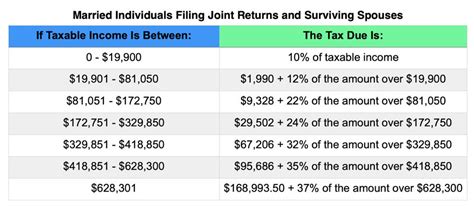

Estimated 2022 Tax Brackets. 10 percent, 12 percent, 22 percent, 24. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.

Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. Irs income tax forms, schedules and publications for tax year 2022: Estimated income tax brackets and rates 2021.

Please Scroll To The Left Or Right On Your Device To View All Information On The Rate Tables.

For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly). 2022 444$ $ 746 $ 564 $ 1,753 2023 498$ $ 771 $ 586 $ 1,855. In most cases, you must make estimated tax payments for tax year 2022 if:

2022 Tax Bracket And Tax Rates.

Inflation,” said jean mccormick, vice president,. Married individuals filling joint returns; Tax brackets and rates for the 2022 tax year, as well as for 2020 and previous years, are elsewhere on this page.

This Table Is For You If You Will Be Filing Taxes That Are Due In April 2022 Or In October 2022 (If You File An Extension).

Underpayment of estimated income tax an addition to tax is imposed by law if at least 90% (662/ 3% if you are a farmer, fisherman or merchant seaman) of your total tax liability is not paid throughout the year by timely withholding and/or installments of estimated tax except in certain situations. Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. All net unearned income over a threshold amount of $2,300 for 2022 is taxed using the brackets and rates of the child’s parents 2022 tax rate schedule standard deductions & personal exemption filing status standard deduction personal exemption phaseouts begin at agi of:

In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower Then taxable rate within that threshold is: 2022 tax brackets for single filers, married couples filing jointly, and heads of households;

In Between, You Can Pay 12 Percent, 22 Percent, 24 Percent, 32 Percent, And 35 Percent Of Your Taxable Earnings In Federal Income Taxes.

The addition to tax does not apply if each 2022 federal income tax rates: Rate for unmarried individuals for married individuals filing joint returns for heads of households;