Because you're getting what amounts to a refundable tax credit now in the form of a third stimulus payment, rather than waiting to get the money from the credit in 2022 when you actually file your 2021 tax return, you're in effect. Just like the previous rounds of.

Jackson Hewitt, TaxAct Stimulus checks to be deposited

The third stimulus check was actually an advance on a tax credit called the recovery rebate credit, according to jackson hewitt, a tax preparation service.

3rd stimulus check tax. American rescue plan approved in march 2020 permitted most citizens to receive up to $1400 each plus an additional $1400 for dependents as a direct payout. The agency is simply sending out information about the third stimulus checks, which were disbursed in 2021. As i said above the 3rd stimulus payment was an advance for 2021.

2020 unemployment payment tax relief, altered child tax credit, and increased 2021 earned income tax credit (eitc) updates are on the linked page: It is really based on your 2021 tax return. The third round of stimulus checks was delivered to millions of americans throughout 2021, but even so, some may not have received their payment.

They just used the last tax return filed (2019 or 2020) to send out the checks fast. You can use smartasset’s tax return calculator to figure out your 2021 tax refund or tax bill. Unhoused people may not have access to stimulus checks — here’s how they can get it you might need to be careful on your 2021 tax returns when you file in 2022, though.

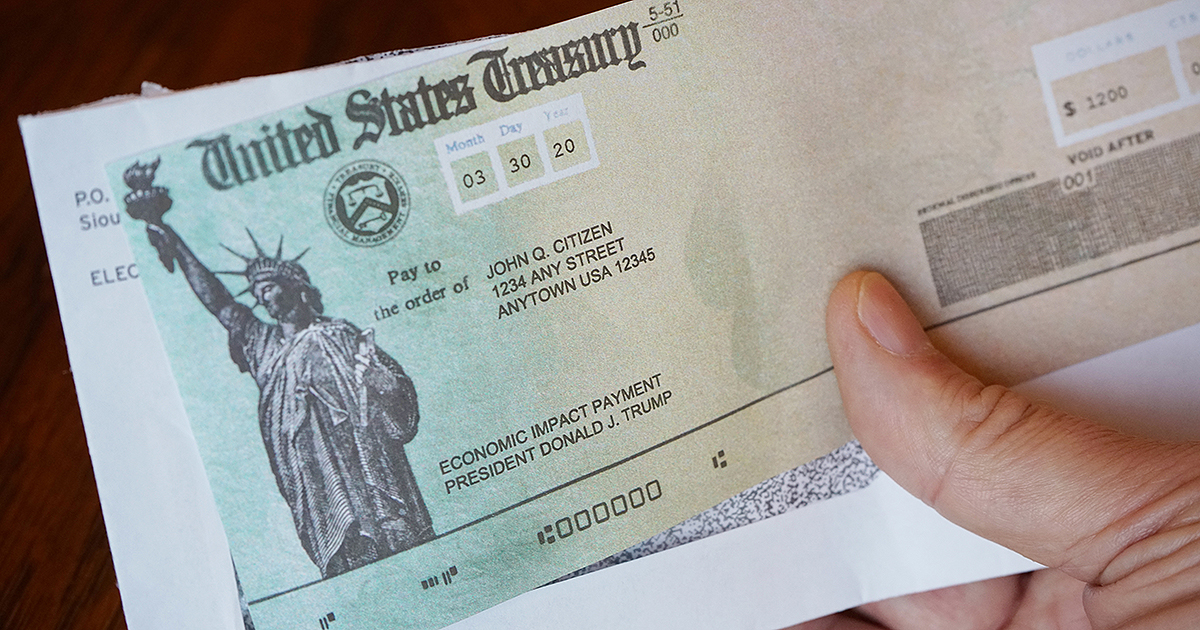

When you get one, don’t. Everything you need to know about the third stimulus check. Since babies born in 2021 were not factored in, the $1,400 checks will be applied to their parent or guardian's 2021 tax return.

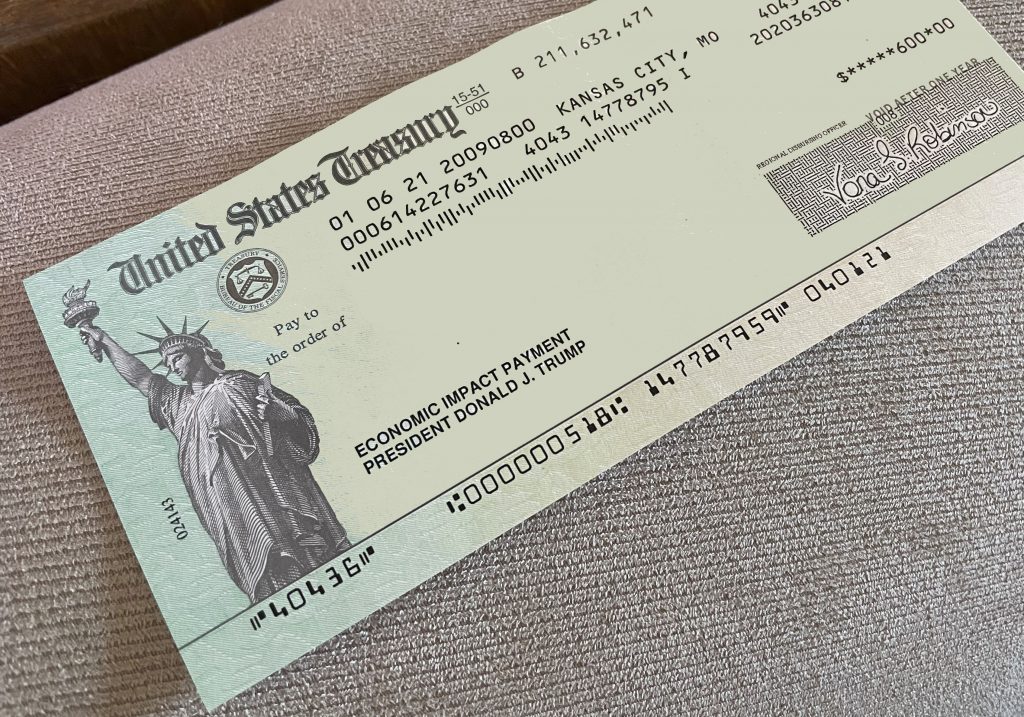

Most people will receive the third stimulus check even if they haven't filed a 2020 tax return. Hence, the irs recommends claiming it as recovery. Your third stimulus payment will be protected from outstanding tax debt and child support, but not from private debts, such as debt accrued due to a civil judgment, ranging from civil damages to.

The government is treating the stimulus checks like advanced tax credits, so you do not need to pay income tax on them. You can check on the status of your third stimulus check by visiting the irs get my payment tool, available in english and spanish. You will not need to pay the government back for your third stimulus check.

The letters are slated to start being mailed in late january. The american rescue plan included up to $1,400 in stimulus payments for each eligible taxpayer, plus an additional $1,400 per dependent. We know how important this money is to you, and we’re here to help.

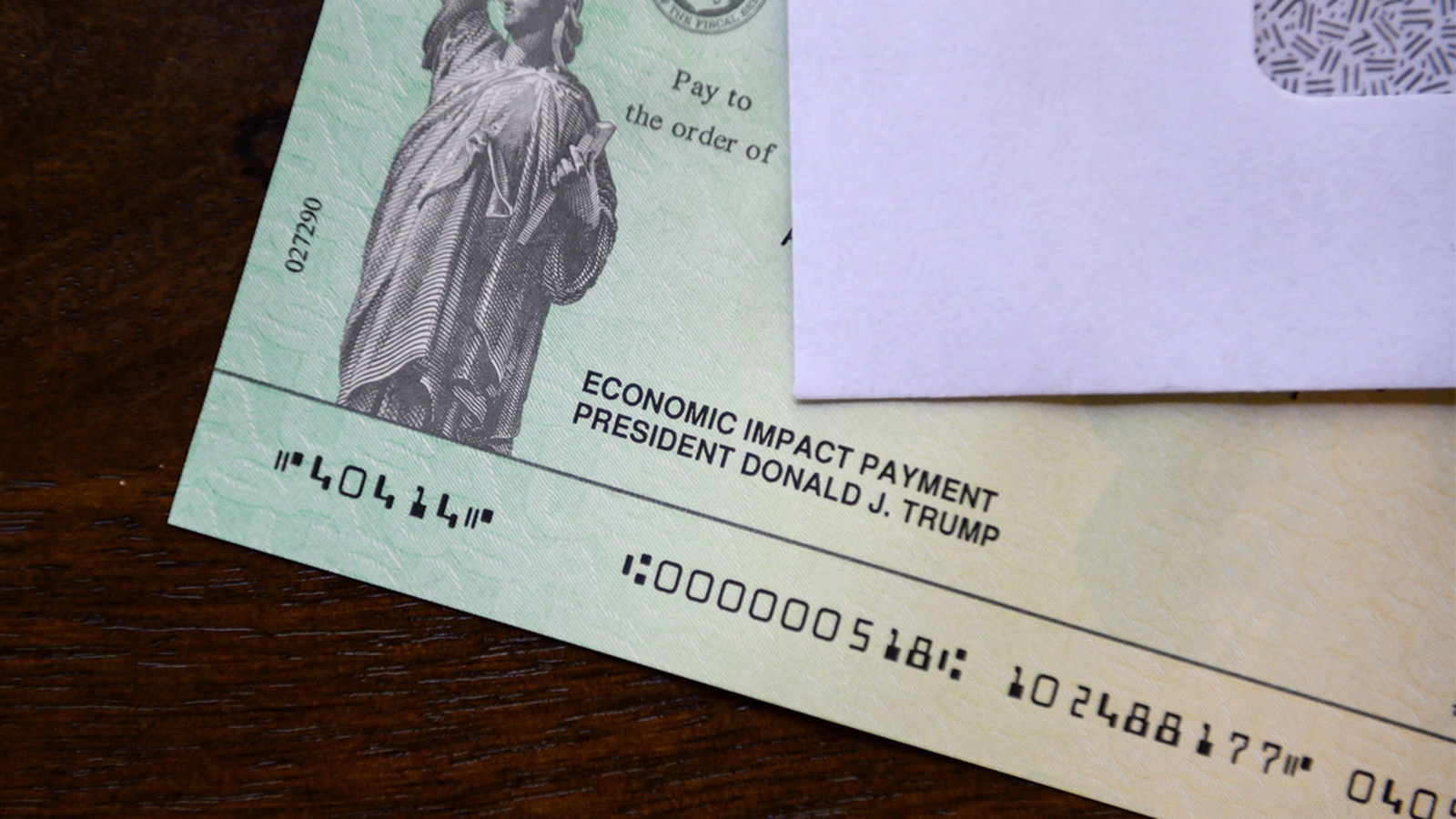

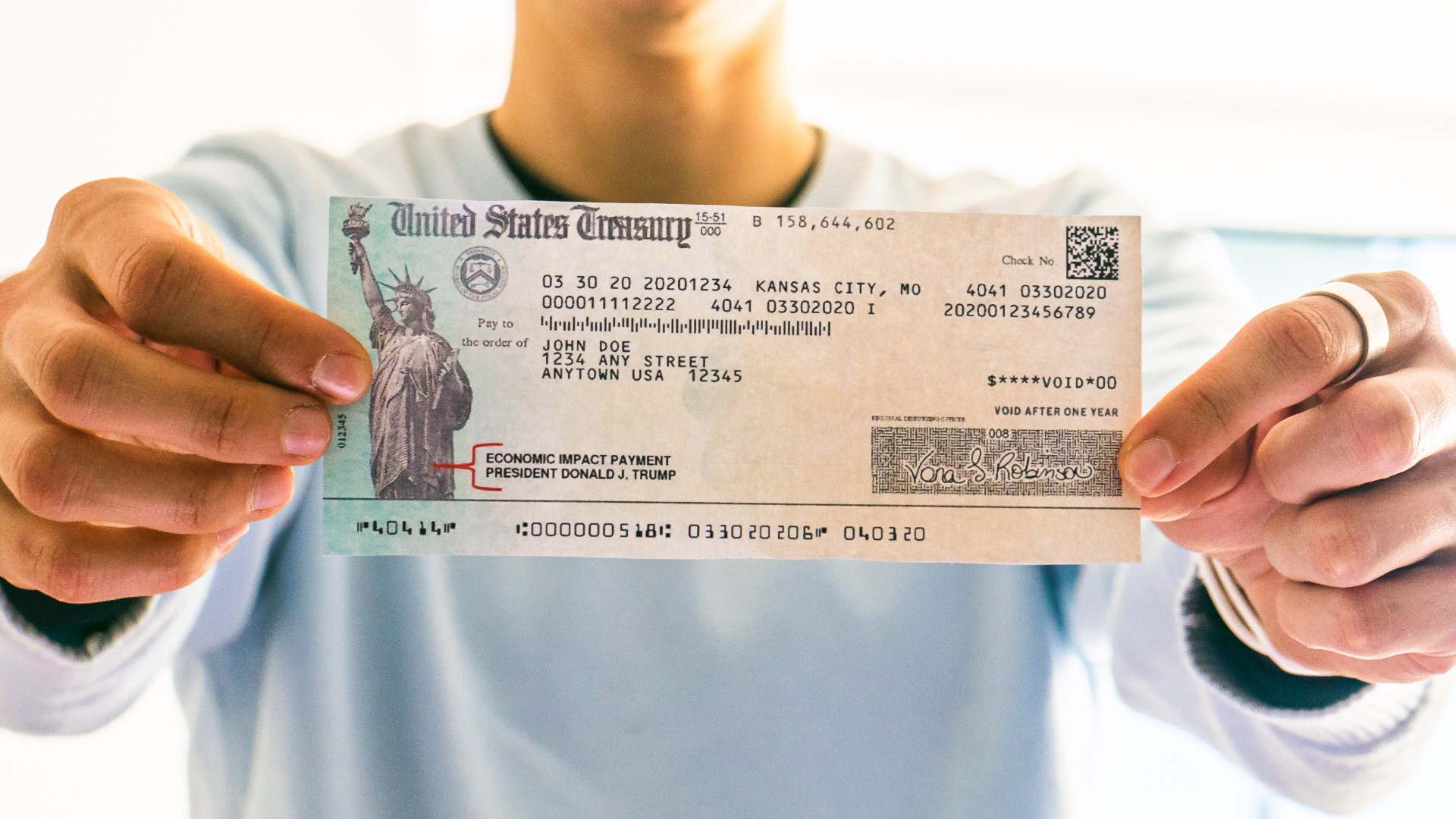

The american rescue plan was signed into law on march 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of americans. If you are missing your third stimulus check, file your 2020 tax return or use getctc.org (available until november 15, 2021) if you don’t have a filing requirement. Sent out as part of president biden’s $1.9tn american rescue plan.

The irs will automatically send your payment. If the irs uses his 2019 tax return to process his third stimulus check, harold will get a $2,800 stimulus payment. According to the irs, “while you are not required to report the third payment on your 2021 return, you.

The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for each qualifying dependent. You do need to report your third stimulus check to the irs when you file your taxes. 13 states won’t let you claim biden’s $10,200 unemployment tax break find:

Americans have until 15 april, 2021 to file their tax return for their income in 2020 with the internal revenue service (irs). Most people will receive the third stimulus check even if they haven't filed a 2020 tax return. Targeted income limits, however, exclude individuals earning over.

Since he won't get the extra amount for a dependent, his payment will drop to. If your situation changed dramatically between. The irs says the recovery rebate credit is intended for people who missed the stimulus payment or didn’t receive the full amount they’re eligible for.

How the third stimulus check became law. For example, if you owed $1,000 in taxes but had a refundable tax credit of $1,200, you'd get a $200 tax refund check from uncle sam. Eligibility for the third round of stimulus checks, issued earlier this year as part of president joe biden's american rescue plan, was based on a family's last tax return filed.

The amount of your third stimulus check is based on your 2019 or 2020 taxes, whichever the irs has on file at the time it determines your payment. If you qualify for it based on your 2021 return it will be added to your refund or reduce a tax due. The irs will send two letters to taxpayers in 2022 who were qualified for either the third stimulus check or the monthly advance child tax credit in 2020.

Until the end of january, they’ll be here.

The Third Stimulus Check For SSI And SSDI Making The Cut

Already got a third stimulus check? The IRS may now have

Second stimulus check update If you received notice that

Any News On Our Second Stimulus Check NEWCROD

Your Third Stimulus Check Could Be Much Bigger If You File

Third Stimulus Check and Your Taxes How Lost Works

Third Stimulus Check Why Some People Should File Their

3rd Stimulus check Tax filing impact, the child tax

Third stimulus checks Are 2,000 checks still possible in

Stimulus check 2021 What to do if you must file a tax return

3rd stimulus checks Social Security recipients could see

Third Stimulus Checks IRS Tax Return, Amount and More

Third stimulus check Get My Payment tool for Social

Third stimulus check update IRS sent 307 million COVID

Third stimulus check update Get more stimulus money by

Third stimulus check update today Should you file your

How To Get Stimulus Check As A Dependent 2021 Stimulus