Child Care Credit Phase Out 2022. Making the credit fully refundable; However, under the latest version of the build back better act, you could choose to have your 2022 child tax credit phased out based on your 2021 modified agi.

The credit is decreased by 50% for any amount between $125,000 and $183,000, where it is then phased out to 20%. This 20% lasts until the income reaches $400,000. Increasing the maximum credit that households can claim to $3,600 per child age 5 or younger and $3,000 per child ages 6 to 17;

Families Earning More Than $183,000 Are Capped At Taking 20% Of Their Child Care Expenses.

The first half was delivered in monthly payments from july to december with $300 for children under the age of six and $250 for those. This is a tax credit, rather than a tax deduction. You may have claimed the child and dependent care credit on the tax return you filed last year if you.

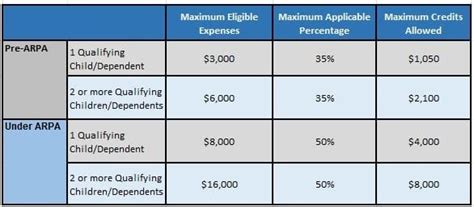

The Expanded Child And Dependent Care Credit Allows Eligible Taxpayers To Claim A Credit Worth Up To $4,000 In Care Expenses Paid For One Qualifying Dependent Or $8,000 For Two Or More Dependents.

The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school. Once that threshold exceeds that number, the credit percentage rate starts to phase out from 50 percent. This expansion is part of the american rescue.

The Expanded Child Tax Credit For 2021 Gets A Lot Of Attention, But There's Another Big Tax Change For Families This Tax Season:

Claimants with one child can receive credits of up to $4,000. Specifically, families with more than one kid who spent $16,000 in qualifying expenses will be able to claim care credits of up to $8,000. Eligible families with an agi of $125,000 or less will.

The Credit Percentage Begins To Phase Out Once Your Adjusted Gross Income Reaches $125,000 And Stops When Your Adjusted Gross Income Is Over $438,000.

Instead of the entire credit being claimed on. Here's what you need to know published thu, jan 13 2022 9:44 am est updated tue, feb 8 2022 4:05 pm est Child and dependent care credit basics for 2020.

The Credit Rate Eventually Completely Phases Out For Families Earning $438,000 Or More.

Benefits of the tax credit. For joint filers, this goes up to $400,000, so most americans won’t need to worry about not getting the maximum amount possible. The child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities.