2022 Tax Brackets Zimbabwe. Amendment to the definition of “tax invoice” and “fiscal tax invoice”. The zimbabwe revenue authority ( zimra) has released the 2022 pay as you earn (paye) tax tables for those who are earning in usd and in local currency.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The tax tables, by the way, were also changed effective january 1, 2022 with the minimum taxable amounts being increased to zwl300 000 per year (zwl25 000 per month) or us$1 200 per year (us$100 per month). The irs changes these tax brackets from year to year to account for inflation and other changes in economy.

Follow These Simple Steps To Calculate Your Salary After Tax In Zimbabwe Using The Zimbabwe Salary Calculator 2022 Which Is Updated With The 2022/23 Tax Tables.

February 7, 2022, 2:35 am pst. Increase excise tax to 25% (from 20%) on cigarettes; Amendment to the definition of “tax invoice” and “fiscal tax invoice”.

Business, Rents) Is Taxed At The Corporate Rate Of Tax (Currently 24%).

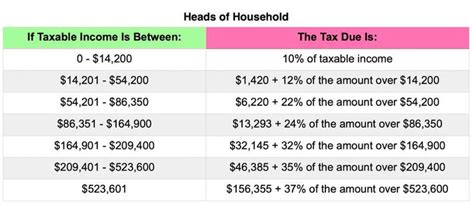

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. These are the rates for taxes due in april 2023. Your specific bracket depends on your taxable income and filing status.

Personal Income Tax Rate In Zimbabwe Is Expected To Reach 50.00 Percent By The End Of 2020, According To Trading Economics Global Macro Models And.

10,452 + 40% for each usd above 36,000. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275. The finance bill after the 2022 zimbabwe national budget was announced, was passed into law on december 31, 2021 and the new finance act brought about a number of changes including those on withholding taxes.

Zimbabwe Residents Income Tax Tables In 2022:

There are seven federal tax brackets for the 2022 tax year: Because of this change, it is possible you could be in a different tax bracket for 2022, even if your income has remained the same. The zimbabwe revenue authority ( zimra) has released the 2022 pay as you earn (paye) tax tables for those who are earning in usd and in local currency.

The Tax Rates Will Range From Nil If One Earns Less Than The Amounts Stated Above Up To 40% For Those In The Highest Tax Bracket.

10 percent, 12 percent, 22 percent, 24. Enter your salary and the zimbabwe salary calculator will automatically produce a salary after tax. The seven 2021 tax rates remain the same for the 2022 tax year, but the tax bracket ranges were adjusted due to inflation.