Child Tax Credit 2022 Head Of Household. How do dependents and the eic affect me? Increased to $9,000 from $6,000 thanks to the american rescue plan ($3,000 for each child over age 6).

The tax code offers a special filing status if you have a dependent and are single or are otherwise not living with a spouse. Tax tables 2022 edition 1 taxable income ($) base amount of tax ($) plus marginal tax rate of the. In order to be eligible for the full amount of the 2021 child tax credit, a filer’s agi had to be less than $75,000 if single, $112,500 as head.

However, If A Family Earns More Than That, The Benefit Begins To Diminish.

This tax filing status commonly includes single parents and divorced or legally separated parents (by the last day of the year) with custody. To be eligible for the child tax credit, married couples. For irs purposes, a head of household is generally an unmarried taxpayer who has dependents and paid for more than half the costs of the home.

1 The Tax Benefits Included In This Table Are The Head Of Household Filing Status, The Earned Income Tax Credit (Eitc), The Child Tax Credit (Ctc), The Additional Child Tax Credit (Actc), The Child And Dependent Care Tax Credit (Cdctc), The American Opportunity Tax Credit (Aotc), The Lifetime Learning Tax Credit (Lltc) And The Other

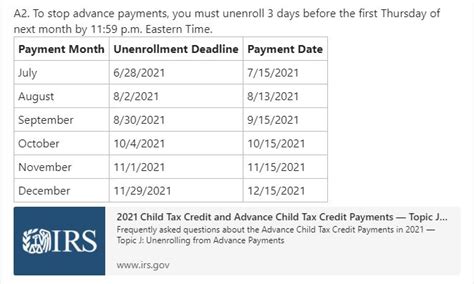

Plus, everything you need to know about child tax credits. Between december 2021 and this january, the irs sent families that received child tax credit payments a letter with the total amount of money they got in 2021. Other household expenses (signature) (date) you must complete the dependent/child tax/education credit worksheet and provide a copy of the divorce/separation/child support agreement.

They Earn $112,500 Or Less For A Family With A Single Parent, Commonly Known As Head Of Household.

How the cola will increase benefits for the average senior couple For children under 6, the ctc is $3,600 with $300 optional monthly advanced payments. In order to be eligible for the full amount of the 2021 child tax credit, a filer’s agi had to be less than $75,000 if single, $112,500 as head.

Around 36 Million Families Received The Final Advance Payment For The Us Child Tax Credit In December.

In addition, the parent who legitimately files as head of household would be eligible for the child tax credit benefit if that parent’s income were under $112,500. For each child under the age of six, you can collect $3,600. What is the 2021 child tax credit?

For Taxes Due In April 2022:

For now, the child tax credit for the 2022 tax year will revert back to its original max of $2,000 per qualifying dependent. When families who did not receive advance payments file their 2021 tax return — that is the return due in april 2022 — they will receive a $3,000 tax. Under the president's plan, your estimated 2022 child tax credit would still generally be based on your most recent tax return.