2022 Tax Brackets Minnesota. For tax year 2022, the state’s individual income tax brackets will change by 3.115 percent from tax year 2021. We last updated minnesota form crp instructions in january 2022 from the minnesota department of revenue.

For tax year 2022, the state’s individual income tax brackets will change by 3.115 percent from tax year 2021. The minnesota estate tax exemption amount has not changed since the amount increased to $3.0 million in 2020. Withholding formula >(minnesota effective 2022)< ;

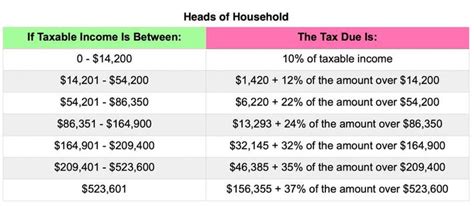

There Are Seven Federal Income Tax Rates In 2022:

The minnesota department of revenue announced the adjusted 2022 individual income tax brackets. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower As of january 1, 2022, the minnesota estate tax exemption amount will remain at $3.0 million.

Under Provisions Of North Carolina’s Biennial Budget Bill Signed By Governor Roy Cooper (D) On November 18, 2021, The State’s Flat Income Tax Rate Was Reduced To 4.99 Percent On January 1, 2022.

Single filers can claim $12,525, and married joint filers can claim $25,050. There are seven federal tax brackets for the 2021 tax year: The minnesota department of revenue announced the adjusted 2022 individual income tax brackets.

Withholding Formula >(Minnesota Effective 2022)< ;

For tax year 2022, the state’s individual income tax brackets will change by 3.115 percent from tax year 2021. Taxable income between $10,275 to $41,775. [38] this is the first of six incremental reductions that will ultimately reduce the rate to 3.99 percent by tax year 2027.

We Last Updated Minnesota Form Crp Instructions In January 2022 From The Minnesota Department Of Revenue.

Taxable income between $41,775 to $89,075. For tax year 2022, the state’s individual income tax brackets will change by 3.115 percent from tax year 2021. This form is for income earned in tax year 2021, with tax returns due in april 2022.

12,450, 53,500, 0, Plus, 5.35%.

The minnesota estate tax exemption amount has not changed since the amount increased to $3.0 million in 2020. Here is a list of our partners and here's how we make money. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).