American Rescue Plan Act Of 2022 How Much Per Child. •emergency and ordinary regulation amendments were filed to implement the rate increase on july 1, 2021. From january 3, 2022 to december 31, 2022.

Increases the earned income tax credit (eitc) for childless workers by up to $1,000 and expands the minimum and maximum age for claiming the credit. Advance payments were also introduced with monthly payments from. $125 million in funding provided by american rescue plan (arp) act of 2021 for eligible child care programs grant application opens:

The American Rescue Plan Act Of 2021 Raised The Amount Of The Child Tax Credit To $3,000 Per Child, Or $3,600 Per Child Under Age 6.

In 2021, that changed to 3,000 dollars per child between six and 17 years of age, and 3,600 dollars per child aged five or younger. Deadline for students enrolled in ctc eligible fall 2021 classes has been. January 23, 2022 by 6:00pm (est) closed.

Application Opens To International Students January 18, 2022.

$125 million in funding provided by american rescue plan (arp) act of 2021 for eligible child care programs grant application opens: The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of. Grant awards up to $2,000 are available.

This Overview Summarizes Key Areas Described

American rescue plan act of 2021 summary and details. Increases the earned income tax credit (eitc) for childless workers by up to $1,000 and expands the minimum and maximum age for claiming the credit. •emergency and ordinary regulation amendments were filed to implement the rate increase on july 1, 2021.

This Resulted In Just Half The Credit Being Paid Out.

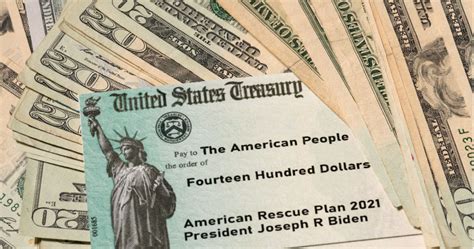

Analysis of the recent covid relief package, including a child tax credit and $1,400 stimulus payments much of the economic relief in the american rescue plan is administered through the tax code in the form of direct payments (stimulus checks) and expanded child tax credit (ctc) in 2021. The credit’s scope has been expanded. •child care providers were able to bill for the increased july rates beginning on august 1, 2021.

This Is Up From The 2020 Child Tax Credit Amount Of $2,000.

The american rescue plan increased the credit to as much as $3,600 per child. Along with the economic impact payments, most parents got extra help from the expansion of the child tax credit. The american rescue plan act authorized the advanced payment of these tax credits at a rate of $250 or $300 per month from july to december.