2022 Ohio Income Tax Brackets. Taxable income between $89,075 to $170,050. Income tax tables and other tax information is sourced from the ohio department of taxation.

The 2021 state income tax rates range from 2.765% to 3.99%, and the sales tax rate is 5.75%. 10 percent, 12 percent, 22 percent, 24. $181.17 + 2.476% of excess over $15,650.

• For Ohio Income Taxes, The Most Notable Changes Are That Instead Of Having Six Income Tax Brackets, Beginning On January 1,.

The 2021 state income tax rates range from 2.765% to 3.99%, and the sales tax rate is 5.75%. Home » tax bracket rates » tax rate 2022 ohio. Additionally, ohio taxable nonbusiness income in excess of $110,650 is taxed at 3.99%.

$928.71 + 3.465% Of Excess Over $41,700

The tax rate remains at 40%. The law changed the next highest income tax bracket for individuals with ohio agi over $110,650 to 3.99% (formerly 4.413%). 10 percent, 12 percent, 22 percent, 24.

$25.74+.990% Of Excess Over $5,200.

Moreover, the lowest bracket level is increased to $25,000, which will exempt anyone making less than $25,000 per year from any state income tax liability. This page has the latest ohio brackets and tax rates, plus a ohio income tax calculator. The law also increased the lowest bracket to $25,000 (previously $21,750), meaning individuals with ohio agi.

According To The Legislative Budget Office, The Reductions Will Decrease Collections By $915.8 Million In Fiscal Year (Fy) 2022 And $784.5 Million In Fy 2023.

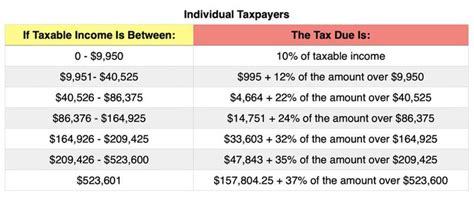

2022 tax brackets and rates. Starting in 2005, ohio’s state income taxes saw a gradual decrease each year. $181.17 + 2.476% of excess over $15,650.

Taxable Income Between $10,275 To $41,775.

Taxable income between $89,075 to $170,050. $77.22+ 1.980% of excess over $10,400. For the 2021 tax year, which you file in early 2022, the top rate is 3.99%.