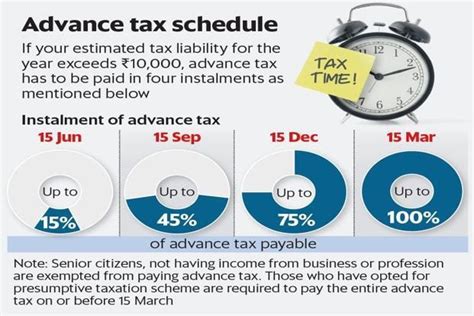

Advance Tax Due Date For Ay 2022-23. At least 45% of tax on total income for the year less advance tax already paid. Hence, the due date of the tax audit report filing is 30 september.

His fourth and final installment of advance tax will fall due on 15th march, 2022. 15% of the advance tax: By 15th march, he should pay 100% of his liability in advance, i.e., rs.

On Or Prior To 15Th Of June:

On or prior to 15th december 75% of the advance tax: Pl send the income tax slab rate for ass. If you’ve never heard of advance tax, you’re not alone.

Refer To Income Tax Act And Rules For Details.

Amount payable as advance tax: May 27, 2021 at 9:53 am. You have to fill challan no/itns 280, which can be done online or through any nearest bank.

Income Tax Audit Date Extended To 15 Feb 2022 And Income Tax Return Date Extended To 15 March 2022.

75,000 as advance tax till 15th december, April 1, 2021 at 11:06 am. By 15th march, he should pay 100% of his liability in advance, i.e., rs.

After The Due Date, Interest Will Be Charged From The Taxpayers.

On or prior to 15th of september 45% of the advance tax: Existing income tax rates are applicable (not opted for provisions of section 115bac). Hence, the due date of the tax audit report filing is 30 september.

“Taxes Are Essentially, Every Society’s Investment In Civilization.

Revised income tax rates are applicable (opted for provisions of section 115bac). 15% of the advance tax: Due date advance tax installment amount 15th june: