Child Care Credit For 2022. Families begin the new year without child tax credit payments. Samantha fields jan 14, 2022.

The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school. The expanded child tax credit for 2021 gets a lot of attention, but there's another big tax change for families this tax season: Distributing families’ eligible credit through monthly checks for all of 2022.

The 2021 Credit Gives Eligible Families $3,600 Per Child Under Age Six, And $3,000 Per Child Ages Six To 17.

Many families are already receiving half their credit in. How do i claim the child care tax credit on my 2022 taxes and what can i expect to save? The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school.

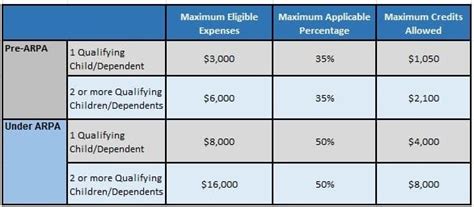

For Your 2021 Tax Return, The Cap On Expenses Eligible For The Child And Dependent Care Tax Credit Is $8,000 For One Child (Up From $3,000) Or $16,000 (Up From $6,000) For Two Or More.

Child care tax credit has been increased to $16,000. Once that threshold exceeds that number, the credit percentage rate starts to phase out from 50 percent. Families can now claim up to 50 percent of qualifying expenses, up from 35 percent previously.

The Size Of The Credit Will Be Cut In 2022, With Full Payments Only Going To Families That Earned Enough Income To Owe Taxes, A Policy Choice That.

Millions of parents have received the child tax credit in 2021, but not many families are aware of the existence of the child and dependent care. One of the most difficult financial burdens when you have young children, is paying for dependent care, but some good news is that there are some relief options when it comes time. Making the credit fully refundable.

Tax Cuts And Jobs Act Tax Deductible Medical Expenses Tax Returns Health Insurance.

For the first time since july, families are not expected to receive a $300. Samantha fields jan 14, 2022. You will need to file irs form 2441 with your personal federal income tax return in order to claim the child care tax credit.

Parents Can Expect More Money To Come From The Expanded Child Tax Credit This Year.

President biden wants to continue the child tax credit payments in 2022. There would be some differences between the 2021 child tax credit payments and 2022 payments if the current version of the build back better act is enacted into law. The effective increase in the value of the child and dependent care tax credit is about 381%.