2022 Tax Brackets For Single Filers. For example, if you are single and your taxable income is $75,000 in 2022, your marginal tax bracket is 22%. 2022 federal income tax rates:

There are seven federal income tax rates in 2022: 2022 federal income tax rates: Ever since the tax cuts and jobs act passed in 2017, an estimated 90% of households take the.

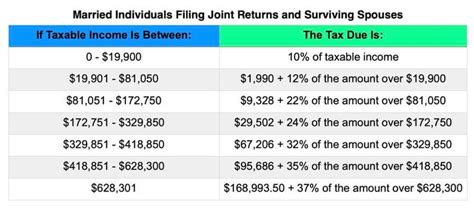

The Top Marginal Income Tax Rate Of 37 Percent Will Hit Taxpayers With Taxable Income Above $539,900 For Single Filers And Above $647,850 For Married Couples Filing Jointly.

2022 capital gains tax rate; Your specific bracket depends on your taxable income and filing status. 2022 federal income tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

12% Tax Rate For Incomes Over $10,275 But Not Over $41,775.

Here are the new brackets for 2022, depending on your income and filing status. 2022 federal income tax brackets and rates. The 2022 tax brackets for single filers.

But That Jump Doesn’t Apply Across The Board.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 10%, 12%, 22%, 24%, 32%, 35% and 37%. All net unearned income over a threshold amount of $2,300 for 2022 is taxed using the brackets and rates of the child’s parents.

If You’re Single, Only Your 2022 Income Over $523,600 Is Taxed At The Top Rate (37%).

Every year the irs revises the tax bracket for inflation. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. There are seven federal income tax rates in 2022:

Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads Of Households;

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Tax tables 2022 edition 1 taxable income ($) base amount of tax ($) plus marginal tax rate of the. 10%, 12%, 22%, 24%, 32%, 35% and 37%.