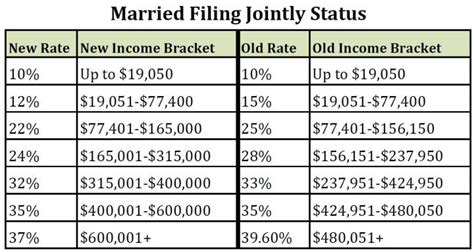

Federal Tax Brackets Married Filing Jointly 2022. 2022 federal income tax rates: Capital gains tax will be raised to 28.8 percent, according to house democrats.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. And since the federal income tax brackets for the 2022 tax year are already available, you can start thinking about how to handle your 2022 finances for instance, a married couple filing a joint return with $100,000 of taxable income in 2022 won't pay $22,000 in tax just because their total taxable… Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns.

Filing Jointly Has Many Tax Benefits, As The Irs And Many States Effectively Double The Width Of Most Mfj Brackets When Compared To The Single Tax Bracket At The Same.

Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. $200,000 for single filers or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately.

For Single Taxpayers And Married Individuals Filing Separately, The Standard Deduction Rises To $12,950 For 2022, Up $400, And For Heads Of Households, The Standard Deduction Will Be $19,400 For Tax Year 2022, Up $600.

In the last 10 years, we have seen a sharp decrease in canadian tax rates. 0% tax rate up to $83,350. 2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households;

For Those Who Were Wondering, This Is Not Some Gift From Congress Or The Irs.

2022 federal tax rate schedule married filing jointly. $12,950 for single taxpayers and married couples filing separately. There are various types of tax brackets 2021 in canada among them can be that of the federal income tax.

15% Tax Rate Up To $517,200

California tax brackets 2022 married filing jointly, irs tax brackets 2022 married filing jointly, tax brackets for. The standard deduction for 2022 has been raised to: That’s because, using marginal tax rates, only a portion of your income is taxed at the 24% rate.

This Is The Lowest Tax Bracket In Canada That Is Applicable To The Taxable Income Of An Individual Or A Company.

Suppose you’re single and had $90,000 of taxable income in 2022. $25,900 for married couples filing jointly. Tax brackets are not the only tax provision changed by the irs's annual inflation adjustments.