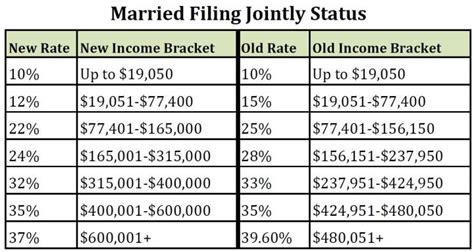

2022 Tax Brackets Married Filing Jointly. Single filers & married couples filing separately. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns.

Irs tax brackets for married couples filing jointly: 2020 tax brackets married filing jointlyshow all. 2022 federal income tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

These Brackets Apply To Your 2022 Tax Filing.

20% tax rate up to $517,200. Single or married filing separately: The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

These Are The 2021 Brackets.

The standard deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income. 37% for incomes over $539,900; The irs also announced that the standard deduction for 2022 was increased to the following:

It’s Broken Into The Four Most Common Filing Statuses:

Single or married filing separately: You can see also tax rates for the year 202 1. Individual single filers, married individuals filing jointly, heads of households, and married individuals filing separately:

$19,400 For Tax Year 2022

2020 tax brackets married filing jointlyshow all. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns. 2022 federal income tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

2022 Tax Brackets (For Taxes Due In April 2023) Announced By The Irs On November 10, 2021, For Individuals, Married Filing Jointly, Married Filing Separately And Head Of Household Are Given Below.

The additional standard deduction for people who have reached age 65 (or who are blind) is $1,400 for each married taxpayer or $1,750 for unmarried taxpayers. 32% for incomes over $170,050 For the tax year 2021, the maximum tax rate for individual single taxpayers with earnings over $523,600 ($628,300 for married couples filing jointly) remains 37 percent.