Child Dependent Care Credit 2022. If you have a spouse, they must also be working or unable to provide care for the dependent at home (for example, if they are on disability). The child and dependent care credit is one of several new tax credits available this year when americans file their federal tax return.

A tax deduction simply reduces the amount of income that you must pay tax on. M illions of parents have received the child tax credit in 2021, but not many families are aware of the existence of the child and dependent care tax credit. The expanded child tax credit for 2021 gets a lot of attention, but there’s another big tax change for families this tax season:

But The Credit Is Completely Phased Out For Families Earning More Than $428,000.

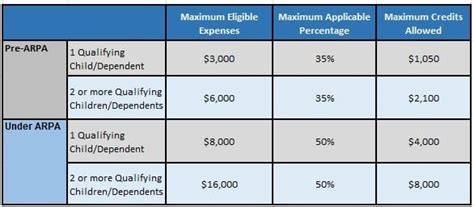

Families can now claim up to 50 percent of qualifying expenses, up from 35 percent previously. They also can’t be claimed as a dependent. The child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities.

But Without Intervention From Congress, The Program Will Instead Revert Back To Its Original Form In 2022, Which Is Less Generous:

Child and dependent care tax credit enhancement act of 2021 Child care credit income limit. This expansion is part of the american rescue.

It’s A Universal Credit That Everyone Can Take Advantage Of.

Child and dependent tax credit increases this year! Individuals or households with earnings up to $125,000 will be able to claim 50 percent of up to $8,000 paid toward having their one child or dependent cared for, so a maximum credit of $4,000. This is a tax credit, rather than a tax deduction.

The Child And Dependent Care Tax Credit Has Been Increased Dramatically.

For families with two or more children, the credit was raised to $16,000 from $6,000. An $8,000 tax credit parents should know about For the 2021 tax year, the child and dependent care tax credit for a family with one child increased from $3,000 to $8,000.

M Illions Of Parents Have Received The Child Tax Credit In 2021, But Not Many Families Are Aware Of The Existence Of The Child And Dependent Care Tax Credit.

Child and dependent care credit: There is no income limit for claiming the child care credit. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school.