2022 Tax Brackets Married Filing Jointly Vs 2022. The maximum deduction is reduced at $68,000 in 2022 (up from $66,000 in 2021) and is completely eliminated at $78,000 or more (up from $76,000). Tax brackets for income earned in 2022.

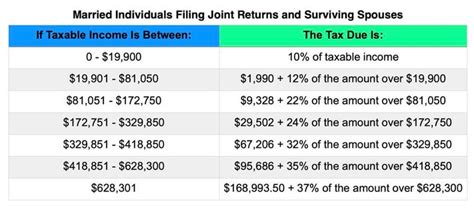

In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. 32% for incomes over $170,050 ($340,100 for married couples filing jointly); The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

When It Comes To Calculating How Much You Owe In Taxes For These Gains, A Lot Depends On How Long You Were Holding The.

The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. The irs isn't changing the percentages people will pay 10% for incomes of $10,275 or less ($20,550 for married couples filing jointly, $14,650 for heads of household). The amount for heads of household is $55,800.

You Can See Also Tax Rates For The Year 2021 And Tax.

The standard deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Also, the standard deduction will increase in 2022 by $400 to $12,950 for single filer or married but filing separately, by $600 to $19,400 for.

2022 Federal Income Tax Brackets And Rates.

10%, 12%, 22%, 24%, 32%, 35% and 37%. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

10 2022 Announced New Tax Brackets For The 2022 Tax Year.

For instance, a married couple filing a joint return with $100,000 of taxable income in 2022 won't pay $22,000 in tax just because their total taxable income falls within the 22% bracket for joint. For example, the 22% tax bracket for the 2021 tax year goes from $40,526 to $86,375 for single taxpayers, but. 20% tax rate up to $517,200.

The Irs Changes These Tax Brackets From Year To Year To Account For Inflation And Other Changes In Economy.

$25,900 for married couples filing jointly. The 2022 standard deduction amounts are as follows: The standard deduction for 2022 has been raised to: