Does Stimulus Check Show As Tax Refund. 1933 after i put in the two rounds of stimulus checks totalling $3600, it shows federaltax due: Only the refundable credit on line 30 is changed to reflect the amount of stimulus you indicated you received.

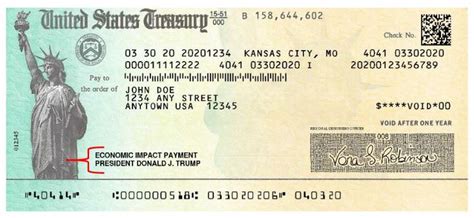

Most, but not all, of those payments have been delivered. Our goal is to create a safe and engaging place for users to connect over interests and passions. You can check the economic impact payment amounts by.

How To Get The Biggest Tax Refund This Year.] Do I Need To Pay Taxes On Stimulus Payments?

Checks are expected to be sent in batches and arrive by december 31, according to as. So if your refund was set to be $1,000, and you're owed another $1,800 from missing stimulus checks, you'll get $2,800 total. Before entering the stimulus amount received, it shows federal refund :

However, The Tax On The Return Is Unchanged As The Stimulus Payment Is Not Taxable On Your Return.

Those checks, no matter how they were spent, are not taxable. No matter how much you received, none of it is included in your gross income and it is not counted as taxable income. If you have not received one or both of your stimulus checks, you will receive your payment in the form of a recovery rebate credit on line 30 of your 2020 federal tax return when you file.

These Are The Ones The Government Will Give You A Refund For, Even If You’ve Hit Net Zero And Don't Owe Anything.

1667 so it is obvious based on this that either a) the money has to be paid back, or b) there is a bug in the online turbo tax program. Watch live raleigh durham fayetteville surrounding area Claiming stimulus check on refund.

This Means When You Prepare Your 2020 Income Tax Return, There Will Be A Line To Include The Section 6428 Credit.

Our goal is to create a safe and engaging place for users to connect over interests and passions. Don't report stimulus checks as income, says jeremiah barlow, head of family wealth services for financial firm mercer advisors. The site states that the stimulus check is not taxble and that it shuld not reduce the amount of refund you receive or increase the amount that you pay in.

He Says If You Tell An Online Tax Program You Did Not Receive A Stimulus Check, It Assumes You Did Not Receive Yours, And Automatically Gives You An Extra $1,200 In Your Refund (Or An Extra $2,400.

The good news is that stimulus money received last year won't increase tax bills this spring. I think tax people have gotten confused and we are paying the differences. The credit on your 2020 return is subtracted by any amount received as a stimulus check in 2020.