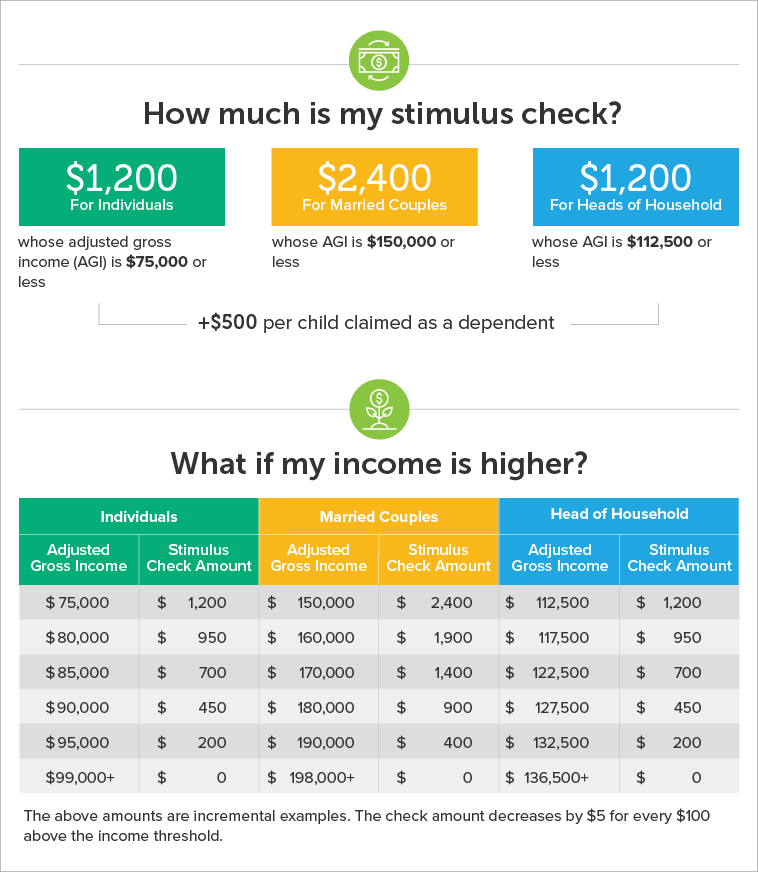

The income limits to get a full check are $75,000 for single filers and $150,000 for married joint filers. $1,400 per person ($2,800 per couple) $1,400 per dependent (over age 17) example:

Second Stimulus Check Check Whether you are Eligible for

An individual must have a social security number (ssn) valid for employment to receive a payment.

3rd stimulus check income limit for married couple. The american rescue plan was signed into law on march 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of americans. $2,800 for qualifying couples who file a joint tax return. This 3rd round of stimulus checks will include:

A married couple with three children earning $110,000 per year would receive $7,000. A third round of $1,400 checks would allow 22.6 million adults to pay their expenses for more. Up to $1,400 for qualifying individuals.

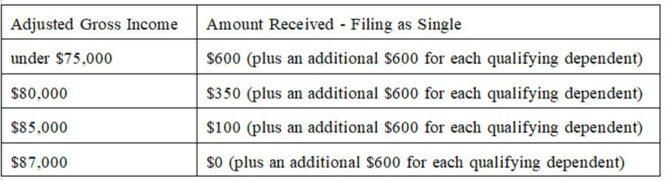

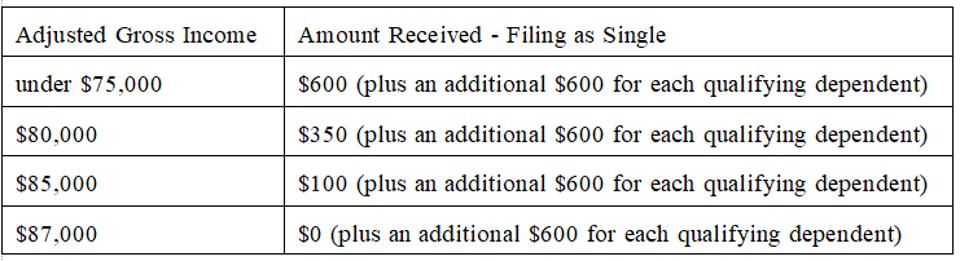

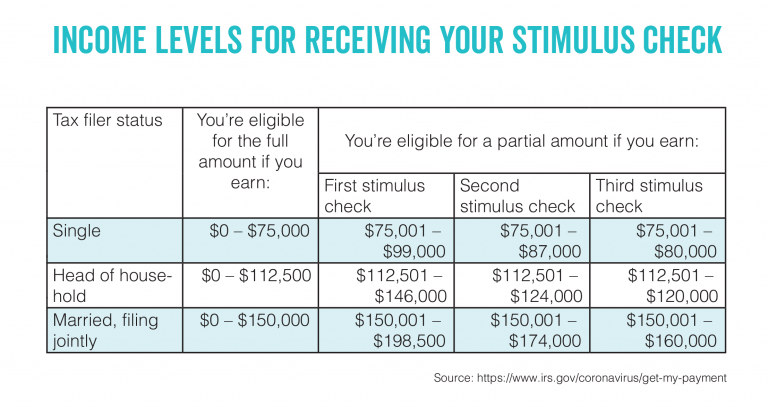

This amount is intended to top off the december $600 stimulus. Anyone with an adjusted gross income (agi) under $75,000 and married couples earning under $150,000 will receive the full $1,400 or $2,800 payment, respectively. Income limits for stimulus checks.

$120,000 for taxpayers filing as head of household That applies to anyone whose reported adjusted gross income for tax years 2018 or 2019 was at least: The legislation provides a third stimulus check that amounts to $1,400 for a single taxpayer, or $2,800 for a married couple that files jointly, plus $1,400 per dependent.

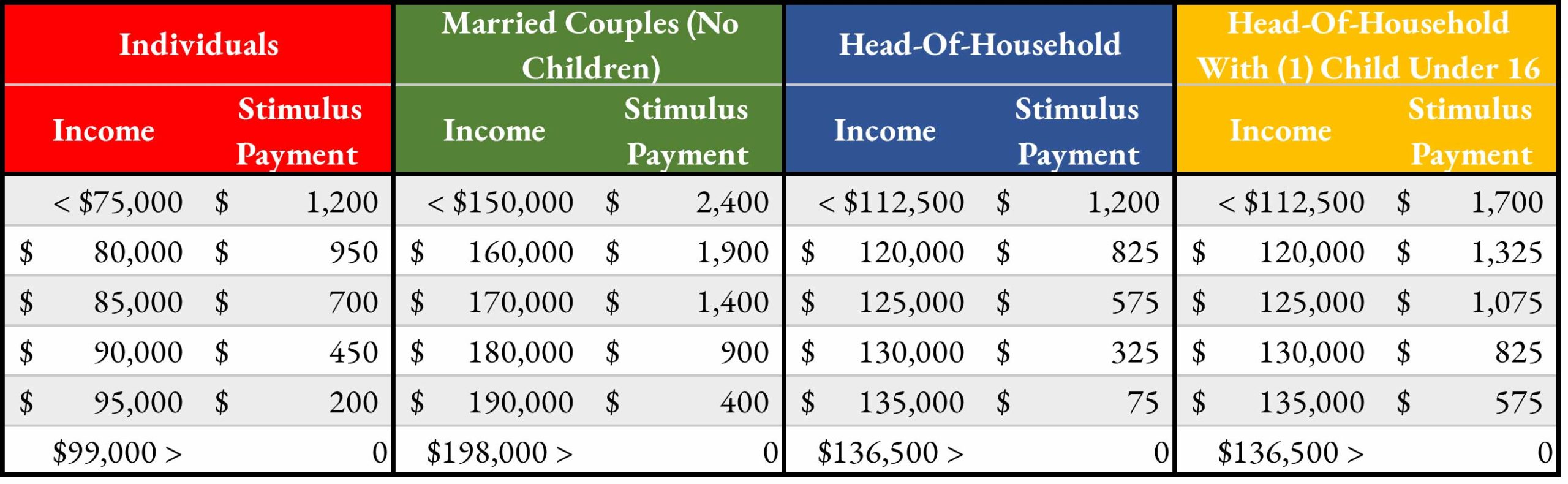

The full amount goes to individuals earning less than $75,000 of adjusted gross income, heads of households (like single parents) earning less than $112,500 and married couples earning less than. Income is $75,000 or below and they file as single; After those limits, there are very.

Income is $150,000 or below and they file as married filing jointly; And for those filing as married filing jointly, the threshold is $150,000. This new law provides a third round of stimulus payments of $1,400 for each qualifying tax filer and each qualifying dependent.

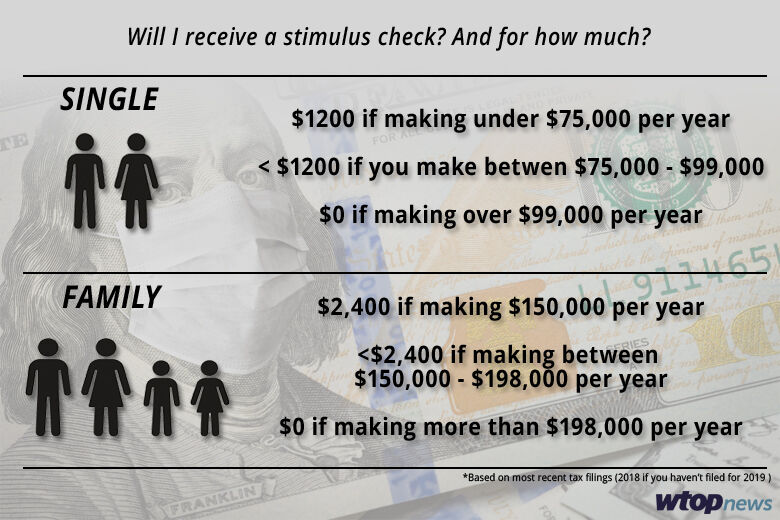

For those filing as head of household, the threshold is $112,500; $1,400 for each child dependent under the. For married couples filing jointly, your combined income must be less than $150,000 per year to earn the $2,400, and if you and your spouse are earning more than $198,000 per year, you won't.

The amount dropped dramatically beyond those income caps, with those receiving $80,000 themselves, or up to $150,000 as a couple, not eligible for any stimulus payments. If either spouse is an active member of the u.s. $136,500 for heads of household.

You are ineligible for stimulus payment if you earn more than the income limit. Income is $150,000 or below and they file as married filing jointly; $99,000 for individuals and married couples filing separately.

How the third stimulus check became law. The full amount goes to individuals earning less than $75,000 of adjusted gross income, heads of households (like single parents) earning less than $112,500 and married couples earning less than. A third round of stimulus checks worth $1,400 has been approved.

Maximum income limits for the third stimulus check were as follows: Armed forces at any time during the taxable year, only one spouse needs to have a valid ssn for the couple to receive up to $2,800 for themselves in the third stimulus payment. Third stimulus check eligibility for couples.

Income is $112,500 or below and they file as heads of households The legislation provides a third stimulus check that amounts to $1,400 for a single taxpayer, or $2,800 for a married couple that files jointly, plus $1,400 per dependent. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

Under the terms of the legislation, individuals were paid $1,400, or $2,800 per married couple, with an additional $1,400 per eligible child. The irs announced on march 12 that the third installment of $1,400 checks was on its way and that most americans would receive the money straight to their bank accounts. The threshold for those filing as single or married filing separately is $75,000;

The first couple of stimulus payments had payments of up to $1,200 and $600, with the income limit kept up to $99,000 for single people, and a sum of $198,000 for married couples. Most of the struggles were experienced by people earning less than $50,000 in annual income, he said. Income is $75,000 or below and they file as single;

Here's how to calculate your stimulus check payment KXLY

STIMULUS CHECK & YOUR BANKRUPTCY FILING Pikunis Law

Third stimulus check Married couples who filed taxes

How the CARES Act Has Helped Investors SmartAsset

FAQs about your stimulus check

3rd stimulus check amount for family of 4 Stimulus Check

3rd stimulus check update Payments will start in March

How much to expect in your coronavirus stimulus check WTOP

Coronavirus Stimulus Payments FAQs Scranton Law Firm

Stimulus Checks For Those Earning More Than 75,000

Here’s who gets a payment under Biden’s 1,400 stimulus

Coronavirus checks Who gets direct cash payments

Will You Get The Third Stimulus Check? Here's How To Know

Third Stimulus Check For Senior Citizens Takeaway For

Stimulus Check Limit Salary ISTIMULUS

Will There Be More Than 3 Stimulus Checks WHCUM

A Guide to Eligibility for the Third Stimulus Payment