2022 Tax Brackets Long Term Capital Gains. Tax brackets for 2022 there are seven federal tax brackets for the 2022 tax year: Capital gains tax rules can be different for home sales.

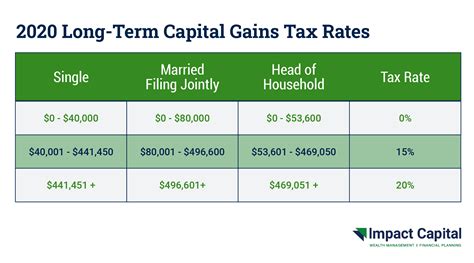

In 2021, the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. 2022 capital gains tax brackets for unmarried individuals, taxable income over for married individuals filing joint returns, taxable income over for heads of households, taxable income over; In 2022, the first $16,000 of gifts to any person are excluded from tax, up from $15,000.

10%, 12%, 22%, 24%, 32%, 35% And 37%.

According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. 2022 0% capital gains tax. Capital gains tax would be increased to 28.8 percent by house democrats.

This Tax Applies To The Profit, Not The Gross Income From The Asset.

If you sell stocks, mutual funds or other capital assets that you held for at least one year, any gain from the sale is taxed at either a 0%, 15%. 2022 capital gains tax brackets for unmarried individuals, taxable income over for married individuals filing joint returns, taxable income over for heads of households, taxable income over; How much these gains are taxed depends a lot on how long you held the asset before selling.

According To A House Ways And Means Committee Staffer, Taxpayers Who Earn More Than $400,000 (Single), $425,000 (Head Of Household), Or $450,000 (Married Joint) Will Be Subject To The Highest Federal Tax Rate Beginning In 2022.

That’s a lot better, but still almost a quarter of your gain. Tax brackets for 2022 there are seven federal tax brackets for the 2022 tax year: 2022 annual exclusion for gifts.

Capital Gains Tax Rates For 2022.

The refundable portion of the child tax credit is adjusted for inflation and will increase from $1,400 to $1,500 for 2022. Don’t be afraid of going into the next tax bracket. In 2022, the first $16,000 of gifts to any person are excluded from tax, up from $15,000.

For Single Tax Filers, You Can Benefit From The Zero Percent.

Capital gains tax will be raised to 28.8 percent, according to house democrats. Here's what those brackets will look like in 2022. In 2021, the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year.