Capital Gains Tax Calculator 2022. You can calculate your annual take home pay based of your annual capital gains tax calculator and gross income. The refundable portion of the child tax credit is adjusted for inflation and will increase from $1,400 to $1,500 for 2022.

Only half of the capital gain from any sale will be taxed based on the marginal tax rate which differs between each province. This means you pay tax on only half the net capital gain on that asset. Capital gains tax would be increased to 28.8 percent by house democrats.

Capital Gains Tax Rate 2022.

Capital gains tax is the tax on the profit you make when you sell or dispose of an asset. Sourced from the australian tax office. The recipient receives a tax bill deduction of 20 percent of the amount transferred

In 2021, The Capital Gains Tax Rates Are Either 0%, 15% Or 20% For Most Assets Held For More Than A Year.

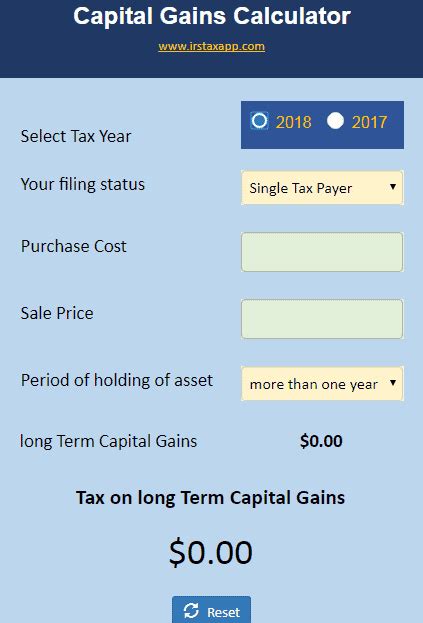

It automatically uses the 2022 federal tax brackets on the capital gains. How much these gains are taxed depends a lot on how long you held the asset before selling. Capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax.

This Means You Pay Tax On Only Half The Net Capital Gain On That Asset.

Only half of the capital gain from any sale will be taxed based on the marginal tax rate which differs between each province. In your case where your capital gains from shares were £20,000 and your total annual earnings were £69,000: How much of these gains is taxed depends a lot on how long you held the asset before selling it.

In 2021, Capital Gains Tax Rates Are Either 0%, 15% Or 20% For Most.

A good capital gains calculator, like ours, takes both federal and state taxation into account. It shows both federal and state taxes. 2022 capital gains tax calculator use this tool to estimate capital gains taxes you may owe after selling an investment property.

Cost Of Obtaining A Valuation Of An Asset For The Purpose Of Calculating A Capital Gain Or Loss Up On Its Disposal.

You pay no cgt on the first £12,300 that you make. In 2021, capital gains tax rates are either 0%, 15% or 20% for most. Gift an asset (give it away) transfer it to someone else;