2022 Tax Brackets Mn. For tax year 2022, the state’s individual income tax brackets will change by 3.115 percent from tax year 2021. Paul — the minnesota department of revenue announced the adjusted 2022 individual income tax brackets.

Those that are filing as. Paul — the minnesota department of revenue announced the adjusted 2022 individual income tax brackets. Taxable income up to $10,275.

There Are Seven Federal Tax Brackets For The 2021 Tax Year:

Your bracket depends on your taxable income and filing status. If you pay estimated taxes, use this information to plan and pay taxes beginning in april 2022. This annual adjustment will prevent taxpayers from paying taxes at a higher rate solely because of inflationary changes in their income.

For Tax Year 2022, The State’s Individual Income Tax Brackets Will Change By 3.115 Percent From Tax Year 2021.

Beginning on january 1, 2022, the standard mileage rates for the use of a vehicle for business purposes is 58.5 cents per mile, 18 cents per mile for medical or moving purposes, and 14 cents. The minnesota department of revenue announced the adjusted 2022 individual income tax brackets. The minnesota estate tax exemption amount has not changed since the amount increased to $3.0 million in 2020.

Taxable Income Between $41,775 To $89,075.

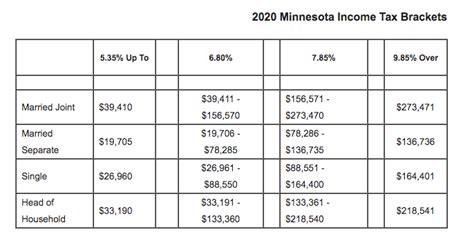

Minnesota tax brackets for tax year 2021 In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Minnesota's 2022 income tax ranges from 5.35% to 9.85%.

For Tax Year 2022, The State’s Individual Income Tax Brackets Will Change By 3.115 Percent From Tax Year 2021.

2022 tax brackets and rates. 2022 minnesota tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. Minnesota uses a graduated scale to assess an estate’s tax liability and its current estate tax rates range from 13% to 16%.

The Minnesota Income Tax Has Four Tax Brackets, With A Maximum Marginal Income Tax Of 9.85% As Of 2022.

The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.minnesota's maximum marginal corporate income tax rate is the 3rd highest in the united states, ranking directly below district of columbia's 9.975%. The bracket adjustment amount starts at $610 for individuals with net income of $84,501 and decreases by $10 for every $100 in additional net income. Taxable income up to $10,275.