BEIJING, Jan 31 (Reuters) – Revenues at China’s commercial companies dropped 4% in 2022 from a year previously, main information revealed on Tuesday, pressed by the influence of stringent COVID-19 visuals, however a predicted financial healing this year is most likely to revitalize the industry’s sales as well as revenues.

The portion decrease for the complete year was much deeper than the 3.6% autumn videotaped in the initial 11 months, the National Bureau of Data (NBS) information revealed, suggesting an inadequate end to the year.

The 8.4 trillion yuan ($ 1.24 trillion) decline in earnings in 2022 adhered to a 34.3% increase in 2021.

Regular as well as prevalent COVID disturbances struck manufacturing at commercial companies, injuring both supply as well as need sides as well as placing substantial higher stress on prices, claimed Bruce Pain, primary financial expert at Jones Lang Lasalle.

Financial experts anticipate financial task to normalise this year, sustained by a recuperation in intake as well as traveling, though some claimed decreasing international need might trigger the production industry to underperform.

” Lots of export-oriented manufacturing facilities either shut previously or returned to manufacturing behind regular this year,” economic experts at Barclays claimed in a customer note, describing manufacturing facility closures for the Lunar New Year vacation that this year dropped in January.

In 2022, earnings at international companies sagged 9.5%, while those at private-sector companies diminished 7.2%, NBS information revealed.

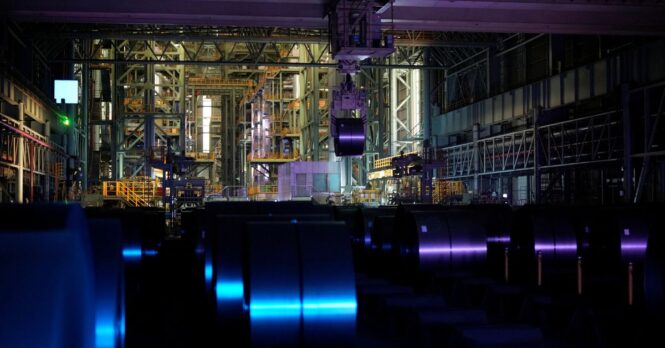

Revenues succumbed to 19 of 41 significant commercial markets in 2014, with the ferrous steels smelting as well as pushing sector reporting the sharpest decrease at 91.3%.

Production industry earnings were down 13.4% as rigid COVID lockdowns as well as visuals interfered with logistics as well as manufacturing at significant production centers in 2014.

Commercial earnings information covers companies with yearly profits over 20 million yuan from their major procedures.

Commercial result in December was 1.3% more than in the very same month a year previously, versus 2.2% gain in November.

Production task was struck in December by the widespread spread of COVID that maintained employees inside your home after the federal government dumped a few of the globe’s most difficult pandemic controls early that month.

The NBS did not report an earnings number for December alone.

Nevertheless, the main production getting supervisors’ index revealed manufacturing facility task recoiled in January, sustained by the easing of the most up to date wave of COVID infections.

Manufacturing facility proprietors aspire to proceed with what they anticipate to be a progressive healing for their industry, that makes virtually a 3rd of the globe’s produced items as well as is a development engine of the globe’s second-largest economic climate.

At a conference chaired by Premier Li Keqiang, the closet on Saturday claimed China ought to intend to aid its economic climate get in very early 2023, concentrating on intake healing as a significant motorist.

China’s financial development in 2022 slowed down to among its weakest prices in almost 50 years as the economic climate was struck hard by stringent COVID visuals as well as a building market depression.

Responsibilities at commercial companies increased 8.6% in 2022 from a year previously, compared to 9.0% development since end-November.

($ 1 = 6.7548 Chinese yuan)

Coverage by Ellen Zhang, Ella Cao as well as Ryan Woo; Modifying by Bradley Perrett, Christopher Cushing as well as Jamie Freed

Our Requirements: The Thomson Reuters Trust Fund Concepts.