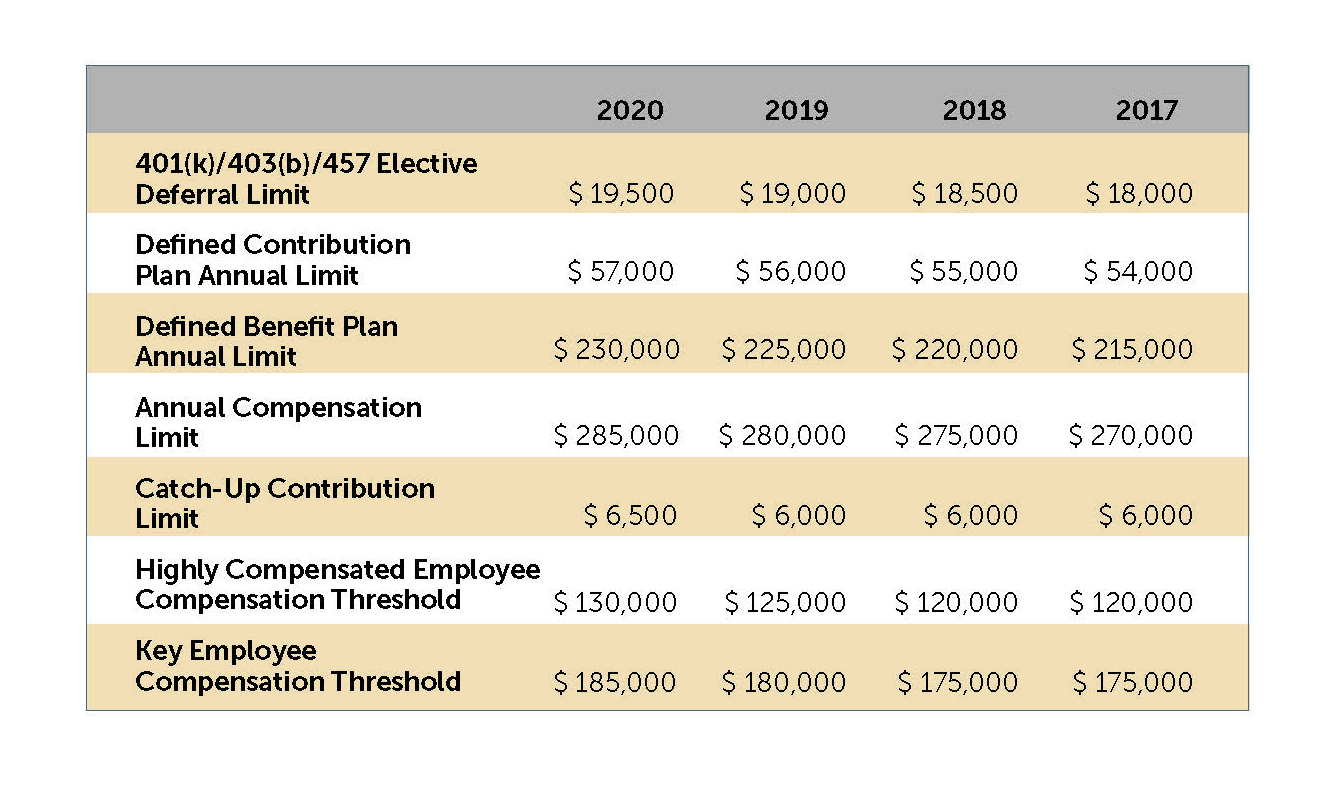

Chart Of 2021 Contribution Limits. To learn more, visit “ contribution limits.”. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $290,000 in 2021 ($285,000 in 2020).

Defined contribution plan limits 2020 2021 change; What is the max tsp contribution? More images for chart of 2021 contribution limits »

The lesser of $58,000 or 100% of the employee’s “includible compensation,” which means the housing allowance paid to a minister is not included, per irs code 415 (c).

Defined contribution plan limits 2020 2021 change; What is the maximum tsp contribution? More images for chart of 2021 contribution limits » What is the maximum 401k contribution per year?

What is the maximum tsp contribution? More images for chart of 2021 contribution limits » The limits for 2021 have been announced. What is the maximum 401k contribution per year?

This limit increases to $64,500 for 2021;

To learn more, visit “ contribution limits.”. The limits for 2021 have been announced. Provision applies, total employee and employer contributions to a 457(b) plan may not exceed $19,500 in 2021. What is the maximum 401k contribution per year?

Defined contribution plan limits 2020 2021 change;

In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $290,000 in 2021 ($285,000 in 2020). See full list on investopedia.com This limit increases to $64,500 for 2021; What is the maximum 401k contribution per year?

The lesser of $58,000 or 100% of the employee’s “includible compensation,” which means the housing allowance paid to a minister is not included, per irs code 415 (c).

The employer contribution limit for sep iras and total contribution To learn more, visit “ contribution limits.”. What is the max tsp contribution? Provision applies, total employee and employer contributions to a 457(b) plan may not exceed $19,500 in 2021.

Merrill lynch does not offer 457(b) plans. The lesser of $58,000 or 100% of the employee’s “includible compensation,” which means the housing allowance paid to a minister is not included, per irs code 415 (c). In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $290,000 in 2021 ($285,000 in 2020). Merrill lynch does not offer 457(b) plans.