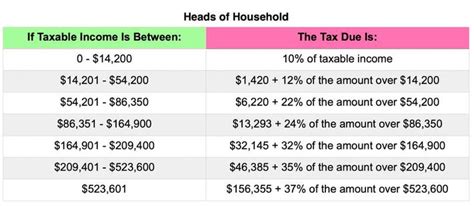

2022 Tax Brackets Hoh. Alternative minimum tax exemption amount single, hoh $75,900 married, joint $118,100 married, separate $59,050 estates and trusts $26,500 child tax credit credit for qualifying dependent children $2,000. We also provide tax services for cryptocurrency.

The 2022 tax brackets affect the taxes that will be filed in 2023. All net unearned income over a threshold amount of $2,300 for 2022 is taxed using the brackets and rates of the child’s parents. Married filing jointly or qualifying widow(er) married filing separately:

The New York Department Of Revenue Is Responsible For Publishing The.

Here's how the tax brackets will work this year. There are still seven brackets broken up by income. Single 2022 income tax brackets.

Alternative Minimum Tax Phaseout Threshold Single, Hoh $539,900 Married, Joint $1,079,800 Married, Separate $539,900 Estates And Trusts $88,300 Gift And Estate Tax Gift Tax Annual Exclusion $16,000.

2022 tax facts & figures. The 2022 tax brackets affect the taxes that will be filed in 2023. The irs also tweaked the marginal tax rates, often referred to as tax brackets, for the year ahead.

If You File Your 2021 Tax Return As A Single And Had A Low Adjusted Gross Income Of $9,000 Last Year, Your Tax Rate Is 10%.;

That’s because federal income is taxed in chunks as you ascend up the tax brackets, making the math a little complex. 2022 federal tax brackets for head of household tax payers. The new york state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 new york state tax calculator.we also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state.

Below Are The 2022 Tax Brackets According To The Irs.

We've summarized income tax brackets and details for you, for the tax year 2021 and filings in 2022. And a 22% tax on the final portion, up to $85,000. If you file as a single and had adjusted gross income of $85,000 in 2021, you pay:

2021 Tax Brackets And Rates.

Note that the tax foundation is a 501(c)(3) educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. A 10% tax on the first $9,950; Here is a look at what the brackets and tax rates are for 2021 (filing 2022):