2022 Tax Table Philippines. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3% and 12.3%. For household employers and household service workers, the minimum and maximum total monthly contributions are php 140 and php 3,280, respectively.

Paying p152,500 income tax on p1 million annual salary, this taxpayer is paying an effective income tax rate of 15.25%, lower than the 19% effective income tax rate during the implementation of train in 2018 to 2022. Here are the current exemptions before the implementation of the tax reform: A tax withheld calculator that calculates the correct amount of tax to withhold is also available.

Interest From Currency Deposits, Trust Funds And Deposit Substitutes:

Taxes withheld by employer of husband at php 118,000 and by employer of wife at nil. Philippines residents income tax tables in 2021: Income tax rates and thresholds (annual) tax rate taxable income threshold;

₱2,400 Per Year Or ₱200 Per Month Worth Of Premium Payments On Health And/Or Hospitalization.

Sss contribution table for household employers and workers. Capital gains derived by foreign corporations from the sale of shares of stock not traded on the philippine stock exchange are subject to a flat tax rate of 15% (previously 5% on the first us$2,000 and 10% in excess thereof). How to use bir tax calculator 2022.

The Financial Year For Tax Purposes For Individuals Starts On 1St July And Ends On 30 June Of The Following Year.

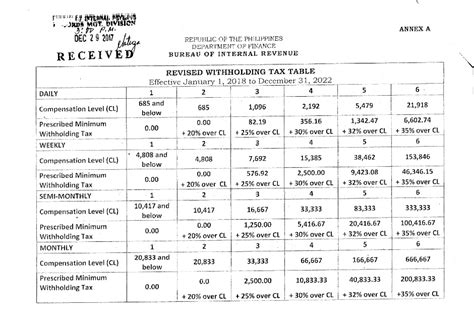

The revised withholding table takes into consideration the new individual income tax rates in the train law as well as the repeal of the personal and additional exemptions for purposes of computing the. Under the revised withholding tax table issued by the bureau, employees who are earning p685 per day or p20,833 per month will be exempted from withholding tax. The pay of sg 1 workers will increase to php 12,034 in 2021, php 12,517 in 2022, and php 13,000 in 2023.

The 2022 Financial Year Starts On 1 July 2021 And Ends On 30 June 2022.

Here are the current exemptions before the implementation of the tax reform: The mcit is imposed beginning on the fourth taxable year following the taxable year the corporation commenced its. Here are the rates and brackets for the 2021 tax year, which you'll file.

Tax Rates For Income Subject To Final Tax.

Refer to the bir’s graduated tax table above to find the applicable tax rate. ₱25,000 worth per qualified dependent child. If you don’t fully understand the table above, we have made a simplified revised withholding tax table of bir.