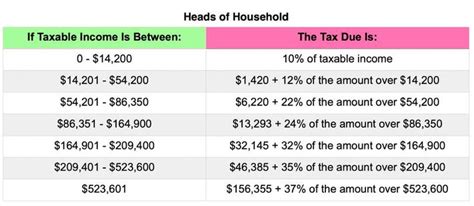

2022 Tax Brackets For Seniors. 2022 tax brackets for single filers, married couples filing jointly, and heads of households; Your bracket depends on your taxable income and filing status.

Changes to the income tax calculator rules were also expected in the budget. 10%, 12%, 22%, 24%, 32%, 35% and 37%. For tax year 2022, for family coverage, the annual deductible is not less than $4,950, up from $4,800 in 2021;

20.5% On The Portion Of Taxable Income Over $49,020 Up To $98,040 And.

10%, 12%, 22%, 24%, 32%, 35% and 37%. For 2022, such taxpayers generally get an additional $1,400 per married person (up from $1,350 for 2021) or $1,750 per single person (up from $1,700). 26% on the portion of taxable income over $98,040 up to $151,978 and.

2022 California Tax Tables With 2022 Federal Income Tax Rates, Medicare Rate, Fica And Supporting Tax And Withholdings Calculator.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). What is the extra standard deduction for seniors over 65? Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes over $215,950 ($431,900 for married couples filing jointly)

Taxable Income Between $89,075 To $170,050.

President joe biden’s 2022 budget proposal raises the top income tax rate up to 39.6%. Those numbers increase to $1,750 and $1,400 in tax year 2022. What will be the standard deduction for 2022?

The 2022 Financial Year Starts On 1 July 2021 And Ends On 30 June 2022.

Here's how they apply by filing status: Before the official 2022 kansas income tax rates are released, provisional 2022 tax rates are based on kansas' 2021 income tax brackets. Taxpayers expected a new 2022 income tax bracket to provide relief to many taxpayers, especially seniors.

The 2022 State Personal Income Tax Brackets Are Updated From The Kansas And Tax Foundation Data.

There are seven federal income tax rates in 2022: Taxpayers with an adjusted gross income over $1. Individuals who are both aged and blind may receive both standard deductions increases.