2022 Tax Brackets With Dependents. For example, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250. This is the lowest tax bracket for 2021 in canada that is applicable to the income tax deductible of an individual or company.

The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children. November 10, 2021 g.e the irs has released its 2022 tax brackets (a bracketed rate table for the irs federal income tax you can claim an exemption for each dependent, but note that with tax reform the personal…. Dependents who have individual taxpayer identification numbers.

The Other Dependent Tax Credit Is Worth $500 For Each Qualifying Dependent.

Dependents if your total income will be $200,000 or less ($400,000 or less if married filing jointly): For example, if you fall into the 25% tax bracket, a $1,000 deduction saves you $250. This is the lowest tax bracket for 2021 in canada that is applicable to the income tax deductible of an individual or company.

For 2022, Assuming No Changes, Ellen’s Standard Deduction Would Be $14,700.

The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Your bracket depends on your taxable income and filing status.

All Net Unearned Income Over A Threshold Amount Of $2,300 For 2022 Is Taxed Using The Brackets And Rates Of The Child’s Parents 2022 Tax Rate Schedule Standard Deductions & Personal Exemption Filing Status Standard Deduction Personal Exemption Phaseouts Begin At Agi Of:

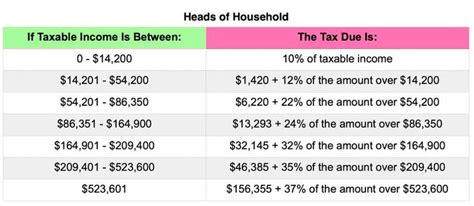

Tax rate for single filers for married individuals filing joint returns for heads of households; The personal income tax system in canada is a progressive tax system. Beginning 2023, however, there will be new income tax rates that are actually lower than those implemented from 2018 to 2022.

Federal Income Tax Brackets And Rates For 2022.

Single $12,950 n/a n/a head of household. Using the chart, you find that the “standard withholding” for a single employee is $176. Review the current 2021 tax brackets and tax rate table breakdown.

Taxation On Corporate Income Is A Tax That Corporations Pay.

2021 tax brackets (due april 15, 2022) tax rate single filers married filing jointly* married filing separately head of household; Federal tax rates range from 15% to 33%. Belgium income tax brackets and other information.