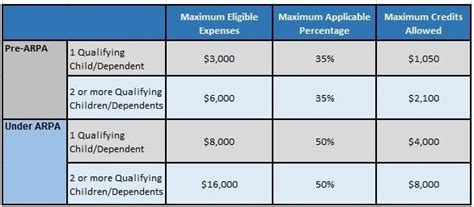

Child Dependent Care Tax Credit 2022. Families can now claim up to 50 percent of qualifying expenses, up from 35 percent previously. However, the amount of it you are receiving in advance will affect your 2021 taxes, as the credit will be reduced.

Once that threshold exceeds that number, the credit percentage rate starts to phase out from 50 percent. You may qualify for a tax credit equal to 20 to 35 percent (in 2020, 50 percent in 2021) of expenses incurred when someone cares for your dependent child (under age 13), your disabled spouse, or your disabled dependent so that you (and your spouse, if married) may work or look for work. Families can now claim up to 50 percent of qualifying expenses, up from 35 percent previously.

If You Don’t Owe Taxes, Any Remaining Tax Credit Will Be Added To Your Tax Refund.

Child care tax credit doubles to $16,000 in 2022; However, the basic starting point is that you get up to $3000 for one dependent and up to $6000 for having multiple dependents in dependent care. The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school.

Remaining Ctc Stimulus Checks May Be Claimed If You Keep This Irs Letter

It can be tricky to calculate exactly how much the tax credit will be worth when it comes time to file your taxes. You do not get that full amount back as a credit, however. But the credit is completely phased out for families earning more than $428,000.

Your Adjusted Gross Income (Agi) Determines How Much You Can Claim Back.

If you're eligible for the child tax credit and didn't receive advance payments, you can receive between $500 and $3,600 per child as credit. Claiming the child and dependent care tax credit. The child care tax credit requires two qualifications that the dependent must fulfill:

How Much You Spend On Care Expenses Won't Affect It.

We’re reviewing the tax provisions of the american rescue plan act of 2021, signed into law on march 11, 2021. Yes, for 2021 taxes (returns filed in 2022), the credit is refundable. As of now, the child tax credit will revert to its original maximum of $2,000 per qualifying dependent for the 2022 tax year.

The Child And Dependent Care Credit Is A Tax Credit That May Help You Pay For The Care Of Eligible Children And Other Dependents (Qualifying Persons).

The child tax credit is $3,000 per child ($3,600 if five or under) starting in 2021. An $8,000 tax credit parents should know about parents will be looking to collect. The child and dependent care tax credit has been increased dramatically.