Company Tax Filing Deadline 2022. You can do the filing by yourself or entrust this task to any person or tax agent who has your company’s corppass accounts. You do, however, still have to file a tax return:

You need to either file your tax return 1120s by this date or request for an extension by filing form 7004 with the irs. 2022 tax filing deadlines and extensions for 2021 tax year. However, april 15, 2022, is emancipation day.

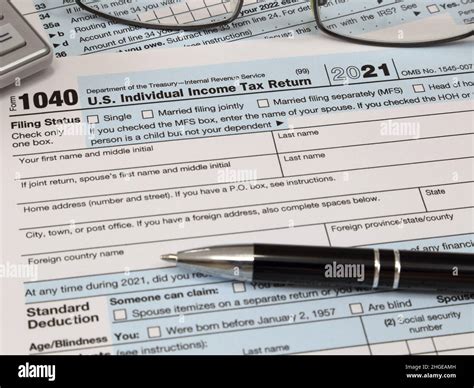

The Filing Deadline To Submit 2021 Tax Returns Or An Extension To File And Pay Tax Owed Is Monday, April 18, 2022, For Most Taxpayers.

The deadline was pushed from april 15 because of emancipation day, which is a holiday in washington, d.c. However, some states have different dates, such as hawaii (april 20), iowa (april 30), maryland (july 15), and oklahoma (june 15). However, april 15, 2022, is emancipation day.

Employed Individuals (Entrepreneurs) Must File A Tax Return.

Individuals, sole proprietors, and c corporations need to file their taxes by this date. What is the business tax deadline for 2022? The deadline is 1 may of the following year if the tax return is filed electronically by the taxpayer or 1 july of the following year if a tax return that is not filed by 1 april is subsequently filed by a tax advisor.

You Need To Either File Your Tax Return 1120S By This Date Or Request For An Extension By Filing Form 7004 With The Irs.

Filing these documents timely helps employers avoid penalties and helps the irs in fraud prevention. With an extension, the deadline for filing is september 15. Please note that irs will only grant an extension if you have timely filed your.

Tips For January 2022 Reported To Employer (Form 4070) February 15.

A 2015 law made it a permanent requirement that employers file copies of. The complete guide to s corporation taxes. File schedule h (1040) and pay employment taxes for household employees (file separately if form 1040 is not filed) april 18 estimated.

• Extended 2021 Us Individual Income Tax Return (1040) • Extended 2021 Report Of Foreign Bank And Financial Accounts:

You can do the filing by yourself or entrust this task to any person or tax agent who has your company’s corppass accounts. If you're filing taxes in maine or massachusetts, where the 18th is a state holiday, you can file taxes on april 19, 2022. For llcs that are taxed as a corporation or single member llcs, the tax deadline is april 15, 2022.