Federal Tax Return Estimator 2022. Audit services only available at participating offices. Tax estimator—figure out your taxes for the upcoming tax season.

This tax return and refund estimator is currently based on 2021 tax year tax tables. The tax estimator will give you a head start to your taxes so you can adjust taxes paid or withheld to get the most out of your federal income tax return. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and refundable credits.

There Are Seven Federal Income Tax Rates In 2022:

The tax estimator will give you a head start to your taxes so you can adjust taxes paid or withheld to get the most out of your federal income tax return. The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The provided information does not constitute financial, tax, or legal advice.

Applies To Individual Tax Returns Only.

2021 federal income tax tables, income tax bracket for 2021, 2021 irs tax schedule, irs tax rate schedules 2021, federal 2021 income tax rate table, irs gov tax tables 2021, federal income tax chart 2021. Just answer a few simple questions about your life, income, and expenses, and our free tax calculator will give you an idea if you should expect a refund and how much, or if you’ll owe the irs when you file taxes in 2021. In most cases, you must pay estimated tax for 2022 if both of the following apply.

Compare Your Take Home After Tax And Estimate Your Tax Return Online, Great For Single Filers, Married Filing Jointly, Head Of Household And Widower

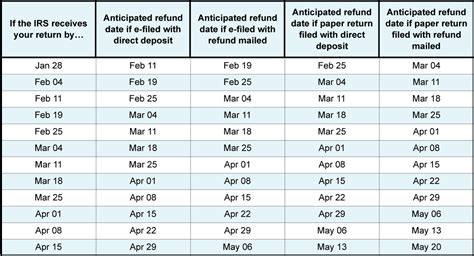

Icalculator aims to make calculating your federal and state taxes and medicare as. Comparison based on paper check mailed from the irs. This tax return and refund estimator is currently based on 2021 tax year tax tables.

Starting Price For State Returns Will Vary By State Filed And Complexity.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. $0 federal + $0 state + $0 to file offer is available for simple tax returns only with turbotax free edition. The table below shows a tax refund calendar with the projected dates taxpayers should receive their tax refund by either direct deposit or check.

Taxable Income $87,450 Effective Tax Rate 15.1%

2022 tax return and refund estimator. You’ll need to provide the tool with minimal information. Amended tax returns not included in flat fees.