Child Care Credit 2022 Income Limit. There is no income limit for claiming the child care credit. The maximum amount you can put into your dependent care fsa for 2022 is $5,000 for individuals or married couples filing jointly, or $2,500 for a married person filing separately.

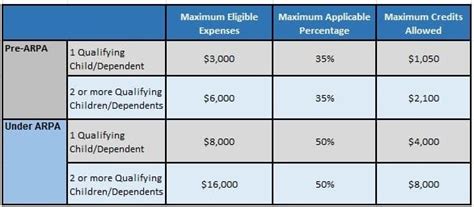

How is the child care credit different for 2021 taxes? In previous years, the maximum amount you could claim was $3,000 for one child or $6,000 for two or more. The child and dependent care tax credit can save families up to $1,200 in 2022 when they hire a nanny or other child care provider.

It’s A Universal Credit That Everyone Can Take Advantage Of.

Tax cuts and jobs act tax deductible medical expenses tax returns health insurance. Once that threshold exceeds that number, the credit percentage rate starts to phase out from 50 percent. For 2021, the child and dependent care credit has the following changes:

There Is No Upper Limit On Income For Claiming The Credit.

How is the child care credit different for 2021 taxes? For the period of july 2021 to june 2022, you could get up to $2,915 ($242.91 per month) for each child who is eligible for the disability tax credit. They earn $150,000 or less per year for a married couple.

You Can Receive Up To $4,000 In Repayment Protection, Which Is $2,000 For Each Excess Qualifying Child, If You Qualify.

The maximum amount you can put into your dependent care fsa for 2022 is $5,000 for individuals or married couples filing jointly, or $2,500 for a married person filing separately. For example, if your income is $10,000, your ontario child care tax credit rate will be 75%. This is up from $19,500 in 2021.

Child Care Credit Income Limit.

Making the credit fully refundable; In previous years, the maximum amount you could claim was $3,000 for one child or $6,000 for two or more. While the monthly advance payments ended in december, the 2022 tax season will deliver the rest of the child tax credit money to eligible parents with their 2021 tax refunds.

For Tax Year 2020, The Maximum Amount Of Care Expenses You're Allowed To Claim Is $3,000 For One Person, Or.

When you file your tax return in 2022, you will get to claim up to $3,600 in child tax credit. There is no income limit for claiming the child care credit. The new child tax credit will go into effect for the 2021 taxes.