Can We File Return For Ay 2022-21. The itr can be filed until the last date with paying applicable late fees. January 2022 to march 2022 is 31st may, 2022.

File your taxes today, get maximum benefits and stay ahead. The last date for filing the income tax return is generally on 31 july of the assessment year (ay). Here’s what you need to do now.

As We Are All Aware That The Newly Launched Income Tax Portal Is Facing Many Technical Glitches And The Honourable Finance Minister Had Earlier Asked Infosys To Update The Portal By 15 Th September 2021, An Extension In The Deadline Of Filing Income Tax Returns Was Already.

The itr can be filed until the last date with paying applicable late fees. Nearly 5.89 crore income tax returns for. The due date of filing itr varies depending on the type of taxpayers viz.

By Anshul | Jan 03, 2022, 05:15 Pm Ist (Updated) Mini.

The deadline for filing belated, revised itr is reduced by three months from 31 march of the relevant assessment year to 31 dec of the assessment year. The last date for filing the income tax return is generally on 31 july of the assessment year (ay). The answer to this question is yes.

You Can File Your Tax Return For The Year 2021 Before The Extended Due Date I.e.

January 2022 to march 2022 is 31st may, 2022. Government has extended the date to file the income tax return by 3 months from september 30, 2021 to december 31, 2021. Here’s what you need to do now.

No, You Can Only File Income Tax Return For One Ay In The Current Financial Year.

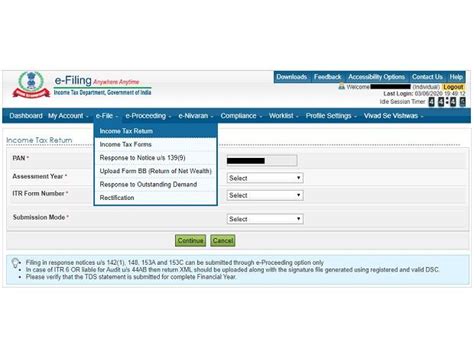

( the cbdt vide circular no. The belated itrs can be filed voluntarily after the normal deadline, up to 31 march of the assessment year. The below infographic would help you choose the correct itr form to.

Under Section 139 (4) A Belated Return Can Be Filed Before The Expiry Of One Year From The End Of Relevant Assessment Year Or Before The Completion Of Assessment Whichever Is Earlier.

File your taxes today, get maximum benefits and stay ahead. Q.18 can i file itr for last 3 years now? And, the rule has also been changed for both the years.