2022 Tax Brackets Iowa. In the case of corporate income taxation, the tax bracket applicable to corporations is the 15% tax bracket. The tax brackets are the same regardless of your filing status and tax rates range from 0.33% to 8.53%.

Tax year 2022 income tax brackets are shown in the table below. Iowa department of revenue announces 2022 income tax brackets, deductions. Jun 17, 2021 @ 6:01am.

Married Individuals Filling Joint Returns;

The state capitol building in des moines. Iowa's 2022 income tax ranges from 0.33% to 8.53%. The department updates withholding formulas and tables each year because individual income tax brackets are indexed annually to adjust for inflation.

Under Provisions Of North Carolina’s Biennial Budget Bill Signed By Governor Roy Cooper (D) On November 18, 2021, The State’s Flat Income Tax Rate Was Reduced To 4.99 Percent On January 1, 2022.

The state income tax system in iowa is a progressive tax system. Tax year 2022 income tax brackets are shown in the table below. The tax brackets are the same regardless of your filing status and tax rates range from 0.33% to 8.53%.

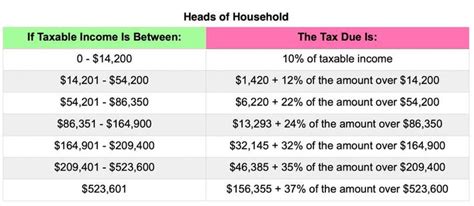

2022 Tax Brackets And Rates In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

10 percent, 12 percent, 22 percent, 24. The tax year 2022 individual income tax standard deductions are: [38] this is the first of six incremental reductions that will ultimately reduce the rate to 3.99 percent by tax year 2027.

$95.87+4.14 Percent For Taxable Income Between $6,972 And $15,687.

Iowa tax brackets for tax year 2021. Employers can find the new iowa 2022 withholding formulas and tables online. 2022 iowa tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Compare Your Take Home After Tax And Estimate Your Tax Return Online, Great For Single Filers, Married Filing Jointly, Head Of Household And Widower

The iowa department of revenue has finalized individual income tax brackets and individual income tax standard deduction amounts for the 2022 tax year (applicable for taxes due in 2023) and the 2022 interest rate, which the agency charges for overdue payments. As you can see your income in iowa is taxed at different rates within the given tax brackets. 2022 iowa individual income tax standard deductions