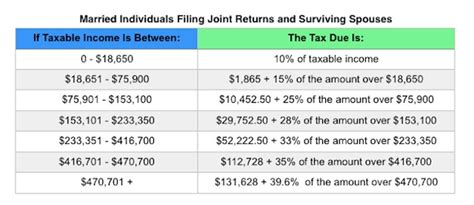

2022 Tax Brackets For Married Filing Jointly. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 2022 tax brackets for single filers and married couples filing jointly tax rate taxable income (single) taxable income (married filing jointly) 10% up to $9,950 up to $19,900 12% $9,951 to $40,525 $19,901 to $81,050 22% $40,526 to $86,375 $81,051 to $172,750 24% $86,376 to $164,925 $172,751 to $329,850 32% $164,926 to $209,425 $329,851 to.

2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. Here are the 2021 tax brackets according to the irs. The tax bracket that is applicable is the 15% tax bracket.

There Are Seven Federal Income Tax Rates In 2022:

The 2022 tax brackets affect the taxes that will be filed in 2023. These are the 2021 brackets. Here are the 2021 tax brackets according to the irs.

2022 Tax Brackets Married Filing Jointly.

Married couples filing jointly : The maximum earned income tax credit (eitc) in 2022 for single and married filing jointly filers is $560 if the filer has no children. The irs also announced that the standard deduction for 2022 was increased to the following:

Single Or Married Filing Separately:

Taxation on corporate income is a tax that corporations pay. The irs changes these tax brackets from year to year to account for inflation and other changes in economy. 32% for incomes over $170,050

In The Last 10 Years, We Have Seen A Sharp Decrease In Canadian Tax Rates.

The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less ($19,900 for married couples filing jointly). 35%, for incomes over $215,950 ($431,900 for married couples filing jointly); For instance, a married couple filing a joint return with $100,000 of taxable income in 2022 won't pay $22,000 in tax just because their total taxable income falls within the 22% bracket for joint.

For Tax Year 2022, The Top Tax Rate Remains 37% For Individual Single Taxpayers With Incomes Greater Than $539,900 ($647,850 For Married Couples Filing Jointly).

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. The irs isn't the irs website defines the new tax brackets as follows: 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.