Child And Dependent Care Credit For 2022. The credit also is available to families that must pay for the care of an incapacitated spouse or an adult dependent. Calculate millie’s child and dependent care credit for 2019 using form 2441.

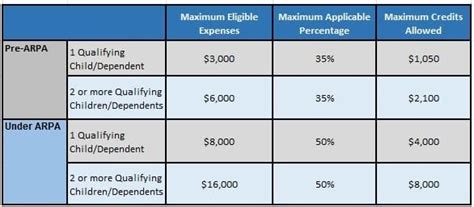

Taxpayers can now claim up to $8,000 in expenses for one child — or up to $16,000 for two or more dependents. Here's what you need to know published thu, jan 13 2022 9:44 am est updated tue, feb 8 2022 4:05 pm est The child and dependent care credit is one of several new tax credits available this year when americans file their federal tax return.

But Without Intervention From Congress, The Program Will Instead Revert Back To Its Original Form In 2022, Which Is Less Generous:

The child and dependent care credit is one of several new tax credits available this year when americans file their federal tax return. Dcap updates the dependent care assistance program (dcap) provides financial relief for workers who need outside care for their dependents. The limit has not been extended for 2022.

There Are Also Maximum Amounts You Must Consider.

You can calculate your credit here. The child and dependent care credit has also been expanded this year, so parents can get up to $8,000 for one child or up to $16,000 for two or more. The child and dependent care tax credit was also expanded under the rescue act.

This Expansion Is Part Of The American Rescue.

Child and dependent care credit: The arpa raised pretax contribution limits for dependent care flexible spending accounts for 2021. That means, for a married couple, each parent can contribute $2,500 to their own dependent care fsa for a total of $5,000.

Your Adjusted Gross Income (Agi) Determines How Much You Can Claim Back.

It can be tricky to calculate exactly how much the tax credit will be worth when it comes time to file your taxes. As of right now, i think it's back to the old rules for 2022. State child and dependent care credit

The Maximum Amount You Can Put Into Your Dependent Care Fsa For 2022 Is $5,000 For Individuals Or Married Couples Filing Jointly, Or $2,500 For A Married Person Filing Separately.

Assume her taxable income is $45,500, and her regular tax is $5,191. For now, this benefit is only available for the 2021 tax year, for which you’ll file your return in 2022. This means the credit can provide money back even if you don’t owe taxes.