Do Long Term Capital Gains Increase Tax Bracket. Here are a few scenarios below: Your tax bracket for your ordinary income depends only on your ordinary income.

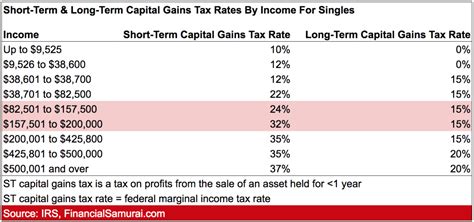

The actual rates didn't change for. So a big capital gain can push. Above that amount, you are now in the 15% ltcg tax bracket and pay 15%.

Also Know, How Do Long Term Capital Gains Affect Your Tax Bracket?

I'm not sure where you are, but in the united states capital gains are taxed at a lower rate than other types of income. Capital gains can also increase your overall tax bill if your agi triggers the 3.8% medicare surtax. Many tax provisions—both at the federal and state level—are adjusted for inflation.

So A Big Capital Gain Can Push.

The changes only apply to tax year 2021. The 2021 tax brackets are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Above that amount, you are now in the 15% ltcg tax bracket and pay 15%.

Do Long Term Capital Gains Increase Your Tax Bracket.

Capital gains will count toward your adjusted gross income for tax purposes. On the 1040, captial gains income is separated from earned income, and income tax is calculated just on earned income. Remember, this isn't for the tax return you file in 2022, but rather, any gains you incur from january 1, 2022 to december 31, 2022.

Tax Rates Generally Increase When Your Income.

But capital gains count as income in determining your tax bracket. Here are a few scenarios below: Capital gains income can bump you up into a higher tax bracket if.

In Its Simplest Form, Yes!

Your tax bracket for your ordinary income depends only on your ordinary income. Your filing status and income tax bracket; The actual rates didn't change for.