2022 Tax Brackets Ny State. If you still need to file a return for a previous tax year, find the new york tax forms below. Also included is an option to increase the top marginal tax rate from 37 percent to 39.6%.

This rate applies to taxable. Calculate your state income tax step by step 6. The new york state basic.

For People Who Pass Away In 2022, The Federal Exemption Amount Will Be $12,060,000.00.

We also updated the new york state and yonkers resident withholding tax tables and methods for 2022. This rate applies to taxable. Corporate franchise tax for tax years beginning on or after january 1, 2021, the new york corporate franchise tax rate increased from 6.5% to 7.25% for companies with a business income tax base of more than $5 million.

If You Want To Simplify Payroll Tax Calculations, You Can Download Ezpaycheck Payroll Software, Which Can Calculate Federal Tax, State Tax, Medicare Tax, Social Security Tax And Other Taxes For You Automatically.

Ny state tax rate brackets 2022. When you die your estate is not subject to the federal estate tax if the value of your estate is less than the “exemption amount” (federally) or the “basic exclusion amount” in new york state. Calculate your state income tax step by step 6.

This Page Has The Latest New York Brackets And Tax Rates, Plus A New York Income Tax Calculator.

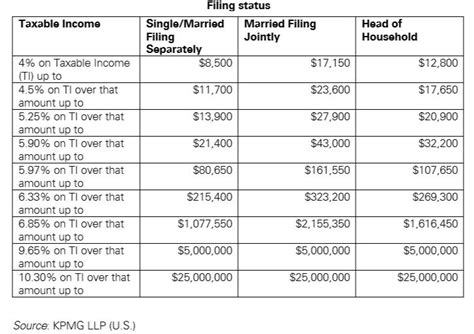

We revised the 2022 new york state personal income tax rate schedules to reflect certain income tax rate reductions enacted under the tax law. The new york state tax tables for 2021 displayed on this page are provided in support of the 2021 us tax calculator and the dedicated 2021 new york state tax calculator.we also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. They have also been revised to reflect certain income tax rate increases enacted under chapter 59 of the laws of 2021 (part a).

The Budget Act Contains Several Key Tax Measures That Cpas Should Be Aware Of;

What is the married filing jointly income tax filing type?. Income tax tables and other tax information is sourced from the new york department of taxation and finance. You can try it free for 30 days, with.

The New York Department Of Revenue Is Responsible For Publishing The.

For federal or irs back taxes access the tax forms here. Learn new york tax rates for income, property, sales tax and more so that you can estimate how much you will pay. 2022 new york tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.