix Tree, a residential rental firm primarily based in China with operations in Wuhan, which went public in January 2020 on the New York Inventory Trade, simply because the pandemic was in its earliest phases. 2022 WL 768975 at *1. At backside, the plaintiffs alleged that “by January 16, 2020 (when the providing paperwork turned efficient) and definitely by January 22, 2020 (when the IPO ended),” Phoenix Tree “had sufficient data to know that China—and Wuhan, particularly—was already beneath siege by the coronavirus, and that it was moderately more likely to have a fabric antagonistic impact on the Firm’s operations and revenues.” Id. at *2 (inside citation marks omitted). Unsurprisingly, the COVID-19 pandemic impacted the corporate, which noticed the early termination of rental leases. Defendants moved to dismiss, and in a March 14, 2022 opinion and order, the court docket granted their movement in full. Id. at *12. The court docket dove deep into the timeline of COVID-19 within the area, discovering that COVID-19 had not sufficiently escalated by January 17 (the day after the providing paperwork turned efficient) such that Phoenix ought to have been conscious, then, of the fabric dangers its enterprise would face consequently. Id. at *6–9. The court docket rejected arguments that Phoenix was in a “distinctive place” to acknowledge the specter of COVID-19 as a result of it had operations in Wuhan. Id. at *7. After the plaintiffs didn’t amend their criticism, on April 21, 2022, the court docket entered judgment, dismissing the case with prejudice. Dkt. No. 83.

2. Failure To Disclose Particular Dangers

Martinez v. Brilliant Well being Grp. Inc., No. 22-cv-00101 (E.D.N.Y. June 24, 2022) (Dkt. No. 38): As mentioned in our 2021 12 months-Finish Securities Litigation Replace, on this case, the plaintiffs allege that Brilliant Well being, an organization that delivers and funds U.S. medical insurance plans, made a collection of materially false or deceptive statements about itself in its IPO registration assertion and prospectus, which overstated the corporate’s prospects, didn’t disclose that it was unprepared to deal with the influence of COVID-19-related prices, and didn’t disclose that it was experiencing a decline in premium income. In April 2022, the court docket granted one in every of six competing motions to nominate a lead plaintiff. Dkt. No. 31. Then, plaintiffs filed an amended criticism on June 24, 2022 including 9 new events as defendants and claiming that though Brilliant Well being warned of potential dangers in its IPO paperwork, it was already experiencing these dangers and their antagonistic impacts “would foreseeably manifest additional near-immediately after the IPO.” Dkt. No. 38 at 5. Defendants’ movement to dismiss is due by October 12, 2022. See Minute Order, No. 22-cv-00101 (E.D.N.Y. Sept. 12, 2022).

3. False Claims About Pandemic And Put up-Pandemic Prospects

Dixon v. The Trustworthy Co., Inc., No. 21-cv-07405 (C.D. Cal. July 18, 2022) (Dkt. No. 71): It is a putative class motion towards The Trustworthy Firm, a vendor of “clear life-style” merchandise, alleging that the corporate’s registration assertion omitted that the corporate’s outcomes had been skewed by a multimillion-dollar improve in demand by COVID-19 on the time of its IPO and that the corporate was experiencing reducing demand for its merchandise. Dkt. No. 59 at 2–3. Not too long ago, the court docket denied defendants’ movement to dismiss partially, discovering that the plaintiffs plausibly alleged that COVID-19-related product demand was declining on the time the corporate revealed the providing paperwork, which claimed that the pandemic was good for the Trustworthy Firm’s enterprise. Dkt. No. 71 at 4–5. On August 1, 2022, defendant moved for partial reconsideration of the court docket’s determination on the movement to dismiss. Dkt. No. 75. The court docket denied that movement on August 25, 2022 with out additional dialogue. Dkt. No. 84.

Douvia v. ON24, Inc., No. 21-cv-08578 (N.D. Cal. Might 2, 2022) (Dkt. No. 83): On this case, the plaintiffs allege that providing paperwork promulgated by defendant ON24, Inc., a “cloud-based digital expertise platform,” had been materially inaccurate, deceptive, and incomplete as a result of they didn’t disclose that the corporate’s surge in new prospects as a consequence of COVID-19 didn’t match the corporate’s conventional buyer profile and that these new prospects had been thus unlikely to resume their contracts. Dkt. No. 80 at 2–3. This case was consolidated with one other motion towards ON24 asserting comparable allegations. In Might 2022, the defendants moved to dismiss the consolidated class motion criticism, claiming that the statements at situation had been inactionable puffery, statements of opinion, merely forward-looking, or protected by the bespeaks-caution doctrine. Dkt. No. 83 at 7–12. The movement is absolutely briefed and awaiting a choice.

Metropolis of Hollywood Police Officers’ Ret. Sys. v. Citrix Sys., Inc., No. 21-cv-62380 (S.D. Fla. Aug. 8, 2022) (Dkt. No. 75): Citrix is a software program firm that gives digital workspaces to companies. See Dkt. No. 62 at 7. The plaintiffs declare that in the course of the pandemic, Citrix hid quite a few company issues and offered closely discounted, short-term licenses that boosted its gross sales. Id. at 2–3. The plaintiffs allege that the corporate’s transition to subscription licenses was not as profitable as the corporate had disclosed, as prospects didn’t make the transition, as a substitute preferring short-term on-premise licensing because of the COVID-19 pandemic. Id. The defendants have moved to dismiss, claiming that the operative criticism inadequately alleges scienter and that the statements at situation had been forward-looking statements, opinion, and/or puffery. Dkt. No. 68 at 10–23. The court docket will hear arguments on the movement to dismiss on September 29, 2022. Dkt. No. 77.

Leventhal v. Chegg, Inc., No. 21-cv-09953 (N.D. Cal.): The plaintiffs declare that Chegg, a textbook, tutoring, and on-line analysis supplier, falsely claimed that on account of its “distinctive place to influence the way forward for the upper schooling ecosystem” and “sturdy model and momentum,” Chegg would proceed to develop post-pandemic. Dkt. No. 1 at 1. The criticism alleges that Chegg knew that its development was a short lived impact of the pandemic and was not sustainable. Id. In April 2022, the case was consolidated with the same motion (Robinson v. Rosensweig, No. 22-cv-02049 (N.D. Cal.)). On September 7, 2022, the court docket appointed joint lead plaintiffs and lead co-counsel. Dkt. No. 105.

In re Progenity, Inc., No. 20-cv-1683 (S.D. Cal.): On this case, the plaintiffs allege that Progenity, a biotechnology firm that develops testing merchandise, made deceptive statements and omitted materials details in its registration assertion, together with that Progenity didn’t disclose that it had overbilled authorities payors and that it was experiencing detrimental developments in its testing volumes, promoting costs, and revenues on account of the COVID-19 pandemic. On September 1, 2021, the court docket dismissed the case with depart to file a second amended criticism, discovering no actionable false or deceptive statements. See Dkt. No. 48. The plaintiffs then filed a second amended criticism on September 22, 2021. See Dkt. No. 49. The corporate filed a second movement to dismiss on November 15, 2021, which stays pending, Dkt. No. 52, and the events participated in a settlement convention in Might 2022, Dkt. No. 58. Gibson Dunn represents the corporate and its administrators and officers on this litigation.

Weston v. DocuSign, Inc., No. 22-cv-00824 (N.D. Cal. July 8, 2022) (Dkt. No. 59): The plaintiffs allege that DocuSign, a software program firm that permits customers to electronically signal paperwork, made false and deceptive statements that the “huge surge in buyer demand” introduced on by the pandemic was “sustained” and “not a brief time period factor.” Dkt. No. 59 at 2. The plaintiffs allege that the defendants knew that the demand was unsustainable after the pandemic subsided, and that the defendants made corrective disclosures revealing that the corporate had missed billings-growth expectations after the preliminary surge of demand dissipated. Id. The court docket appointed lead plaintiff and lead counsel on April 18, 2022, see Dkt. No. 42, and plaintiffs filed the amended criticism on July 8, 2022, see Dkt. No. 59.

4. Insider Buying and selling And “Pump And Dump” Schemes

In re Eastman Kodak Co. Sec. Litig., No. 21-cv-6418, 2021 WL 3361162 (W.D.N.Y. Aug. 2, 2021): Now we have been following the consolidated instances captioned beneath the heading In re Eastman Kodak Co. Securities Litigation since our 2020 12 months-Finish Securities Litigation Replace. The plaintiffs on this putative class motion allege that Eastman Kodak and sure of its present and former administrators and choose present officers violated securities legal guidelines by failing to reveal that its officers had been granted inventory choices previous to the corporate’s public announcement that it had obtained a mortgage to supply medication to deal with COVID-19. Dkt. No. 116 at 2. The defendants moved to dismiss earlier this yr, arguing partially that the inventory choices grants didn’t represent insider buying and selling as a result of the criticism lacked any allegation that the corporate and the person defendants didn’t have the identical data earlier than the choices grants had been issued, which is important “[b]ecause an choice grant is a ‘commerce’ between an organization and an officer,” Dkt. No. 159-1 at 21. The defendants additionally argued that the plaintiffs didn’t allege that the “timing of the [o]ptions [g]rants was manipulated to supply extra compensation to the officers.” Id. The court docket lately heard oral argument on the pending movement, however has but to situation a choice. Dkt. No. 196.

In re Vaxart Inc. Sec. Litig., No. 20-cv-05949, 2021 WL 6061518 (N.D. Cal. Dec. 22, 2021): Stockholders allege that Vaxart insiders—administrators, officers, and a serious stockholder—profited from deceptive statements that (1) overstated Vaxart’s progress towards a profitable COVID-19 vaccine and (2) implied that Vaxart’s “supposed vaccine” had been “chosen” by the federal authorities’s Operation Warp Pace program. Dkt. No. 1 at 6–7. After Vaxart’s inventory value rose in response to those statements, the insiders “cashed out,” exercising choices and warrants price tens of millions of {dollars}. Id. at 7–8. As we mentioned within the 2021 12 months-Finish Securities Litigation Replace, the court docket concluded that the criticism adequately alleged that sure defendants dedicated securities fraud, however the plaintiffs didn’t allege securities fraud on the a part of a hedge fund that was the corporate’s main stockholder as a result of the criticism didn’t display that the entity was a “maker” of the deceptive statements or managed Vaxart’s public statements. 2021 WL 6061518 at *8. The events engaged in discovery, and the plaintiffs lately reached a settlement with all remaining defendants, besides two particular person representatives from the hedge fund. Dkt. No. 215 at 6; Dkt. No. 216. The 2 particular person defendants sought to remain extra discovery, arguing that the plaintiffs improperly used discovery from the opposite defendants to hunt to amend their pleadings to boost new allegations towards the 2 particular person defendants and convey new claims towards the hedge fund. Dkt. No. 215 at 6. The plaintiffs, in flip, sought depart to increase the time to amend the criticism till 30 days after the 2 particular person defendants considerably accomplished doc manufacturing, Dkt. No. 216, which was opposed by the 2 defendants, Dkt. No. 219. On September 8, 2022, the court docket granted the movement to remain additional discovery and famous that the deadline to file the amended criticism could possibly be mentioned additional at a listening to scheduled for September 29, 2022. Dkt. No. 235.

B. Stockholder By-product Actions

In re Vaxart, Inc. Stockholder Litig., No. 2020-0767-PAF, 2022 WL 1837452 (Del. Ch. June 3, 2022): Not like the Vaxart securities class motion mentioned above, this case was filed derivatively on behalf of the Vaxart company entity. Particularly, Vaxart stockholders alleged that the officers, administrators, and purported controlling stockholder stored non-public the announcement relating to the corporate’s choice to take part in Operation Warp Pace in order that they might preserve the inventory value artificially low earlier than exercising their choices. 2021 WL 5858696, at *1, *13. As mentioned in our 2021 12 months-Finish Securities Litigation Replace, the court docket granted the defendants’ movement to dismiss as to the by-product claims as a result of the plaintiffs didn’t plead demand futility, however requested supplemental briefing on the plaintiffs’ remaining claims. Id. at *24. The court docket lately dismissed the plaintiffs’ remaining breach of fiduciary obligation declare regarding an modification to the fairness incentive plan and their unjust enrichment declare arising from compensation selections made earlier than and after the approval of the modification. 2022 WL 1837452, at *1. The case is now absolutely dismissed.

In re Emergent Biosolutions Inc. By-product Litig., No. 2021-0974 (Del. Ch.): Along with the putative securities class motion mentioned above, the administrators of Emergent BioSolutions Inc. and its present and former CEO are dealing with a shareholders’ by-product go well with within the Delaware Court docket of Chancery. See Compl. at 1–8. The criticism alleges fiduciary obligation breaches, unjust enrichment, company waste towards all defendants, and an insider buying and selling declare on the half of the present CEO. See id. at 96–97. The plaintiffs declare that the defendants didn’t put in place any compliance buildings to watch its vaccine-manufacturing enterprise, leading to important high quality management points with its COVID-19 vaccine. See id. at 94. The case is at present stayed pending the end result of the securities lawsuit mentioned above.

C. SEC Instances

SEC v. Berman, No. 20-cv-10658, 2021 WL 2895148 (S.D.N.Y. June 8, 2021): In each our 2020 12 months-Finish Securities Litigation Replace and our 2021 12 months-Finish Securities Litigation Replace, we mentioned a associated civil and felony case filed towards the CEO of Resolution Diagnostics Corp. Within the felony case, a federal grand jury indicted the CEO on December 15, 2020 for allegedly making an attempt to defraud traders by making false and deceptive statements in regards to the growth of a brand new COVID-19 fast take a look at. Dkt. No. 1 at 6–7. The CEO allegedly claimed the take a look at was on the verge of FDA approval though the take a look at had not been developed past the conceptual stage. Id. at 6–7, 9. Solely two days after the indictment within the felony case, the SEC filed a civil enforcement motion primarily based on the identical underlying details towards each Resolution Diagnostics Corp. and its CEO. The SEC claims that the defendants violated Part 10(b) of the Trade Act and Rule 10b-5. 2021 WL 2895148, at *1. The court docket stayed discovery in June 2021 within the civil case in mild of the parallel felony case towards the CEO. Id. Discovery stays stayed, and the felony trial is ready for this coming December. Dkt. No. 30.

SEC v. SCWorx Corp., No. 22-cv-03287 (D.N.J. Might 31, 2022): Along with the non-public securities lawsuit mentioned above, the SEC lately filed a securities enforcement motion towards hospital provide chain SCWorx and its CEO, alleging that the defendants falsely claimed in a press launch to have a “dedicated buy order” from a telehealth firm for “two million COVID-19 exams” amounting to $840 million when the “dedicated buy order” was, in actuality, solely a “preliminary abstract draft.” Dkt. No. 1 at 2–3. SCWorx has agreed to pay a penalty of $125,000, along with disgorgement of roughly $500,000. The CEO was additionally indicted in a parallel felony fraud case arising from the identical allegations. 2:22-cr-00374-ES, Dkt. No. 1. On August 17, 2022, the court docket ordered that the SEC’s enforcement motion be stayed till the parallel felony case is accomplished. Dkt. No. 20.

SEC v. Certain, No. 22-cv-01967 (N.D. Cal. Mar. 28, 2022): The SEC filed this civil enforcement motion in March towards a gaggle of workers at Twilio, a cloud computing firm, and their family and friends, alleging that they violated Part 10(b) and Rule 10b-5 by participating in insider buying and selling in Might 2020. Dkt. No. at 1. The SEC alleges that the staff discovered that Twilio’s prospects unexpectedly elevated their utilization of the cloud computing companies due to the COVID-19 pandemic, resulting in considerably elevated earnings for the corporate that exceed its income steering. Id. at 5–6. In response to the SEC’s criticism, the staff knowledgeable the opposite defendants about Twilio’s anticipated efficiency prematurely of its Might 6, 2020 earnings announcement, who, in flip, traded on this data. Id. at 8–9. Parallel felony fees had been additionally introduced towards one of many defendants.

VI. Falsity Of Opinions – Omnicare Replace

As readers will recall, in Omnicare, the Supreme Court docket held that “a honest assertion of pure opinion is just not an ‘unfaithful assertion of fabric reality,’ regardless whether or not an investor can finally show the idea improper,” however that an opinion assertion can type the idea for legal responsibility in three completely different conditions: (1) the speaker didn’t really maintain the idea professed; (2) the opinion contained embedded statements of unfaithful details; and (3) the speaker omitted data whose omission made the assertion deceptive to an affordable investor. 575 U.S. at 184–89. Since that call was handed down in 2015, there was important exercise with respect to “opinion” legal responsibility beneath the federal securities legal guidelines, and the primary half of 2022 has been no exception.

A. Survival At The Movement To Dismiss Stage

Within the first half of 2022, instances with claims premised on allegedly deceptive opinions survived motions to dismiss primarily based on Omnicare. For instance, in Fryman v. Atlas Monetary Holdings Inc., No. 18-cv-01640, 2022 WL 1136577, at *9–21 (N.D. Sick. Apr. 18, 2022), an Illinois district court docket held that plaintiff traders adequately acknowledged a Part 10b-5 declare towards a monetary companies holding firm primarily based on deceptive statements by firm executives. The plaintiffs alleged that the corporate misled traders with regard to a considerable improve in its loss reserves. Id. at *2–4. The criticism alleged quite a lot of misstatements, together with statements by the CEO that the reserve will increase had been attributable to remoted points, that “[w]e really feel very strongly that we’ve remoted the problem,” and that the reserves had been ample and “look like holding up in step with the expectations we had.” Id. at *14. Regardless of being phrased as a perception (“[w]e really feel strongly”), the court docket thought-about the pleading ample. Id. at *14–15. Within the court docket’s view, the statements omitted materials details that “battle[ed] with what an affordable investor would take from the assertion[s]” themselves. Id. at *14 (inside citation omitted). The court docket concluded the defendants’ “contemporaneous information surrounding the reserve deficiencies” evidenced that they “didn’t really imagine” the reserves had been enough or that the “will increase had been attributable to remoted incidents.” Id. “Thus, the opinion statements in regards to the trigger or adequacy of [the company’s] reserves may nonetheless be deceptive beneath Omnicare as a result of the defendants didn’t maintain the beliefs professed.” Id. (inside citation and corrections omitted).

The Fryman court docket additional thought-about the importance of the context surrounding the statements at situation to find out the opinion was actionable beneath Omnicare. “Context issues,” and whether or not an opinion is actionable beneath Omnicare will depend on its “full context.” Omnicare, 575 U.S. at 190; see Fryman, 2022 WL 1136577, at *11, 20. The court docket rejected the defendants’ assertions that the CEO’s statements had been nothing greater than inactionable puffery; “when assessed in context,” these statements had been “not puffery as a result of they aren’t imprecise or unimportant to an affordable investor, who would need to know if future reserve will increase could be wanted which may diminish [the company]’s web earnings.” Id. at *20.

Context is a typical thread operating by way of current Omnicare instances. In Metropolis of Sterling Heights Police & Hearth Retirement System v. Reckitt Benckiser Group PLC, No. 20-cv-10041, 2022 WL 596679, at *18–19 (S.D.N.Y. Feb. 28, 2022), plaintiffs plausibly alleged that a few of the defendant pharmaceutical firm’s statements of opinion had been actionable as “greater than mere puffery or statements of opinion” in mild of the complete context through which the statements had been made. The corporate’s CEO made a number of factual statements a couple of product’s market share and “business success” with out disclosing it had carried out anticompetitive practices. Id. at *2, 6. The court docket recognized quite a lot of adequately pleaded misstatements, together with: (1) “the information has already demonstrated that [the specific product] may be very clearly the popular product”; (2) the product’s “resilience” and “market share efficiency” demonstrated it was “the best choice” in the marketplace; (3) the product was “designed with the intent of being a decrease potential for abuse and misuse than the earlier merchandise in the marketplace”; and (4) “we’re not within the enterprise of forcing the market or sufferers to do something.” Id. at *18–20 (inside quotations omitted). Within the court docket’s view, the CEO “positioned at situation the rationale for the [product’s] sturdy gross sales” and due to this fact “had an obligation to reveal that gross sales had been derived a minimum of partially from allegedly untruthful statements and anticompetitive conduct.” Id. at *18. This was data “an affordable investor would have thought-about . . . materials to know.” Id. at *19. The CEO thereby “materially mispresented the explanations for the sturdy market place” of the product. Id. at *20.

B. Omnicare As A Pleading Barrier

In one other line of instances, defendants have used Omnicare to efficiently argue for the dismissal of inadequately pleaded claims counting on allegedly false or deceptive opinions. In In re Peabody Vitality Corp. Securities Litigation, the Southern District of New York dismissed claims towards Peabody—an vitality firm—given the “broader surrounding context,” amongst different causes. No. 20-CV-8024, 2022 WL 671222, at *18 (S.D.N.Y. Mar. 7, 2022). There, the court docket examined a number of statements made by Peabody and its executives relating to a hearth at a mine in Queensland, Australia. One assertion by an government, that the “overwhelming majority of the mine is unaffected,” was held to be non-actionable as a result of, learn in “the suitable context,” the opinion was an estimate primarily based on out there information and was not “rendered deceptive and actionable simply because Peabody was really unable” to determine damages to all elements of the mine. Id. at *18.

In In re Ascena Retail Group, Inc. Securities Litigation, the District of New Jersey relied on Omnicare to dismiss Part 10(b) and Rule 10b-5 claims towards a retail clothes model and two of its executives. Civ. No. 19-13529, 2022 WL 2314890, at *9 (D.N.J. June 28, 2022). In response to the plaintiffs, the defendants made false statements in regards to the worth of the corporate’s goodwill and tradename. Id. at *6. They argued that defendants overstated the worth of those property in public statements and monetary disclosures beneath GAAP, regardless of contemporaneous indicators of impairment, together with (1) deteriorating efficiency; (2) modifications in “shopper habits and spending;” (3) modifications within the firm’s business technique; and (4) falling share value. Id. Defendants countered that plaintiffs didn’t allege “a single particularized allegation” that they “disbelieved” the challenged statements or “omitted materials personal data.” Id.

The court docket agreed with defendants, discovering plaintiffs had not proven the defendants “disbelieved their very own statements, conveyed false statements of reality, or omitted materials details going to the idea of their opinions.” Id. at *7. The statements did little greater than present the defendants had been “conscious” of the corporate’s “more and more tough enterprise atmosphere.” Id. The corporate’s statements about goodwill and tradenames “relaxation[ed] on the accounting procedures outlined by GAAP for evaluating and testing these property,” which “require the train of subjective judgment.” Id. Making use of Omnicare, the court docket held that the challenged statements weren’t false or deceptive as a result of, though the corporate knew of its difficult enterprise atmosphere, GAAP granted it discretion. Id. The scale of the impairment “means that Defendants’ valuations had been overly optimistic and that an impairment may and even ought to have been recorded earlier,” however the firm’s “impairment cost seems higher defined on account of Defendants’ errors, dangerous luck, or poor efficiency, not a longstanding effort by Defendants to dupe traders and fraudulently inflate Ascena’s share value.” Id. at *8. Accordingly, the court docket dismissed the criticism. Id. at *9; see additionally Nacif v. Athira Pharma, Inc., No. C21-861, 2022 WL 3028579, at *1, 15 (W.D. Wash. July 29, 2022) (holding that “laudatory opinions” a couple of biopharmaceutical firm’s CEO, the place the corporate allegedly misled traders by omitting “materials details regarding [the CEO’s] prior analysis,” weren’t actionable the place plaintiffs failed to indicate “that the opinions had been both offered with out affordable investigation or in battle with then-known data”) (emphasis in authentic); Constructing Trades Pension Fund of Western Pennsylvania v. Insperity, Inc., 20 Civ. 5635, 2022 WL 784017, at *10 (S.D.N.Y. Mar. 15, 2022) (discovering an “overly optimistic” assertion “exuding confidence whereas acknowledging danger doesn’t represent a misstatement” actionable beneath Omnicare, significantly the place such statements are “predictions, not ensures”); In re Peabody Vitality Corp. Securities Litigation, 2022 WL 671222, at *19 (discovering an announcement regarding an anticipated manufacturing timeline non-actionable the place defendants had individually “cautioned that . . . manufacturing estimates had been topic to reevaluation”).

We are going to proceed to watch developments in these and comparable instances.

VII. Federal SPAC Litigation

The usage of particular function acquisition corporations (“SPACs”) surged in the course of the coronavirus pandemic. Utilizing a SPAC to go public has a number of perceived benefits, together with a extra streamlined path than a conventional IPO. The surge in SPAC transactions generated new alternatives for start-ups, high-growth corporations, and retail traders to entry the general public markets. The primary half of 2022 noticed each a corresponding spike in SPAC-related securities litigation and a set of newly proposed SPAC-related guidelines and amendments from the SEC.

Part 10(b) materials misstatement or omission claims proved to be the commonest avenue for SPAC-related securities claims. Such claims steadily are filed towards working corporations which are acquired by SPACs and start reporting monetary outcomes that aren’t aligned with prior, extra optimistic enterprise projections. The SEC, in the meantime, has proposed a set of recent guidelines and amendments that search to impose conventional IPO ideas and laws on the SPAC transaction course of. Complying with the proposed guidelines, that are defined in depth in our current Consumer Alert, will curtail SPAC flexibility and improve the complexity and value of finishing a de-SPAC transaction. These litigation developments, alongside the SEC’s elevated curiosity in regulating SPAC transactions, underline the significance of sturdy disclosure controls and disciplined due diligence all through the SPAC course of.

A. Clover Well being: Prototypical 10(b) And 20(a) Claims In The SPAC Context

A notable variety of claims involving SPACs survived motions to dismiss within the first half of 2022, a number of of which had been primarily based on pretty routine allegations of deceptive statements made throughout pre-merger and post-merger disclosures. See, e.g., In re Romeo Energy Inc. Sec. Litig., 2022 WL 1806303 (S.D.N.Y. June 2, 2022) (alleging deceptive statements within the related registration assertion, proxy assertion, and prospectus); In re XL Fleet Corp. Sec. Litig., 2022 WL 493629 (S.D.N.Y. Feb. 17, 2022) (alleging deceptive statements in press releases and SEC filings beginning the date the de-SPAC merger settlement was introduced). The current determination in Bond v. Clover Well being Investments, Corp. is a prototypical instance with a fulsome opinion; it seems to be the primary time a federal court docket has expressly credited a fraud-on-the-market concept when deciding a movement to dismiss federal securities claims arising from a SPAC-related providing. 2022 WL 602432 (M.D. Tenn. Feb. 28, 2022).

B. The Northern District Of California Continues To Apply The PSLRA’s “Secure Harbor” Provision For Ahead-Trying Statements

Though use of the PSLRA’s protected harbor provision for “forward-looking statements” has been questioned within the context of SPACs as a consequence of their speculative nature, courts have continued making use of the protected harbor to dismiss claims involving SPACs. The Northern District of California, for instance, lately dismissed claims of alleged misstatements associated to enterprise development and anticipated income beneath the protected harbor. Moradpour v. Velodyne Lidar, Inc., 2022 WL 2391004, at *14–16 (N.D. Cal. July 1, 2022). The court docket discovered that the defendants’ statements associated to enterprise development and anticipated income from present contracts had been, in truth, forward-looking and accompanied by acceptable cautionary language, because the PSLRA requires. Id.

Though no court docket has but discovered that the “forward-looking assertion” protected harbor doesn’t apply to SPAC transactions, the protected harbor’s future in federal SPAC litigation stays unsure. The SEC has lately proposed a rule that might disqualify SPACs from the protected harbor by revising the definition of “clean verify firm” to omit the requirement that the corporate situation “penny inventory.” If the proposed rule had been to change into efficient, the time period “clean verify firm” would embody any development-state firm with no particular marketing strategy or function, or which has indicated that its marketing strategy is to interact in a merger or acquisition with an unidentified firm or corporations, or different entity or particular person—together with SPACs. As a result of the forward-looking assertion protected harbor wouldn’t be out there for statements made in reference to an providing by a “clean verify firm,” the change would eradicate a significant protection towards SPAC-related claims.

C. One Plaintiff Is Pursuing New Theories Of Legal responsibility Towards SPACs And Their Advisers

One plaintiff has gained consideration by submitting three actions asserting violations of the Funding Firm Act of 1940 (the “ICA”) and the Funding Advisers Act of 1940 (the “IAA”). These fits try to classify SPACs as funding corporations and sure concerned people as funding advisers, which might topic them to completely different units of laws and theories of legal responsibility. One motion was voluntarily dismissed as a result of the goal firm ceased operations, and one other is stayed. A 3rd, Assad v. E.Merge Expertise Acquisition Corp., No. 1:21-cv-07072 (S.D.N.Y. Aug. 20, 2021), is energetic and pending within the Southern District of New York.

In Assad, a stockholder plaintiff alleged that E.Merge, the defendant SPAC, is topic to legal responsibility beneath the ICA as “an funding firm . . . whose major enterprise is investing in securities” as a result of “that is all E.Merge has ever executed with its property.” Dkt. No. 1 at ¶ 4. The plaintiff within the case has asserted that E.Merge—as an “funding firm”—violated the ICA’s rule towards issuing shares of frequent inventory for lower than their web asset worth by offering shares of frequent inventory as compensation to its sponsors and administrators. Id. ¶¶ 82–90. E.Merge has moved to dismiss the claims, arguing that (1) the ICA doesn’t confer a personal proper of motion; (2) E.Merge is just not an funding firm, particularly as a result of it doesn’t interact primarily within the enterprise of investing in securities; and (3) plaintiff has not alleged any violation of the ICA. See Dkt. No. 31. In mild of E.Merge’s forthcoming dissolution and liquidation, throughout which it intends to return all investor funds, this case was stayed on September 2, 2022 pending the submission of a stipulation of dismissal, which is the events anticipate submitting by the top of September. See Dkt. No. 56–57.

In September 2021, shortly after the plaintiff started submitting these claims, greater than sixty regulation corporations—together with Gibson Dunn—issued a joint assertion urging that no authorized or factual foundation exists for classifying SPACs as funding corporations. It seems the SEC agrees. As we mentioned in our current Consumer Alert, the SEC’s proposed guidelines regarding SPACs present a protected harbor that can exempt SPACs from the ICA. To qualify for the protected harbor, the SPAC (1) should keep property consisting solely of money objects, authorities securities, and sure cash market funds; (2) search to finish a single de-SPAC transaction the place the surviving public firm might be “primarily engaged within the enterprise of the goal firm;” and (3) should enter into an settlement with a goal firm to interact in a de-SPAC transaction inside 18 months after its IPO and full its de-SPAC transaction inside 24 months of such providing.

VIII. Different Notable Developments

A. Second Circuit Holds That Firm Has Responsibility To Disclose SEC Investigation

In Might, the Second Circuit, in Noto v. twenty second Century Grp., Inc., 35 F.4th 95 (2nd Cir. 2022), issued an opinion which will elevate questions as to when an organization should disclose a governmental investigation. The plaintiffs in Noto alleged that twenty second Century Group “reported materials weaknesses in its inside monetary controls” in a number of public SEC filings over a two-year interval, they usually claimed that the corporate’s statements relating to these accounting weaknesses had been deceptive as a result of the corporate didn’t disclose the existence of an SEC investigation into those self same accounting weaknesses. Id. at 105.