2022 Tax Brackets Single Irs. In order to keep up with inflation, tax brackets are adjusted. The irs changes these tax brackets from year to year to account for inflation and other changes in economy.

For example, the 10 percent tax bracket applies to income up to $9,950 for single filers in 2021 tax brackets, whereas it was $9,700 for 2020. Updated 2022 irs tax brackets final 2022 tax brackets have now been published by the irs and as expected (and projected) federal tax brackets have expanded, while federal tax rates stayed the same. Tax rate (%) 2022 tax brackets 2021 tax brackets;

This Difference Is Going To Be Higher For The 2022 Tax Season As The Inflation Is Higher And More Visible As The Department Of Labor Announced The Consumer Price Index Is The Highest Since 2008.

The irs also announced that the standard deduction for 2022 was increased to the following: According to the irs, the standard deduction for couples will rise to $25,900 in 2022, up by $800 in 2021. This difference is going to be higher for the 2022 tax season as the inflation is…

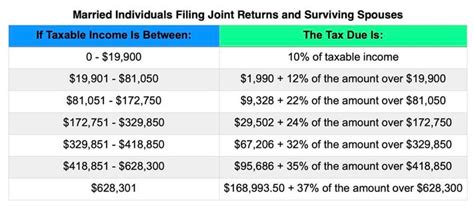

Married Filing Jointly Or Qualifying Widow(Er) Married Filing Separately:

22% tax rate for incomes over $41,775 but not over. Each subsequent portion of your income will have an increased tax rate. The upper thresholds of tax brackets will increase to.

10% Tax Rate For Incomes Less Than $10,275.

The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children. Your bracket depends on your taxable income and filing status. A tax bracket is the rate at which your income is taxed by the government.

The Maximum Earned Income Tax Credit In 2022 For Single And Joint Filers Is $560 If The Filer Has No Children (Table 5).

2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. Updated 2022 irs tax brackets final 2022 tax brackets have now been published by the irs and as expected (and projected) federal tax brackets have expanded, while federal tax rates stayed the same. See the latest tables below.

The Following Tax Brackets Are For Federal Income In 2022.

It's likely this decision will affect you: In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275. Tax rate for single filers for married individuals filing joint returns for heads of households;