2022 Tax Brackets Compared To 2022. Importantly, the 2021 brackets are for income earned in 2021, which most people will file taxes on before april 15, 2022. Final 2022 tax brackets have now been published by the irs and as expected (and projected) federal tax brackets have expanded, while federal tax rates stayed the same.

The following rates will apply: €400 €1,462 €1,462 normal rates of employer’s prsi will be reintroduced from 1 march 2022. 2021 tax brackets the income ranges, adjusted annually for inflation, determine which tax rates apply to you you may be making plans for filing your 2021 income taxes, but in a few short weeks you’ll be living in tax year 2022, and tax year 2022 will differ substantially from 2021.

Latest 2021 2022 Tax Brackets And Federal Income Bankrate.

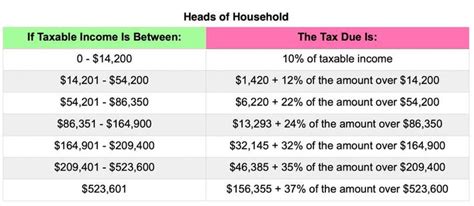

Final 2022 tax brackets have now been published by the irs and as expected (and projected) federal tax brackets have expanded, while federal tax rates stayed the same. Income tax brackets will rise to. There are seven tax brackets for most ordinary income for the 2021 tax year:

Single Tax Brackets And Standard Deduction.

2022 tax brackets (taxes due april 2023 or october 2023 with an extension) tax rate $29,467 plus 37c for each $1 over $120,000. 2022 federal income tax brackets and rates ;

The 2022 Tax Brackets Affect The Taxes That Will Be Filed In 2023.

Tax brackets 2022 vs 2022. 2021 tax brackets the income ranges, adjusted annually for inflation, determine which tax rates apply to you you may be making plans for filing your 2021 income taxes, but in a few short weeks you’ll be living in tax year 2022, and tax year 2022 will differ substantially from 2021. Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep.

In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

Importantly, the 2021 brackets are for income earned in 2021, which most people will file taxes on before april 15, 2022. Married tax brackets and standard deduction 2021 federal income tax brackets (for taxes due in april 2022 or in october 2022.

Your 2022 Tax Brackets Vs.

2021 federal income tax brackets. The 2022 financial year starts on 1 july 2021 and ends on 30 june 2022. $5,092 plus 32.5c for each $1 over $45,000.