Child And Dependent Care Credit 2022. M illions of parents have received the child tax credit in 2021, but not many families are aware of the existence of the child and dependent care tax credit. Here's what you need to know published thu, jan 13 2022 9:44 am est updated tue, feb 8 2022 4:05 pm est

Dependent care assistance program (dcap) account holders will see changes for 2022 as well. The expanded child tax credit for 2021 gets a lot of attention, but there’s another big tax change for families this tax season: But to do this you must pay more than half.

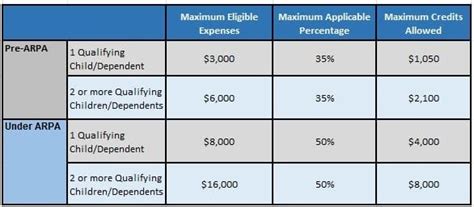

The Effective Increase In The Value Of The Child And Dependent Care Tax Credit Is About 381%.

If you have a spouse, they must also be working or unable to provide care for the dependent at home (for example, if they are on disability). But without intervention from congress, the program will instead revert back to its original form in 2022, which is less generous: Generally, you may not take this credit if your filing status is married filing separately.

The Expanded Child Tax Credit For 2021 Gets A Lot Of Attention, But There’s Another Big Tax Change For Families.

But to do this you must pay more than half. An $8,000 tax credit parents should know about It can involve various things, but the main reason you may want to claim this credit is to cover the cost of child care.

The Child And Dependent Care Tax Credit Was Also Expanded Under The Rescue Act.

The maximum amount of qualifying expenses you can claim is $8,000 if you have one dependent. A child who provides care must be 19 or older by the end of the tax year. Changes to the credit could give families almost four times as much money back.

M Illions Of Parents Have Received The Child Tax Credit In 2021, But Not Many Families Are Aware Of The Existence Of The Child And Dependent Care Tax Credit.

For tax year 2021 (the return you’ll file in 2022), the child and dependent care credit is worth up to 50% of qualified childcare expenses. Prior to 2021, the child tax credit (ctc) was applied to annual tax returns. However, with the passage of arpa, half of the anticipated credit for 2021 was provided in the form of advance monthly payments.

Dependent Care Assistance Program (Dcap) Account Holders Will See Changes For 2022 As Well.

You must have at least one dependent child or adult who cannot provide their own care. The child and dependent care credit is one of several new tax credits available this year when americans file their federal tax return. The child and dependent care tax credit has been increased dramatically.