2022 Tax Brackets Individual. Importantly, the 2021 brackets are for income earned in 2021, which most people will file taxes on before april 15, 2022. 0.33 percent for taxable income between $0 and $1,743;

The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. Rate for unmarried individuals for married individuals filing joint returns for heads of households; $5,092 plus 32.5c for each $1 over $45,000.

See Below For How These 2022 Brackets Compare To 2021 Brackets.

Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes over $215,950 ($431,900 for married couples filing jointly) The irs changes these tax brackets from year to year to account for inflation and other changes in economy. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent, And 37 Percent.

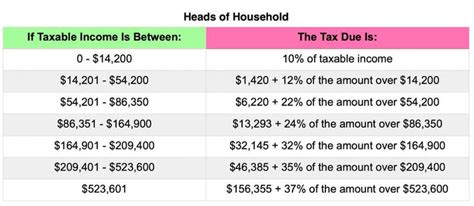

There are seven tax rates in 2022: Kentucky, illinois, and tennessee tornado victims have until may 16, 2022 to file 2021 individual income tax returns, as well as various 2021 business returns. 2022 tax brackets for single filers, married couples filing jointly, and heads of households;

$95.87+4.14 Percent For Taxable Income Between $6,972 And $15,687

Tax year 2022 income tax brackets are: The state has been slowly eliminating its lowest tax bracket by exempting $1,000 increments every year since 2018. 0.33 percent for taxable income between $0 and $1,743;

That 14% Is Called Your Effective Tax.

The 2022 financial year starts on 1 july 2021 and ends on 30 june 2022. 2022 tax bracket and tax rates. Income tax if taxable income is over but not over the tax is of the amount over;

2021 Tax Brackets (Due April 15, 2022) Tax Rate Single Filers Married Filing Jointly* Married Filing Separately Head Of Household;

19c for each $1 over $18,200. R14 067 r13 635 r13 500 r13 257 r12 726 secondary (65 and older) r8 613 r8 199: Tax rate for single filers for married individuals filing joint returns for heads of households;