2022 Tax Brackets Explained. See irs taxable income thresholds for previous tax brackets for back taxes or future, 2022 brackets. If your income is below the threshold for your filing status, you are likely in the clear:

More than $114,000 up to $142,000. For an individual making $60,000, this will raise your taxable income to $65,000. 58 rows federal tax bracket rates for 2022.

Uk Income Tax Rates And Tax Brackets Explained Benjamin Franklin Was Famously Quoted As Saying, “Nothing Can Be Said To Be Certain Except Death And Taxes.” While Many Of Us Begrudgingly Accept This As Truth, Understanding Tax Allowances, Tax.

More than $91,000 and up to $114,000. This means you are in the 22% tax bracket and you will owe $1,200 for your gains. 10% for incomes of $10,275 or less ($20,550 for.

The Current Tax Year Is From 6 April 2021 To 5 April 2022.

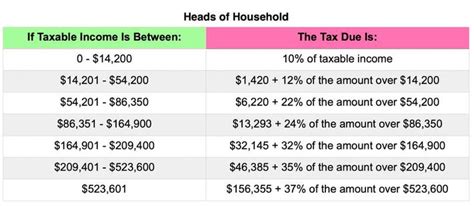

2022 (based on 2020 individual tax return) 2022 (based on 2020 joint tax return) $91,000 or less. The table below shows the tax bracket/rate for each income level For reference, here’s how the irs website has broken down the new tax brackets for 2022:

$56,700 For Married Filing Separately.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. $113,400 for married filing jointly. Here are the 2022 federal tax brackets.

$72,900 For Single Or Head Of Household.

The following are the federal tax. Below are income tax rate tables by filing status, income tax bracket tiers, and a breakdown of taxes owed. For example, if you earned $100,000 and claim $15,000 in deductions, then your taxable income is $85,000.

However, The Tax Brackets Have Been Adjusted To Account For Inflation.

Remember, these aren't the amounts you file for your tax return, but rather the amount of tax you're going to pay starting january 1, 2022 to december 31, 2022. 10%, 12%, 22%, 24%, 32%, 35% and 37%. More than $142,000 up to $170,000