How To Get Tax Refund In The Philippines. Through the electronic filing and payment system (efps), electronic bir forms (ebirforms), and manual filing. Employees may receive their income tax refund through the following:

You don’t need to go to the bir to follow up on this. Excess tax paid can be refunded to you by crediting your bank account with ecs transfer. Through the electronic filing and payment system (efps), electronic bir forms (ebirforms), and manual filing.

Base On Our Sample Computation, If You Are Earning ₱25,000/Month, Your Taxable Income Would Be ₱23,400.

As per pd 1183, the travel tax is paid by people leaving the country. P800 and total tax refund amount: This usually occurs if the employee was hired in the middle of the year with no previous employer and the resulting annual gross income is less than the taxable ceiling of 250,000.00.

The Withholding And Remittance Must Be Erroneous.

You don’t need to go to the bir to follow up on this. Present passport and documents to the travel tax officer and a spa if the claimant is not a passenger. Manual filing involves personally submitting your accomplished itr.

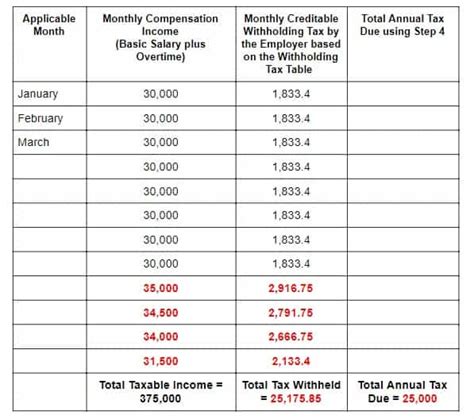

General Formula For Computing Annual Income Tax Refunds:

There are three ways to pay taxes and file itr for taxpayers in the philippines: If not, then you still owe the government some tax. How to claim tax refund in philippines for income tax.

Filipinos Are Known To The World As Resilient And Extremely Hardworking People.

Here’s how to get a philippine travel tax refund on your flight tickets. However, despite the… read morefilipino workers and tax computations in. If the government finds out that your employer deducted too much from your salary, then your tax return must be returned on or before january 25.

The Administrative And Judicial Claims For Credit Or Refund Must Be Filed Within Two Years From The Date Of Payment Of Tax.

And when you think everything is ok,. How to compute tax refund in the philippines. [email protected] , for flights booked on.