2022 Tax Brackets Roth Ira. 70% chance contributing or converting to a roth ira is the right choice; 30% chance contributing or converting to a roth ira is the right choice;

Backdoor roth ira is one of the most important strategies pitched by whitecoat investor. Retirement calculator roth ira income limits for 2022 roth ira contribution limits for 2022 are based on your annual earnings. > $204,000 but < $214,000.

If Your Magi Falls In The Reduced Contribution Category, You Must Calculate Your Allowed Contribution.

$20,500 if you’re under 50 $27,000 if you’re over 50 your employer could choose to match or not match, and contribute some funds to your 401k if they want. (1) net investment income, or (2) magi in excess of $200,000 for single In 2022, the maximum roth ira contribution limit was $6,000, or $7,000 if at least age 50.

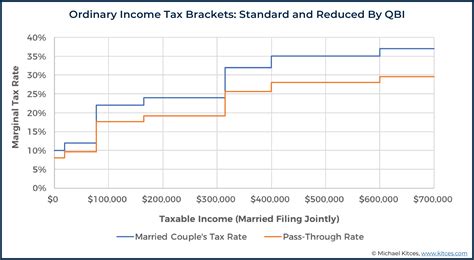

Those Who Earn Over $600,000 Won’t See A Different Tax Rate That Applies To Them.

Any individual taxpayers earning above $400,000 per year, and married couples earning more than $450,000 a year, could not contribute to their savings. The irs limits contributions to $6,000 for individuals under 50 and $7,000 for individuals 50 and over for 2022. 40% chance contributing or converting to a roth ira is the right choice;

If That's Not Enough For You, You Might Have To Pair A Roth Ira With Another Type Of Retirement Account.

70% chance contributing or converting to a roth ira is the right choice; Married filing jointly or qualifying widow (er) < $204,000. 30% chance contributing or converting to a roth ira is the right choice;

New Tax Brackets Effective In 2022

For 2022, the roth ira contribution limit is remains as it was in 2021: There is no change from 2021. 60% chance contributing or converting to a roth ira is the right choice;

Here Are The Tax Rates For The 2022 Taxes, Which You’ll File For The Income Earned In 2021.

You can only contribute up to $6,000 to a roth ira in 2022 or $7,000 if you're 50 or older. Retirement calculator roth ira income limits for 2022 roth ira contribution limits for 2022 are based on your annual earnings. We're seeing a few tax brackets, including: